Wall Street has been skeptical about software stocks for a while, but sentiment has gone from bearish to doomsday lately with traders dumping shares of companies across the industry as fears about the destruction to be wrought by artificial intelligence pile up.

“We call it the ‘SaaSpocalypse,’ an apocalypse for software-as-a-service stocks,” said Jeffrey Favuzza, who works on the equity trading desk at Jefferies. “Trading is very much ‘get me out’ style selling.”

The anxiety was underscored Tuesday after AI startup Anthropic released a productivity tool for in-house lawyers, sending shares of legal software and publishing firms tumbling. Selling pressure was evident across the sector with London Stock Exchange Group Plc, which has a large data analytics business, falling as much as 10%, while Thomson Reuters Corp plunged as much as 17% in early trading. CS Disco Inc sank as much as 14%, and Legalzoom.com Inc declined 16%.

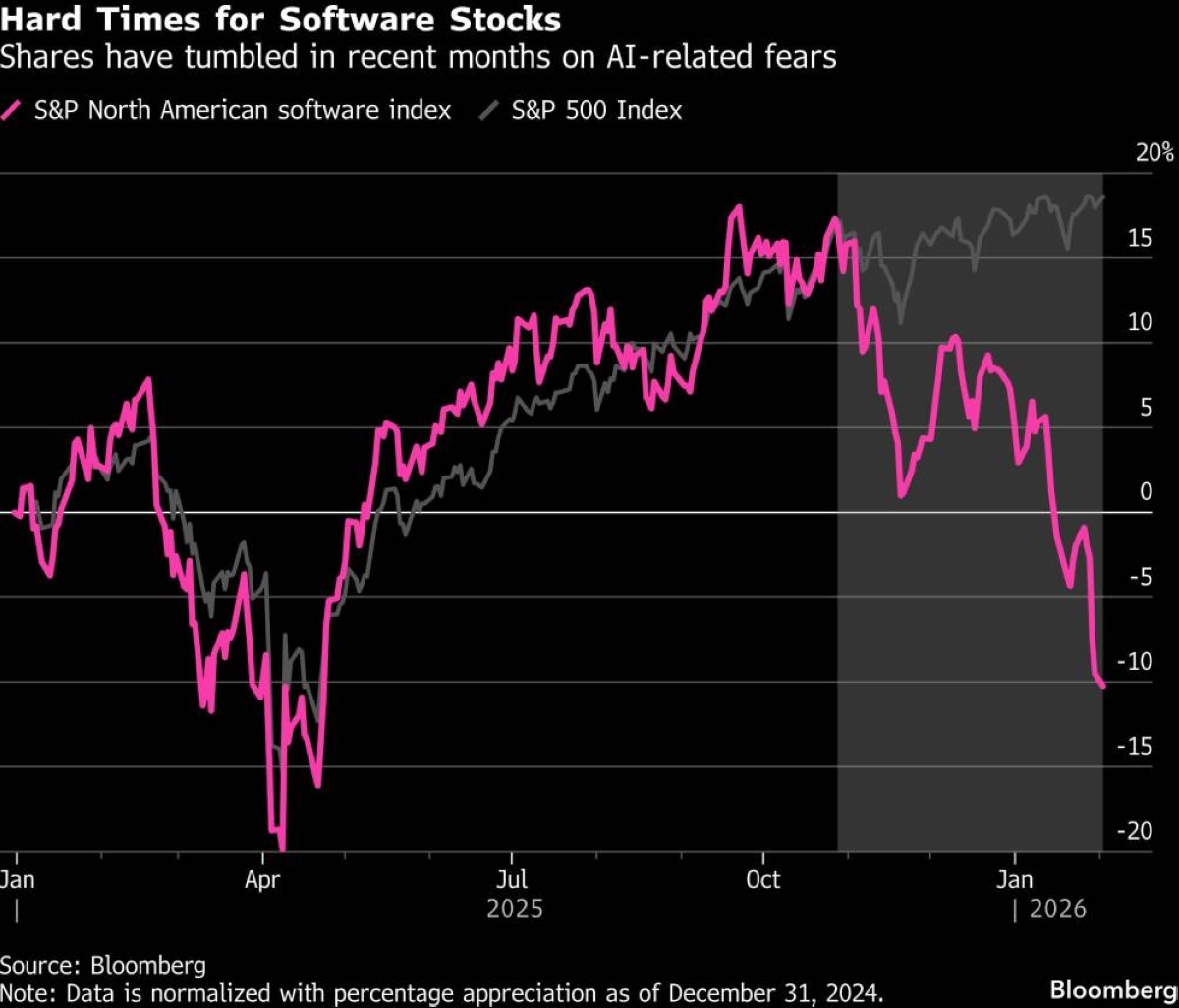

Perceived risks to the software industry have been simmering for months, with the January release of the Claude Cowork tool from Anthropic supercharging disruption fears. Video-game stocks got caught up in the slide last week after Alphabet Inc began to roll out Project Genie, which can create immersive worlds with text or image prompts. All told, the S&P North American software index is on a three-week losing streak that pushed it to a 15% drop in January, its biggest monthly decline since October 2008.

“I ask clients, ‘what’s your hold-your-nose level?’ and even with all the capitulation, I haven’t heard any conviction on where that is,” Favuzza said. “People are just selling everything and don’t care about the price.”

The concerns are brewing in private equity as well, with firms including Arcmont Asset Management and Hayfin Capital Management hiring consultants to check their portfolios for businesses that could be vulnerable, according to people with knowledge of the matter. Apollo cut its direct lending funds’ software exposure almost by half in 2025, from about 20% at the start of the year.

Among US public companies, so far this earnings season just 67% of software companies in the S&P 500 have beaten revenue expectations, according to data compiled by Bloomberg. That compares with 83% for the overall tech sector. While all software stocks have beaten earnings expectations, that’s mattered little in the face of concerns about long-term prospects.

For example, Microsoft Corp reported solid earnings last week, but investors’ focus on slowing growth in cloud sales put fresh scrutiny on the amount it’s spending on AI, sending the stock tumbling 10% on Thursday. January was the worst month for Microsoft shares in more than a decade. Meanwhile, earnings reports from ServiceNow Inc and SAP SE gave investors additional reasons to be cautious about growth prospects for software companies.

Microsoft fell 1.4% on Tuesday, on track for a fourth straight negative session.

On the flipside, Palantir Technologies Inc gave a bullish revenue forecast when it reported earnings after the bell on Monday. It also posted fourth-quarter revenue growth of 70%, exceeding Wall Street estimates. Shares rose 8.5% on Tuesday.

“The fear with AI is that there’s more competition, more pricing pressure, and that their competitive moats have gotten shallower, meaning they could be easier to replace with AI,” said Thomas Shipp, head of equity research at LPL Financial, which has $2.4tn in brokerage and advisory assets. “The range of outcomes for their growth has gotten wider, which means it’s harder to assign fair valuations or see what looks cheap.”

Those AI-related fears led Piper Sandler to downgrade software firms Adobe Inc, Freshworks Inc and Vertex Inc on Monday. “Our concern is that the seat-compression and vibe coding narratives could set a ceiling on multiples,” analyst Billy Fitzsimmons wrote. Vibe coding refers to using AI to write software code.

To be sure, some investing pros view the selloff in software stocks as an opportunity. The Sycomore Sustainable Tech fund, a European open-end fund that has beaten 99% of its peers over the past three years, bought Microsoft shares amid the downturn on the expectation that the company will eventually emerge as an AI winner.

It doesn’t hurt that the software giant’s stock looks cheap at the moment, trading for 23 times estimated earnings, the lowest in about three years. And from a technical perspective, its 14-day relative strength index is in oversold levels. More broadly, the software index’s multiple is the lowest in years, and its RSI indicates it’s oversold.

The software sector is “probably oversold enough for a bounce,” Jonathan Krinsky, BTIG’s chief market technician, wrote in a note to clients last week. However, he added, “it is going to take a long time to repair and build a new base,” and that “we have not been fans of software for a while given the deteriorating relative strength that really accelerated” in the fourth-quarter of last year.

The central issue facing investors who want to buy software stocks is separating the AI winners from the losers. Clearly, some of these companies are going to thrive, meaning their stocks are effectively on sale after the recent rout. But it may be too early to determine who they are.

“The draconian view is that software will be the next print media or department stores, in terms of their prospects,” said Favuzza at Jefferies. “That the pendulum has swung so far to the sell-everything side suggests there will be super-attractive opportunities that come out of this. However, we’re all waiting for an acceleration, and when I look out to 2026 or 2027 numbers, it is hard to see the upside. If Microsoft is struggling, imagine how bad it could be for companies more in the path of disruption, or without its dominant position.”