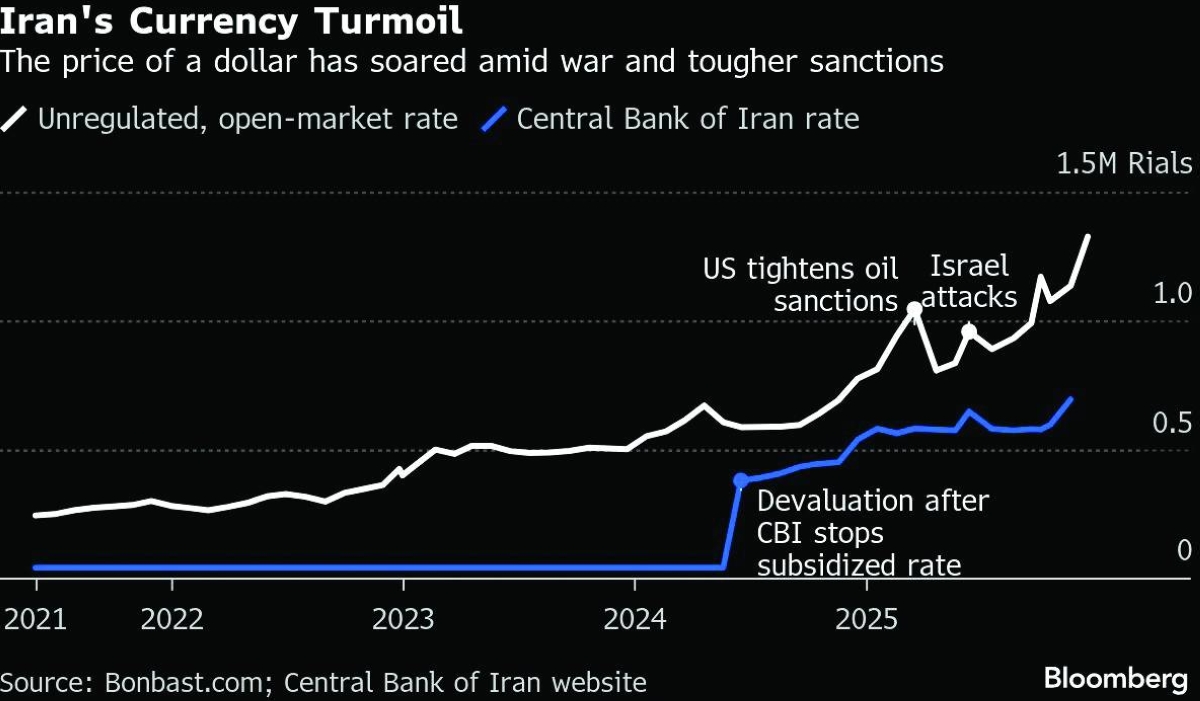

Iran’s currency depreciated to record lows against the dollar last week as multiple challenges including oil sanctions, regional tensions and spiralling inflation plague the economy.

The greenback was trading at a little under 1.3mn rials on the unregulated, open market in Tehran late on Wednesday, according to the website Bonbast and the Telegram accounts of three foreign-exchange shops in the Iranian capital. That was just off all-time highs hit earlier in the week, the traders said.

The rial has weakened dramatically over the past year, hitting successive record lows in the wake of broader international sanctions.

Since 2018, when US President Donald Trump exited a landmark nuclear deal during his first term, the rial has lost more than 95% of its value versus the dollar. When he returned to office this year, Trump revived his “maximum pressure” strategy against Iran, which involves aggressive economic sanctions and culminated in June’s airstrikes on Iran.

A drop in oil exports, the biggest single source of foreign currency revenue for Iran, the fact that importers want to settle outstanding foreign trade before the end of the Western calendar year, a recent increase in gasoline prices and persistently high levels of inflation have all weighed on the informal foreign-exchange market in Iran, the state-run Hamshahri newspaper reported, citing Kamal Seyyed Ali, former deputy governor of the Central Bank of Iran.

Iran’s Minister of Economic Affairs and Finance, Ali Madanizadeh recently warned that while tensions with Israel remain high, the dollar is likely to only strengthen further, stoking faster inflation.

He likened the task of managing inflation and market volatility in Iran to “performing surgery in a field hospital” during the war with Iraq “while under constant bombardment”, according to the state-run Islamic Republic News Agency.

Iran has several parallel exchange rates including an official CBI rate, that is only accessible to a limited number of organisations and companies, and a much more expensive, unregulated rate that is used by the vast majority of the population and is a key economic bellwether.