Oil

Oil prices edged up nearly 1% to a two-week high on Friday on increasing expectations the US Federal Reserve will cut interest rates next week, which could boost economic growth and energy demand. Traders expect the Fed to cut rates by 25 basis points.

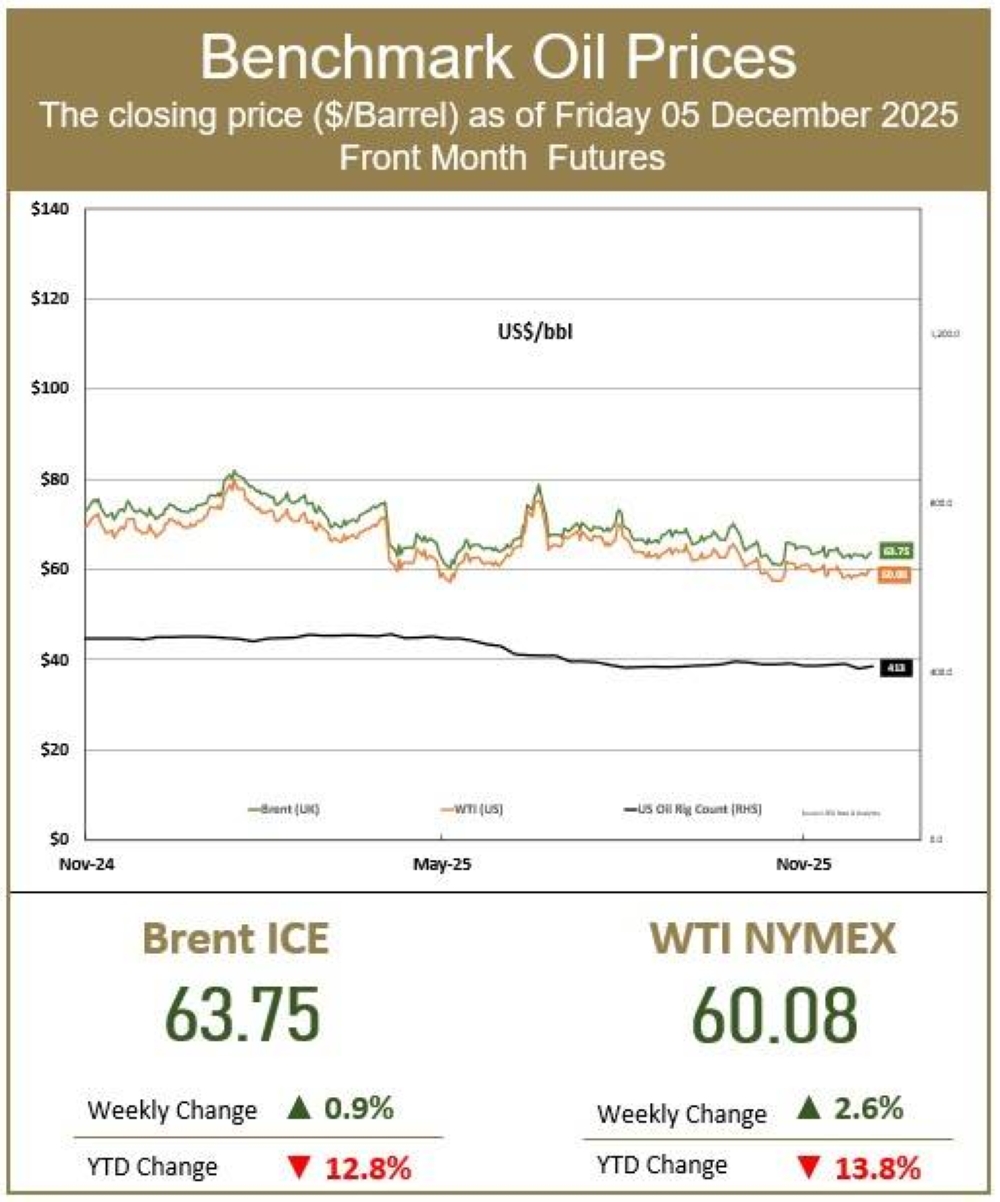

Brent crude futures settled at $63.75, while US West Texas Intermediate (WTI) crude finished at $60.08. For the week, Brent was up about 1% and WTI spiked 3%, marking a second straight weekly gain for both contracts.

Investors also focused on news from Russia and Venezuela to determine whether oil supplies from the two sanctioned Opec+ members will increase or decrease in the future.

The failure of US talks in Moscow to achieve any significant breakthrough over the war in Ukraine has helped to boost oil prices so far this week.

Gas

Asian spot liquefied natural gas (LNG) prices hit their lowest level in two months as high inventories and mild weather weighed on demand.

The average LNG price for January delivery into north-east Asia was $10.66 per million British thermal units (mmBtu), down from $10.90 per mmBtu last week, industry sources estimated.

Weaker coal demand weighed on prices, with weather not showing the coldest side for this time of the year and mainland China may remain warm until the middle of the month while a cold phase just left South Korea. Meanwhile, the relatively high shipping costs create an extra burden for Asian buyers, needing to overbid European counterparts with a larger premium.

In Europe, gas prices fell on forecasts of warmer and windier weather. The Dutch TTF price settled at $9.35 per mmBtu, recording a weekly loss of 4.2%.

This article was supplied by the Abdullah bin Hamad Al-Attiyah International Foundation for Energy and Sustainable Development.