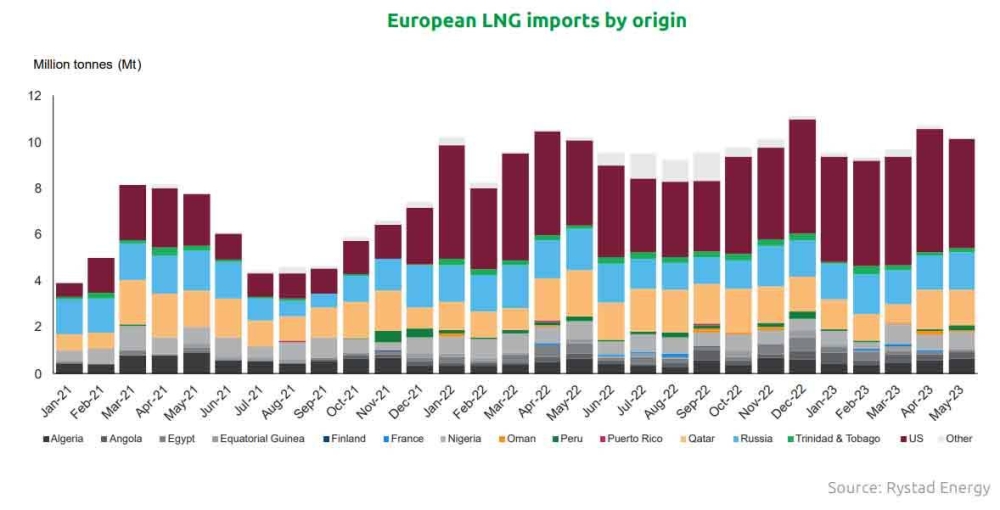

The Middle East, led by Qatar, will be an important region in the global LNG landscape, the International Gas Union (IGU) said in its latest report.With ongoing expansion plans at the huge North Field, Qatar could "potentially boost" LNG export capacity to 126mn tonnes per year (MTPY) by 2030, from 77.8 MTPY (as of August 2023) it said.“Given the low-cost production of North Field East fields and shipping cost advantages, Qatar is primed to serve both European and Asian LNG demand in the long term,” IGU said in its ‘Global gas report 2023’.Qatar, Russia, and Nigeria are the next three dominant exporters of LNG to Europe, with the region’s largest being France, Spain, Belgium, and the Netherlands, it said.The report noted global gas demand decreased by 1.5% in 2022 compared to 2021, with large declines in Europe and Asia offset by strong growth in North America.Falling demand in the regions hit hardest by the energy crisis persisted during the first half (H1) of 2023 and was primarily driven by industrial slowdown and decreased heating demand caused by a mild winter in the northern hemisphere.Although global demand dropped by 1.5% in 2022, regional demand destruction was a lot more pronounced, IGU said.Europe’s gas demand decreased by almost 12% in 2022 year-on-year, in response to the supply and price shocks coming on the heels of the Russia-Ukraine war.The good luck of a very mild 2022-23 winter was a major contributor to Europe’s reduced gas demand, together with significant losses in industrial demand, gas to coal switch, and renewables uptake.Spikes in international spot LNG prices caused the demand in Asia to fall by 18 bcm (1.9%) in 2022 compared to 2021.Significant demand destruction also happened in South Asia, where the price of LNG became unaffordable, causing switching to coal wherever possible and leading to shortages and blackouts.For instance, Pakistan and Bangladesh saw a 12% and 15% reduction in gas demand, respectively. On the contrary, North American gas demand grew by 4.8% or 49 bcm year-on-year in 2022, a notable increase driven primarily by increased gas-fired power generation as well as residential and commercial applications.The North American market prices remained largely isolated and affordable, due to its predominantly regional nature with domestic production.IGU noted that from January to August of this year, the European Union (EU) saw a cumulative gas consumption decrease of roughly 10% year-on-year (both an effect from industrial slowdown and the EU’s intentional switch from gas to other energy sources), while China saw gas demand grow by 5.4% year-on-year during H1, 2023.

Pratap John

Pratap John is Business Editor at Gulf Times. He has mainstream media experience of nearly 30 years in specialties such as energy, business & finance, banking, telecom and aviation, and covered many major events across the globe.

Most Read Stories