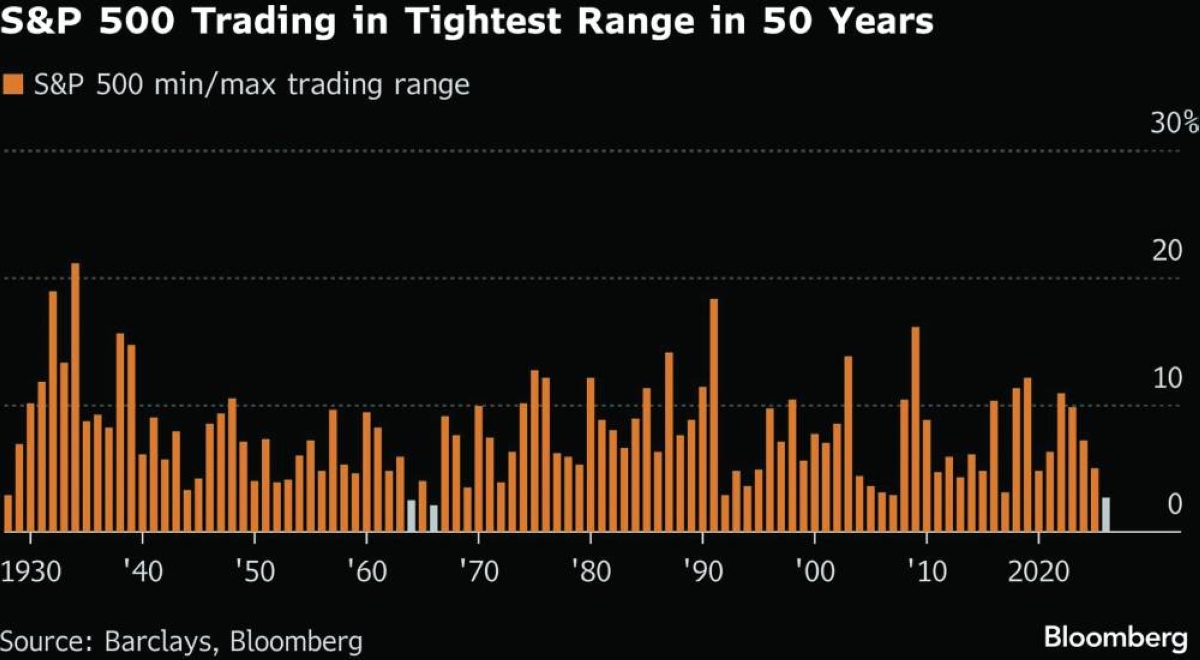

The placid surface of an equity market that’s treaded water for months is masking dramatic swings underneath, as stock moves whipsaw traders and threaten more turbulence ahead.Though the S&P 500 Index has notched its narrowest trading range to start a year since the 1960s, according to Barclays Plc, worries over disruptions from artificial intelligence have sparked dizzying swings in one sector to the next. Single-stock volatility stands at about seven times that of the broader market, the widest divergence in at least 30 years, according to the firm.Such are the contours of a market where breakthroughs in AI — once a source of bullishness — now often fuel uncertainty. The backdrop is taking a toll on investors, who saw the S&P 500 close out the week at almost the same level it traded at four months ago.“This is a stock picker’s market, but not in a conventional sense,” said Michael O’Rourke, chief market strategist at JonesTrading Institutional Services LLC. These days, “stock picking is about avoiding implosions.”Stefano Pascale, head of US equity derivatives research at Barclays, pins the bifurcated volatility dynamic on investors trying to discern which sectors could be next hit by AI disruption, as well as high valuations and elevated rates.Should it persist — strategists on JPMorgan Chase & Co’s trading desk expect it to be the “new normal” throughout the year — investors could face several challenges.For one thing, similar backdrops have preceded tectonic market shifts in the past, including the 2008 crash and, more recently, President Donald Trump’s sweeping tariff rollout last year, according to Barclays.To O’Rourke, the environment also suggests that cracks are forming in investors’ optimistic outlook for the broader market, raising the risks that they will more readily sell if bad news hits. Potential near-term catalysts include a US strike on Iran and earnings from AI bellwether Nvidia Corp next week.“When you go into a crisis, all correlations go to one,” O’Rourke said, suggesting that stocks that had been moving independently could suddenly fall in lockstep. The volatility at the single-stock level could be “the early warning sign or potential tremor about some investors feeling less confident.”Evidence that investors are feeling less confident has mounted, with stock- and sector-specific selloffs pushing many to reassess the risks of holding highly concentrated positions, according to Tom Hainlin, national investment strategist at US Bank NA.Hedge funds have been net-sellers of US equities month-to-date at the fastest pace since last March, according to Goldman Sachs’ Prime trading desk. Separately, Bank of America clients dumped US stocks last week, with single-stock outflows reaching $8.3bn, the third-highest level since records began in 2008.Meanwhile, stock pickers earlier this month trimmed their equity exposure to the lowest level since July, according to a poll from the National Association of Active Investment Managers.They may have good reason for doing so, given the uncertainty that has accompanied rapid advancements in AI. Jed Ellerbroek, portfolio manager at Argent Capital Management, said AI is being adopted at a faster pace than the internet was in the late 1990s and warned that investors should get used to “unprecedented” levels of disruption this year.Worries over AI spending have even hit some of the so-called Magnificent Seven tech companies, with Microsoft Corp and Meta Platforms Inc both down double-digits since the end of October, when a rotation out of tech stocks began.Of course, there are plenty of arguments for shrugging off the volatility and staying the course in stocks. Fourth-quarter earnings season has seen the share of S&P 500 companies reporting a rise in quarterly profits hit the highest level in four years. Investors have also been encouraged by more sectors participating in the market’s rally, which for months had largely been concentrated in tech.“At a high level, this phenomenon speaks to strength in the overall environment and suggests systemic risk is muted,” said Cayla Seder, macro multi-asset strategist at State Street.Still, with AI adoptions showing few signs of slowing, Argent’s Ellerbroek believes it’s only a matter of time until volatility breaks through to the index level and warns investors to stay diversified.Investors are investigating in detail “whether AI is a help or a harm,” he said. “There aren’t free passes being given out anymore.”

Sunday, February 22, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.