The euro area economy has remained under significant stress in recent years, facing an accumulation of major headwinds that included record monetary policy tightening, an energy crisis, weak external demand, and high global uncertainty, QNB stated in its latest economic commentary.

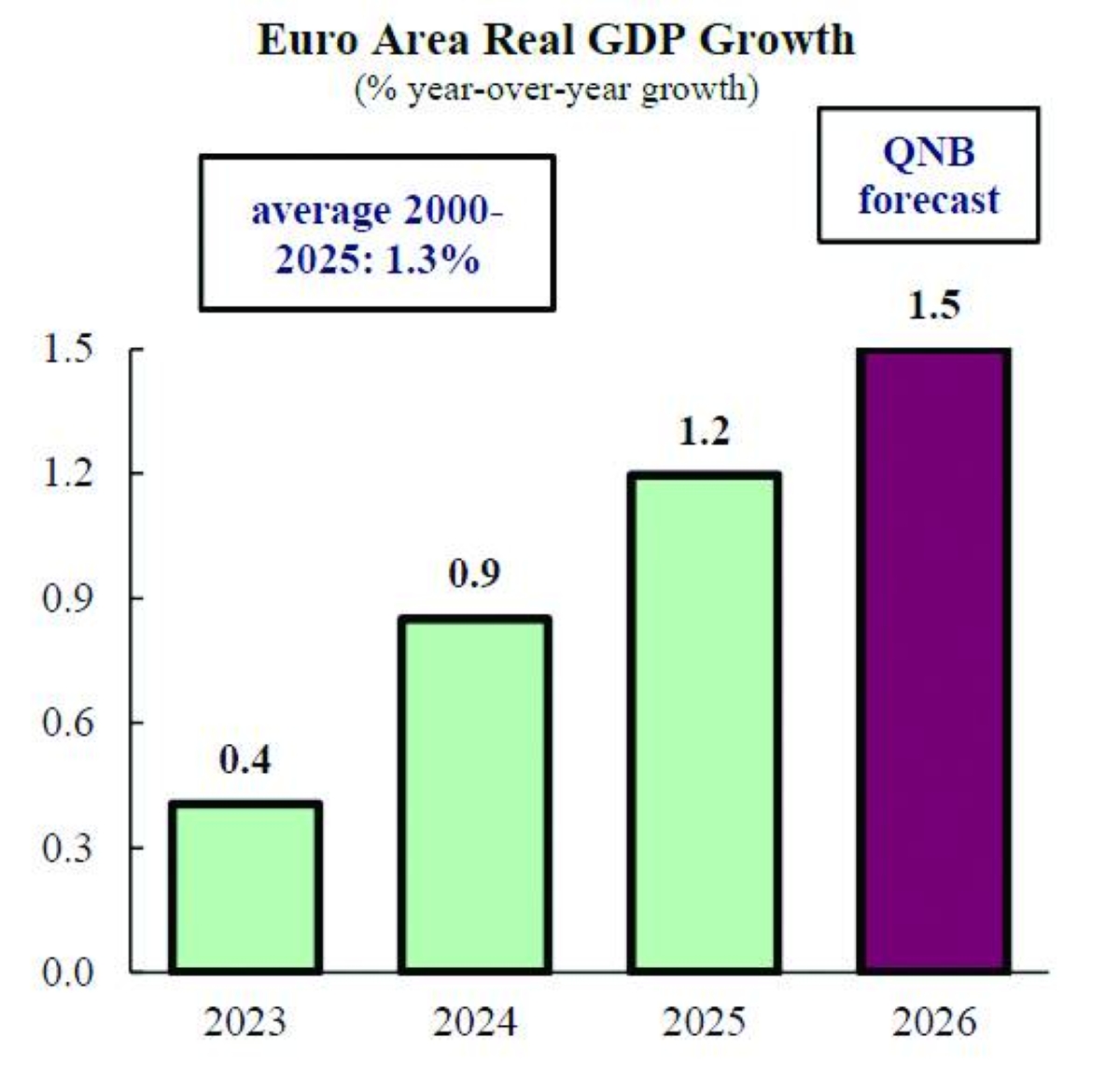

“In this challenging environment, euro area growth has been modest, averaging only 0.8% over the three years of 2023-2025. In comparison, this is less than a third of the 2.6% annual growth average of the US economy during the same period,” stated QNB.

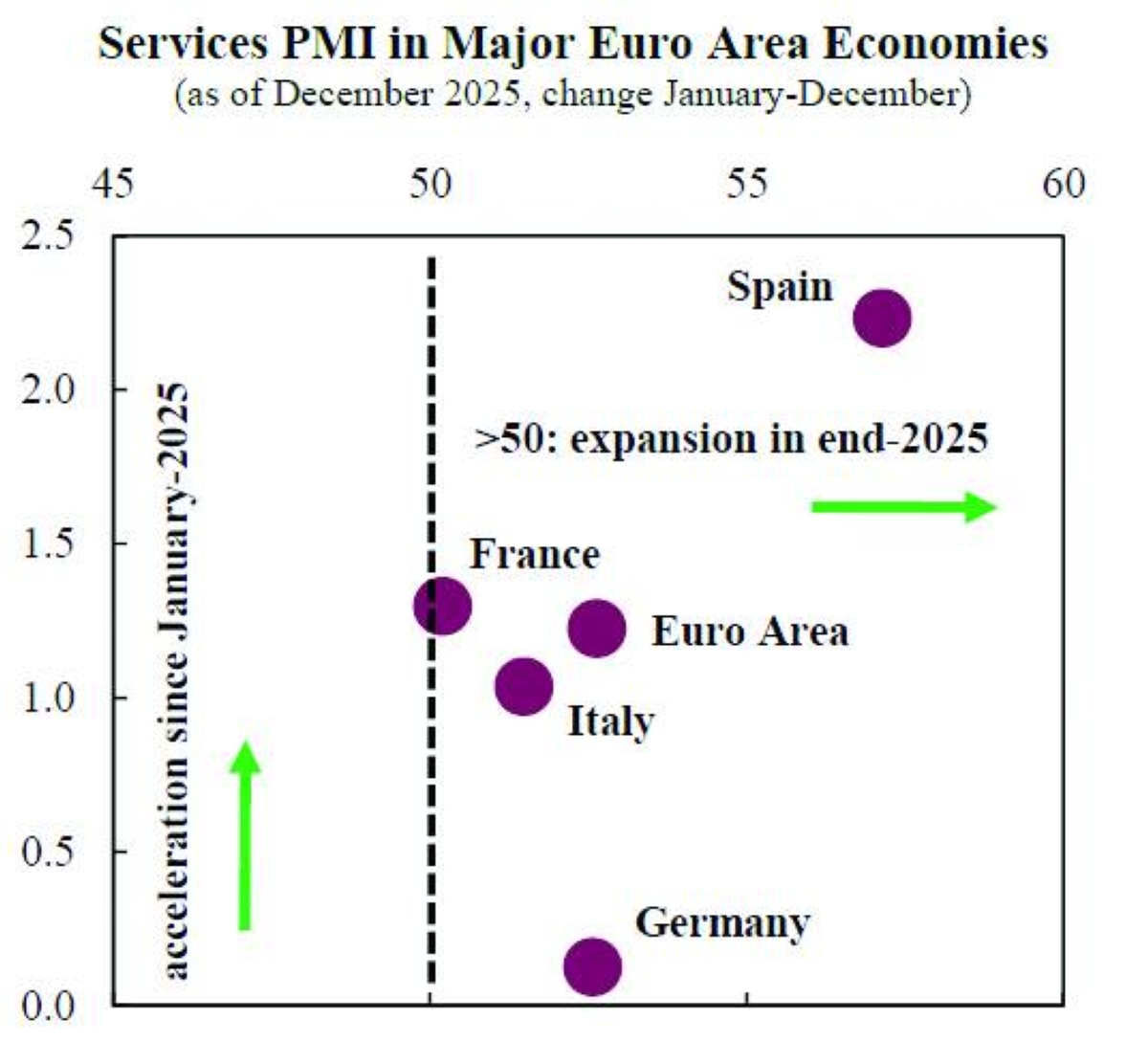

“By the end of last year, key leading indicators began to point to improving trends in the euro area. The Purchasing Managers Index (PMI) is a benchmark survey-based indicator that provides a measurement of improvement or deterioration in the economic outlook. The latest prints of the PMI highlight a more robust expansion in the services sector in the euro area as a whole.

“Furthermore, in each of the bloc’s four major economies (Germany, France, Italy, Spain), the reference gauges stand above the 50-point threshold that mark expansion in activity. Since the services sector accounts for close to 70% of the Euro Area economy, this is an encouraging signal for the region. In our view, the euro area economy is set for a slight recovery this year. Three key factors support our analysis,” QNB stated.

First, consumer spending will be boosted by improving financial conditions and real income growth, according to QNB. Inflation has been brought under control in the euro area, fluctuating close to the 2% target of the European Central Bank (ECB) over the last year. This has allowed monetary policy to become more favourable, as the ECB has lowered its benchmark policy rate by 200 basis points (bp) from a highly restrictive level of 4% in mid-2024 to 2% by June-last year, a level that is no longer restraining consumer spending and is leading to an expansion of credit to the private sector in real terms, QNB stated.

Additionally, QNB noted that lower inflation rates and stable labour markets, with the unemployment rate close to an all-time low of 6.3%, are resulting in income growth outpacing inflation. This year, income is expected to expand at a rate of 1.5%, controlling for the price of goods and services, which will translate into similar growth of consumption. Since household consumption represents over half of the euro area economy, this is an encouraging sign for aggregate growth in 2026, stated QNB.

Second, Germany’s fiscal stimulus and defence spending in the whole euro area will result in a fiscal impulse for growth in 2026, QNB pointed out. This year, QNB noted that Germany will deliver a significant fiscal expansion, mostly explained by spending in subsidies, social spending and defence.

The German deficit is expected to reach 3.7% of GDP, delivering a boost to economic growth of 0.5 percentage points (pp) to Germany, which represents close to 30% of the euro area economy.

Additionally, across the euro area, the Russia-Ukraine war has triggered defence spending initiatives that are estimated to escalate to more than 1% of additional GDP in more than 16 countries that have applied for coordinated flexibility under the European Union fiscal rules, noted QNB.

The total increase in military outlays could contribute to approximately 0.2-0.4 pp of real GDP growth in 2026. Overall, fiscal policy will no longer represent a drag on euro area economic growth during 2026, implying an improvement in conditions for economic growth relative to the contractionary effect of fiscal policy during 2025, QNB stated.

Third, the manufacturing sector is showing signs of stabilisation and an improving outlook, according to QNB. During 2023-2024, a battery of negative factors affected manufacturing, including tight monetary policy, weak external demand, elevated energy costs, and a prolonged inventory correction. As a result, the manufacturing sector underwent a prolonged downturn during 2023-2024, reaching contraction rates of 6% in year-over-year terms, QNB stated.

Last year, manufacturing began to recover and deliver positive growth rates, as the inventory correction that weighed on manufacturing in 2023-2024 largely faded, no longer representing a drag on activity, stated QNB. Additionally, energy costs have normalised from crisis levels. The negative impact of global trade tensions is also beginning to diminish, as the drag from tariffs and uncertainty gradually fades. Although structural headwinds remain, the performance of the manufacturing sector is set to improve compared to last year. This is expected to be supportive for the Euro Area, as manufacturing represents 15-20% of the region’s GDP.

“All in all, despite significant challenges remaining, we expect a continued improvement in economic growth for the euro area. This year, we expect real GDP to expand by an above-consensus 1.5%, to be supported by improving conditions for consumption, the manufacturing sector recovery, and fiscal spending,” QNB stated.