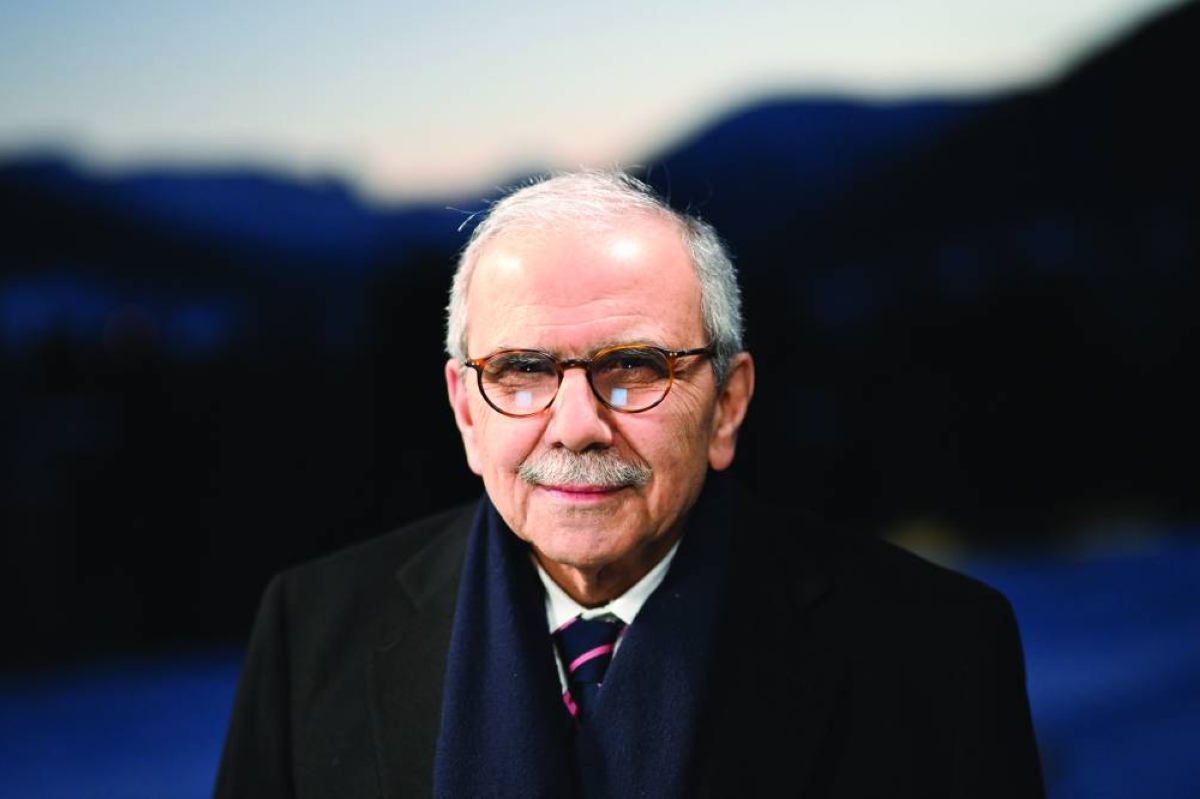

The Gulf Co-operation Council (GCC) remains "a bright spot in the world economy" in the current challenging global economic scenario, noted Bo Li, deputy managing director, International Monetary Fund, while launching the IMF's 2025 GCC report 'Enhancing Resilience to Global Shocks: Economic Prospects and Policy Challenges for the GCC Countries' at Doha Forum 2025.

According to Li, the global economic context remains challenging and despite the challenging external environment, the GCC economies have been resilient and the GCC growth is expected to accelerate from 3.3% in 2025 to 4.4% in 2026.

“The world economy is adjusting to a landscape that is being shaped by major structural transformations, ranging from geopolitics and trade relations to new technologies and demographic shifts. In this environment, global growth remains subdued and risks to the outlook are tilted to the downside," said Li.

Li noted that the outlook shows some differences across regions. He explained: “While economic growth is set to slow in some parts of the world, the GCC remains a bright spot in the world economy. In an environment characterised by heightened global uncertainty, trade tensions and a decline in oil prices and a conflict in the region, the GCC economies have demonstrated remarkable resilience.”

He noted that the resilience results from a combination of favourable external conditions and good policies. “It is fair to say that the resilience of the GCC over the past year has largely been the result of good policies, prudent macroeconomic policies and strong structural reform momentum,” he highlighted

The official said the GCC economic growth will be bolstered by the continued strength of non-hydrocarbon economy amid diversification efforts.

“In this uncertain environment, the overarching policy objective is to enhance resilience and accelerate economic diversification irrespective of oil prices,” he continued.

Li stated that the continued challenge for fiscal policy is to balance the objectives of intergenerational equity, economic diversification, and counter-cyclical stabilisation.

“Amid high global uncertainty, financial sector policies should continue to proactively manage systemic risks. Accelerating and prioritising reforms will support the transition to a new growth model. In this regard, diversification efforts would benefit from the deepening of domestic financial markets and the fostering of new and more diverse international economic relationships,” he stressed.

“In this regard, I am very happy to see the theme of this year's Doha Forum, ‘Justice in Action’ which is very appropriate. We look forward to deepening further our excellent partnership on capacity development with the GCC countries,” he added.