Air cargo has consistently proven itself as a crucial stabiliser for the global economy; its inherent agility successfully blunting the impact of the 2025 tariff cycle and mitigating the severe disruptions caused by the Covid-19 pandemic.

The air cargo segment is a vital cornerstone of global commerce, acting as a crucial enabler of international trade, particularly for time-sensitive and high-value goods. While accounting for a mere 1% of world trade volume, it represents an estimated 35% of its total value, moving goods worth more than $8tn annually.

Global air cargo demand, measured in cargo tonne-kilometres (CTK), rose 3.3% year-on-year (y-o-y) as of October, according to the International Air Transport Association (IATA).

Activity was surprisingly strong as importers front-loaded shipments ahead of tariff changes. Demand has remained firm since, though growth is expected to moderate later in the year. For 2025, IATA now projects 3.1% y-o-y growth, an upward revision from 0.7% in our June forecast.

Cargo traffic in Asia-Pacific is expected to grow by 8.5% y-o-y this year. Year-to-date or YTD (January-October) data shows broad-based strength across nearly all routes, led by the Europe corridor, which expanded by 10.6%.

Chinese exporters diverted shipments affected by US tariffs to other trading partners and adopted strategies such as adding intermediate stops or shifting production to countries outside the tariff lists.

While this substitution effect materialised quickly, it might not be sustainable if future tariffs target rerouting practices, the global trade body of airlines noted.

The low pricing that supported inventory reductions might not persist, reinforcing our more cautious outlook for 2026.

Europe is forecast to grow by 2.5% in 2025. Among Europe’s international routes, only those with Asia (+10.6%) and North America (+7.1%) expanded, as per October YTD data.

Africa and Latin America are expected to grow by 3.0% and 4.0%, respectively.

In contrast, the Middle East and North America are likely to contract by 1.5% and 1.2%, driven by tariffs in North America and geopolitical tensions combined with easing ocean freight disruptions in the Red Sea for the Middle East.

Global air freight yields averaged $2.4/kg YTD through October, about 30% above 2019 levels. Yields were slightly stronger in the first quarter, growing by approximately 4% y-o-y, supported by front-loading and a high base from early 2024. However, momentum weakened from the second quarter onward, with average y-o-y declines of 2.6%, reaching a low of -5.4% in September, but improving again in October to -4.0% y-o-y.

In contrast, sea freight rates fell sharply in both monthly and yearly terms, making ocean shipping more attractive and reducing air cargo’s relative price competitiveness.

Demand growth by cargo hold type shows a clear divergence: dedicated freighters’ CTK rose by mere 1.4%, reflecting limited expansion on the freighter side due to persistent supply chain bottlenecks, while belly cargo surged by 7.8% YTD through October.

Aircraft delivery delays continue to hamper fleet expansion, also on the cargo side.

Delays in wide-body freighter deliveries, with the Boeing 777X-F pushed to 2028 and Airbus A350F to late 2027, are leading operators to stretch existing fleets and rely on passenger aircraft conversions.

However, the pool of suitable passenger aircraft is shrinking due to limited availability of new passenger aircraft. This sustained supply shortfall is driving up air freight rates, particularly for dedicated freighters, and is likely to take years to unwind. Medium wide-bodies, notably the Airbus A330 and Boeing 767, dominate the conversion market as immediate, though costlier, substitutes for delayed next-generation freighters.

The global cargo load factor reached 45.3% in October 2025 YTD, broadly unchanged from 2024. While demand growth is expected to slow in 2026, steady air cargo demand amid global uncertainties and persistent capacity constraints should keep load factors broadly flat.

For 2026, IATA expects air cargo demand to continue to expand, albeit at a slower pace than in 2025, in line with softening global trade.

The slowdown is unlikely to be as pronounced as the general trade deceleration, as air cargo continues to benefit from rising demand for high-value, time-sensitive goods, particularly driven by e-commerce and semiconductors.

Persistent global uncertainties around tariffs and supply chain disruptions will reinforce air transport’s role as the most reliable mode of delivery.

Overall, IATA forecasts 2.6% growth for the industry in 2026, led by Asia-Pacific at 6%. Other regions should grow around 2%, while the Middle East will stagnate, and North America will edge down by 0.5%.

Undoubtedly, air cargo industry's ability to provide speed, security, and flexibility makes it an indispensable component of the modern, interconnected global economy, enabling businesses to meet demanding customer expectations and adapt to volatile market conditions.

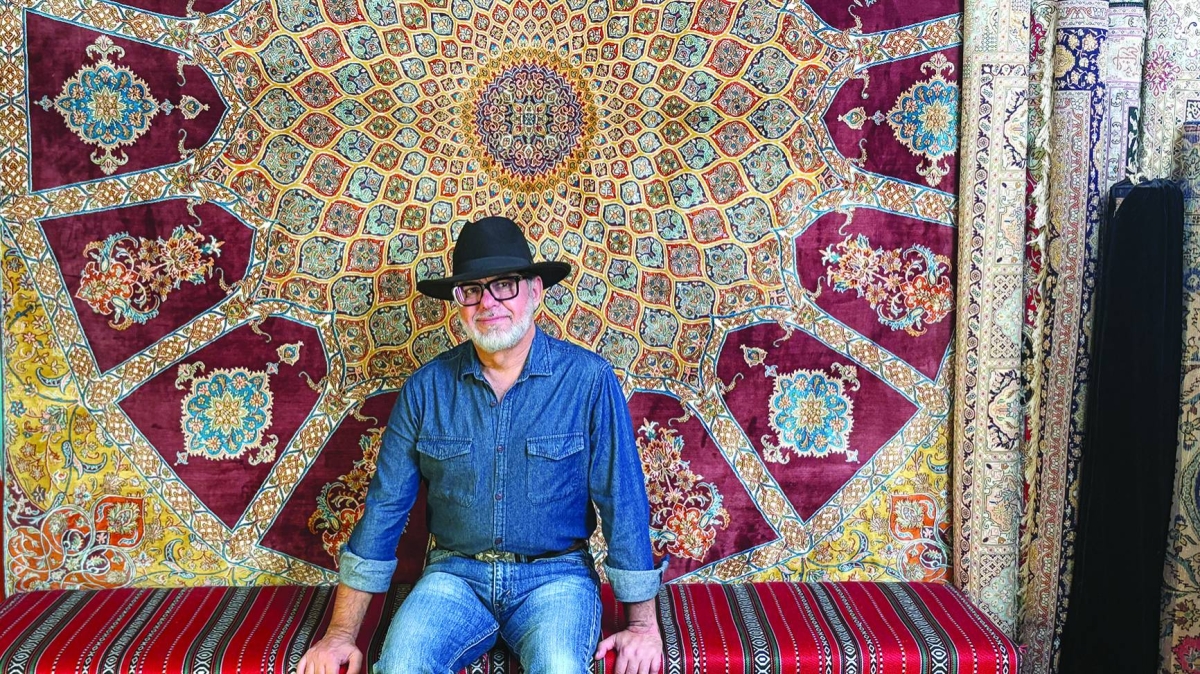

Pratap John is Business Editor at Gulf Times. X handle: @PratapJohn.