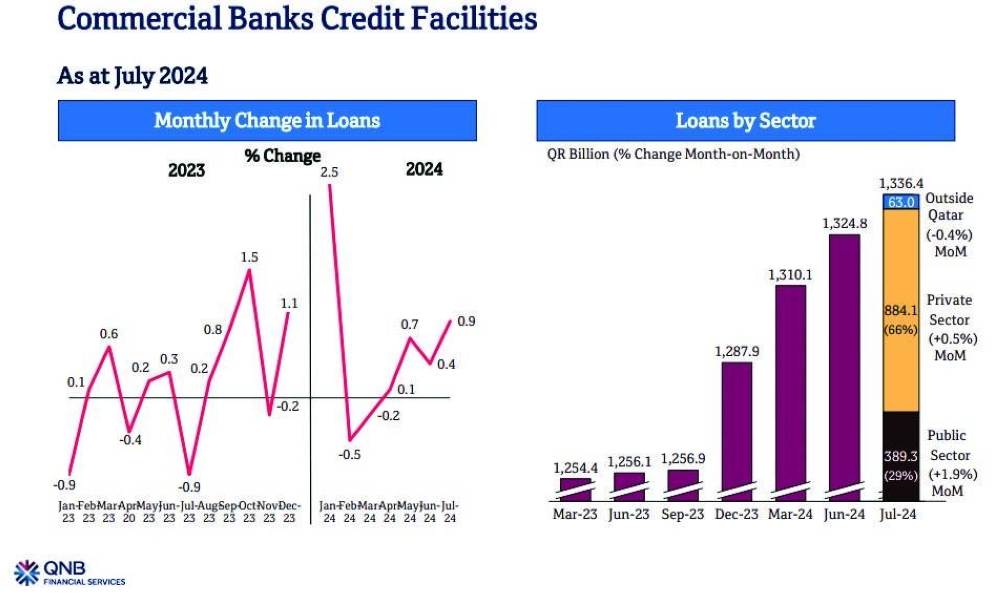

The Qatar banking sector’s total assets reached QR2tn for the first time in August, driven by domestic assets, QNB Financial Services said in its ‘Qatar Monthly Key Banking Indicators’.According to QNBFS, total assets of banks increased by 0.7% during August to reach QR2.002tn. The total rise in August was mainly due to a gain by 1% in domestic assets.Total assets were up by 1.7% in 2024, compared to a growth of 3.4% in 2023. Assets grew by an average 6.8% over the past five years (2019-2023)Liquid assets to total assets edged down to 29.7% in August this year, compared to 29.9% in July, QNBFS noted.Deposits with banks were higher by 0.3% during August to reach QR1,035.2bn. The deposits rise was mainly due to an increase by 1.9% in public sector deposits.Deposits increased 5% in 2024, compared to a decline by 1.3% in 2023. Deposits grew by an average 4.1% over the past five years (2019-2023), QNBFS said.In terms of credit facilities extended by commercial banks, QNBFS said loans went up by 0.5% during August to reach QR1,342.9bn.The loans gain in August was mainly due to a rise by 0.4% in the private sector and 0.5% in the public sector. Loans moved up by 4.3% in 2024, compared to a growth of 2.5% in 2023. Loans grew by an average 6.5% over the past five years (2019-2023).Loan provisions to gross loans stood at 4%, both in July and August this year, according to QNBFS.The Loans to deposits ratio went up to 129.7% in August. Loans went up by 0.5% in August to reach QR1,342.9bn, while deposits moved up 0.3% that month to reach QR1,035.2bn.The overall loan book was higher by 0.5% in August, driven mainly by private sector loans. Total private sector loans increased by 0.4% m-o-m (+2.8% in 2024) during August.The real estate sector continued to be the main driver for the private sector loans in August 2024. The segment (contributes 21% to private sector loans) rose by 2.1% m-o-m (+8.5% in 2024), while consumption and others (contributes 20% to private sector loans) moved up by 0.7% m-o-m (-2.6% in 2024).However, general trade (contributes 21% to private sector loans) edged down by 0.2% m-o-m (+3.3% in 2024) and services (contributes 32% to private sector loans) was marginally down m-o-m (+3.6% in 2024) in August.Total public sector loans gained 0.5% m-o-m (+6.3% in 2024) in August. The government segment (represents 29% of public sector loans) was the main driver for the public sector with an increase of 1.7% m-o-m (+7.7% in 2024), while the semi-government institutions segment went up by 2.6% m-o-m (-6.1% in 2024).However, the government institutions’ segment (represents 65% of public sector loans) edged slightly lower by 0.1% m-o-m (+6.9% in 2024) in August, QNBFS said.Outside Qatar loans increased by 1% m-o-m (+13.6% in 2024) in August.Public sector deposits moved up by 1.9% m-o-m (+8.9% in 2024) in August.Looking at segment details, the government segment (represents 34% of public sector deposits) shot up by 7.1% m-o-m (+31.1% in 2024), while the government institutions’ segment (represents 55% of public sector deposits) went up by 1% m-o-m (+6.5% in 2024).However, the semi-government institutions’ segment dropped by 7.8% m-o-m (-23% in 2024) in August.Private sector deposits was marginally lower by 0.1% m-o-m (+0.5% in 2024) in August.On the private sector front, the companies and institutions’ declined by 0.4% m-o-m (-5.9% in 2024). However, the consumer segment edged up by 0.2% m-o-m (+6.1% in 2024).Non-resident deposits declined by 2.1% m-o-m (+9.1% in 2024) during August, the report said.An Analyst told Gulf Times: “The key highlight for the month of August is the increase in total assets by 0.7%, reaching the QR2tn mark for the first time, as domestic assets drove the monthly rise. The 0.5% increase in the overall loan book came from a continued rapid increase by 2.1% from the real estate segment in the private sector and a 1.7% gain in the government segment from the public sector.“Overall deposits were driven mainly by the surge in government deposits, which increased by 7.1% in August and showed a jump by 31.1% for the year 2024.”

Pratap John

Pratap John is Business Editor at Gulf Times. He has mainstream media experience of nearly 30 years in specialties such as energy, business & finance, banking, telecom and aviation, and covered many major events across the globe.

Most Read Stories

2