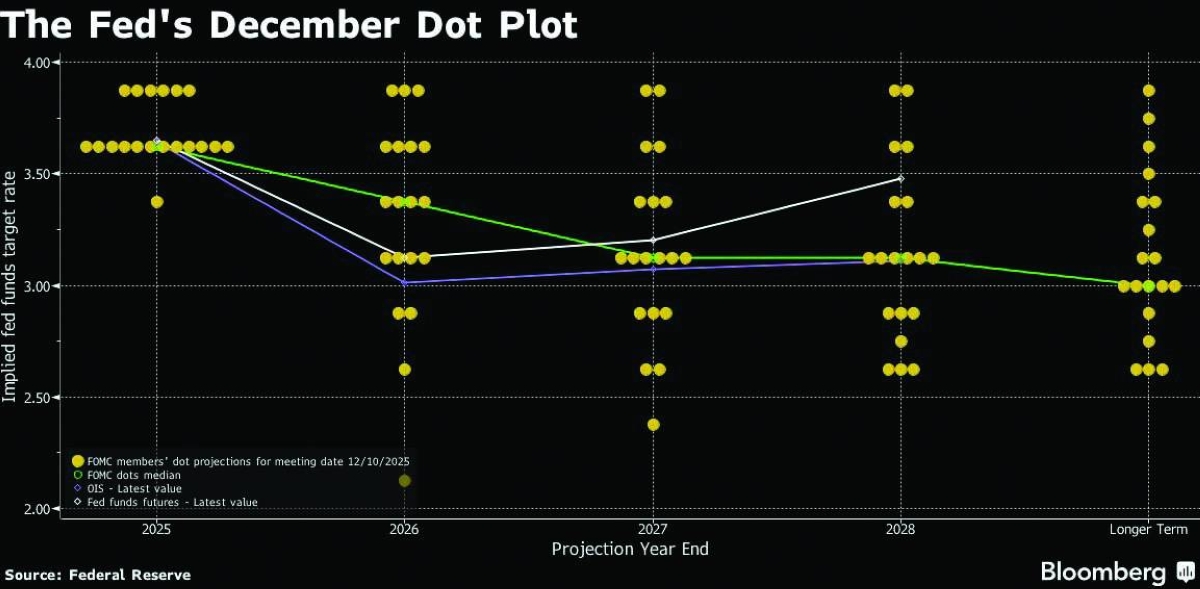

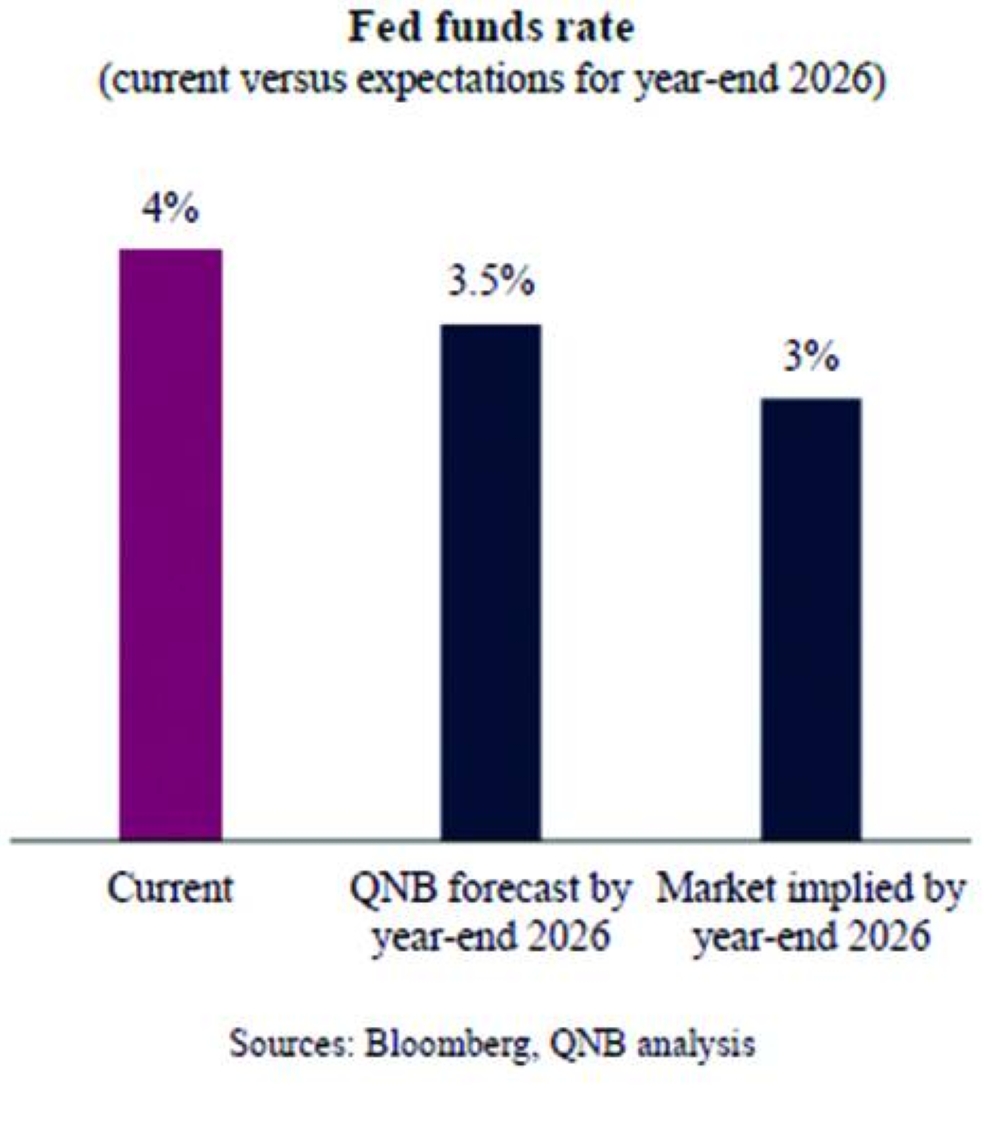

The Federal Reserve confronts an unusual, perhaps unprecedented, combination of powerful economic forces operating in often conflicting ways.The division between interest rate hawks and doves is not the only issue.In the weeks running up to this week’s meeting of the US Federal Reserve, there has been an unusually volatile change of expectations. The assessed probability of a further quarter-point interest rate cut, to follow those in September and October, swung from a high of 90% to a low of 30% and back up to 90%. The 25 bps reduction is widely expected, taking it to 3.75-4.0%. The central banks of the Gulf Co-operation Council will duly reduce their base rates by the same amount consequently, in line with the policy of pegging currencies to the US dollar.The uncertainty in the markets reflects an unusual combination of policy challenges. The Fed has twin objectives: Supporting the labour market and controlling prices, and sometimes the two objectives are in conflict. This partly explains the divisions within the Federal Reserve: Both sides have strong arguments. Indeed, the discussion prior to the October interest rate decision was split three ways: Most were in favour of a quarter-point cut, with one vote for holding interest rates, and one vote for a half-point reduction.Since the 2008 financial crash, there has been a perceptible bias in Fed policy towards permitting liquidity, to prevent a recession, but this does come with a risk not only of inflation, but high levels of leverage, risk-taking and elevated asset prices.There has been some balance, and in June 2022 the Federal Reserve began a sustained policy of quantitative tightening (QT), reversing the easing policy (QE) that had predominated since 2008. The policy has been to tighten gradually and moderately, by not replacing expiring bonds with fresh purchases by the central bank. The chair of the Federal Reserve Jerome Powell has signalled that QT is now coming to an end. The new policy is one of ‘ample reserves’ – central bank purchases of government bonds at the same rate as that of GDP growth, whereas for a full QE policy it would be at a higher rate.Nonetheless, this is a significant easing of policy. One objective is to ease the cost of Government deficits, still running at 6% of GDP with no sign of falling, even as the debt climbs above the 100% mark. So far, the policy has been effective, and yields on US government debt have fallen.The bias towards liquidity has some merit, but in practice it encourages tendencies towards high levels of short-term leverage for long-term ventures, and it raises the level of interest rate needed for inflation to be curbed. This year has witnessed what has been dubbed an ‘everything rally’ in which risk stocks and defensive investments have risen in tandem – tech stocks, crypto, bond prices and gold. Historically they would be inversely correlated.It appears to be a benign combination, but there are risks, and it is one of the factors that makes policy making unusually challenging. There is a market expectation that the Fed will always come to the rescue with additional liquidity – lower interest rates and/or quantitative easing. But it cannot always oblige, and it is unhealthy for investors to become reliant on this sugar rush. There are indications that the market is expecting, or hoping for, a succession of further interest rate cuts in 2026 – perhaps as many as four. They may be disappointed, and it would be unwise to base investment strategies on this expectation.One of the causes of the fluctuating expectations is a factor beyond the control of the Fed: lack of data. The prolonged Government shutdown meant an extended period of time without accurate, national-level economic indicators. The jobs report for October was not released at all, and the November figures will be available after the 9-10 December meeting – at which the most recent official employment statistics will be for September.On balance, from the regional and private sector sources from which data is available, the jobs market is struggling. Meanwhile, inflation is above the target rate but not excessively, so a quarter point reduction this month is a reasonable policy.There are other dynamics, and there are no easy decisions. The AI investment boom may be justified by consequent productivity gains across the economy, but it is a big bet with a risk of substantial stock market falls if the gains fall below expectations. Moreover, the boom has played a significant role in maintaining short-term consumer demand, as a high proportion of households are invested in the stock market. So any losses would spread through the economy. Outside the tech sector, economic growth is sluggish, although company and household balance sheets are healthy.And the AI revolution may have some negative impacts on employment levels – it may bring about a jobless recovery if productivity gains are substantial.Next year could see some formidable challenges: If AI adoption and productivity gains are not sufficient to justify the huge investment in AI infrastructure, and if the end of QT unleashes excessive exuberance in leverage and asset prices. A further unknown is the individual who replaces Powell as chair of the Federal Reserve when his term ends in May. A chair who is keen to support President Donald Trump’s preference towards low interest rates and high asset prices could help fuel economic recovery, or introduce excessive risk. The President has indicated he will announce the appointee early in 2026. The individual is rumoured to be Kevin Hassett, an economic adviser to President Trump.The policy combination is, at least nominally, pro-growth. But the inflationary risks are not negligible. Stagflation and market falls are also possibilities.The author is a Qatari banker, with many years of experience in the banking sector in senior positions.