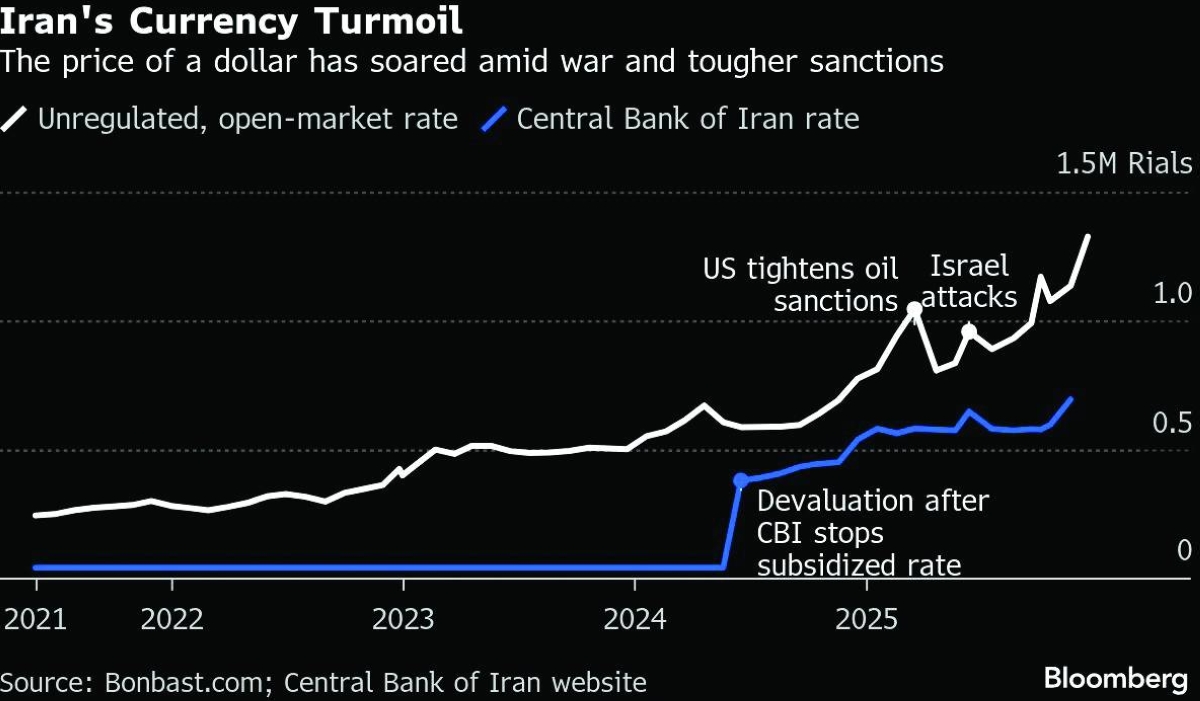

Iran could agree to dilute its most highly enriched uranium in exchange for all financial sanctions being lifted, its atomic chief said Monday, one of the most direct indications so far of its position at talks with Washington.US and Iranian diplomats held talks through Omani mediators in Oman last week in an effort to revive diplomacy, after US President Donald Trump positioned a naval flotilla in the region raising fears of new military action.The talks follow a crackdown on anti-government demonstrations in Iran last month when thousands of people were killed, the biggest domestic unrest since the 1979 Revolution.Trump joined an Israeli bombing campaign last year and hit Iranian nuclear sites. He also threatened last month to intervene militarily during the protests but ultimately held off.Washington has demanded Iran relinquish its stockpile — estimated last year by the UN nuclear agency at more than 440kg — of uranium enriched to up to 60% fissile purity, a small step away from the 90% that is considered weapons grade.The head of Iran's Atomic Energy Organisation, Mohammad Eslami, said Monday: "The possibility of diluting 60% enriched uranium... depends on whether, in return, all sanctions are lifted or not".Eslami, whose remarks were reported by Iran's ISNA news agency, said however that another proposal, sending Iran's highly enriched uranium abroad to another country, had not been discussed at the talks with US officials.Ali Larijani, a close adviser to Iran's Supreme Leader Ayatollah Ali Khamenei and secretary of its national security council, will visit Oman Tuesday following the US-Iranian talks there, the semi-official Tasnim news agency reported."During this trip, (Larijani) will meet with high-ranking officials of the Sultanate of Oman and discuss the latest regional and international developments and bilateral cooperation at various levels," Tasnim said.The date and venue of the next round of talks have yet to be announced. Iran’s President Masoud Pezeshkian said Monday that a new round of talks would be "an appropriate opportunity for a fair and balanced resolution of this case," and that a desired outcome could be reached if the US avoids maximalist positions and respects its commitments.Iran would continue to demand the lifting of sanctions and insist on its nuclear rights including enrichment, he said.Iran and the US held five rounds of talks last year on curbing Tehran's nuclear programme, with the process breaking down mainly due to disputes over uranium enrichment inside Iran.Since Trump struck Iran's facilities, Tehran has said it has halted enrichment activity. It has always said its nuclear programme is solely for peaceful purposes.The US wants to include Iran's ballistic missile arsenal in negotiations, but Tehran has ruled this out.In a televised statement aired Monday, Khamenei called on Iranians to participate in the coming anniversary of the Revolution."The presence of the people in the march and their expression of loyalty to the Islamic Republic will cause the enemy to stop coveting Iran," Khamenei said.

Tuesday, February 10, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.