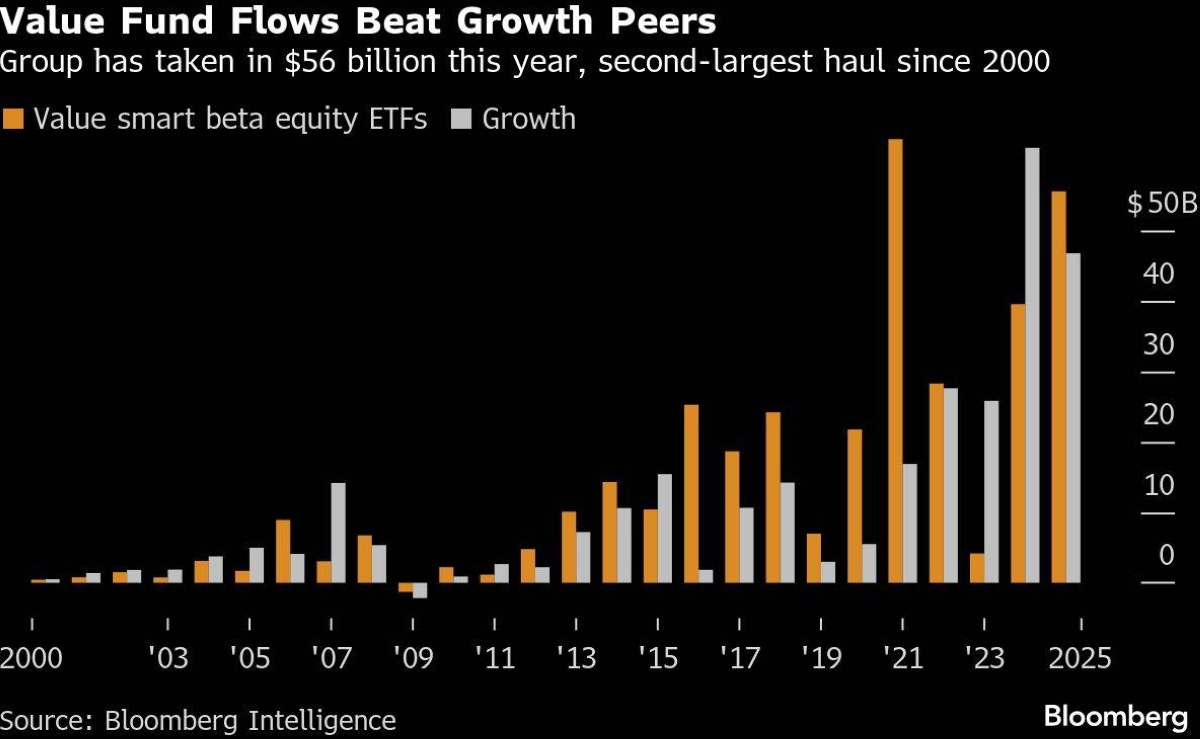

Alongside all the triumphant AI talk, surging retail spirits and whiplash trades in crypto, a quieter trend was unfolding across global markets in 2025: Diversified strategies posted some of their strongest returns in years.It’s an achievement that has largely flown under the radar.Simple portfolios split between stocks and bonds delivered double-digit advances, the best year since 2019. Multi-asset “quant cocktails” — blending commodities, bonds and global equities — outperformed the S&P 500. A Cambria Investments exchange-traded fund holding 29 ETFs spanning across global markets posted its best year on record, bolstered by hefty gains overseas.This week’s inflation report was a lesson in their wisdom. Softer-than-expected US inflation data on Thursday sparked a rare in-tandem rally in both stocks and bonds. So-called risk parity funds posted gains on the week, a reminder that market conditions still reward balance, even in a world where artificial intelligence continues to obsess investors.But while 2025 may have marked a comeback for old-school Wall Street prudence, it will also go down as another year when investors kept walking away from those very strategies. Capital has continued to migrate toward concentrated Big Tech exposure, thematic trades from nuclear power to quant computing, and blunt hedges such as gold.“Despite all the focus on the AI story, 2025 was not a stocks story,” said Marko Papic, chief strategist at BCA Research. “It was all about global diversification.”As market valuations stretch and concentration deepens — particularly in tech-heavy US benchmarks — some strategists warn that abandoning diversification now could leave portfolios exposed at precisely the wrong moment.Retail investors, in particular, have been backing away from balanced and multi-asset funds for years. The category — including public risk parity funds and 60/40 portfolios, which traditionally allocate 60% to equities and 40% to bonds — has posted outflows for 13 straight quarters, before a modest rebound this autumn, according to JPMorgan Chase & Co. While money has continued to flow into dedicated bond and equity funds, the middle — traditional blended strategies — remains out of favour.Nikolaos Panigirtzoglou, a strategist at JPMorgan, points to a multi-year stretch of underwhelming performance, compounded by unusual cross-asset correlations that dulled returns. The 2022 bond market rout — triggered by aggressive central bank tightening — further damaged confidence in fixed income as a buffer within cross-asset portfolios.“That just destroyed the psyche of retail investors about the bond market,” said Jim Bianco of Bianco Research. “And that’s the big thing — that’s why investors keep jumping around from asset to asset.”April offered a fresh scare. When President Donald Trump announced new trade tariffs during a televised “Liberation Day,” markets sank. The S&P 500 fell 9% in a week; a benchmark 60/40 portfolio dropped more than 5%. Treasury bonds rallied while gold fell. Bitcoin dropped sharply, then snapped back.Yet under the surface, a broadening has been underway for most of the year. Value-oriented equity ETFs, many of which eschew the top-heavy tech complex, pulled in more than $56bn this year, the second-largest annual inflow since at least 2000. Cambria’s Global Value ETF jumped roughly 50%, its best since launch. International stocks rebounded on fiscal reform tailwinds and a weaker dollar. Small caps outperformed in the fourth quarter.Some strategists believe the shift will extend into 2026. Greg Calnon, global co-head of public investing at Goldman Sachs Asset Management, expects US earnings growth to broaden, with small caps and international stocks outperforming. He sees continued strength in municipal bonds, supported by attractive tax-adjusted yields relative to Treasuries and robust investor demand.JPMorgan Asset Management’s David Lebovitz is tilting toward emerging-market debt and UK gilts while maintaining selective US and AI equity exposure.Still, others see signs of froth. Bank of America Corp notes that 2025 showed the second-strongest dip-buying impulse in nearly a century. Emily Roland, co-chief investment strategist at Manulife John Hancock Investments, said markets have become increasingly disconnected from fundamentals.“This year has been a short-term investor’s dream,” she said. “We would be careful with the dash for trash as of late. It has been a momentum-driven year where fundamentals and earnings growth have been seemingly irrelevant.”Yet even as investors abandon classic 60/40 bets, many have not given up on multi-asset approaches. Capital has flowed into alternative assets — from private credit and infrastructure to hedge funds and digital assets — as investors seek exposure beyond public markets. In some cases, the search has become less about portfolio balance and more about access to alternative assets, yield or insulation from public-market volatility.“They aren’t losing faith, but the 60/40 is evolving, and it’s important to recognise that what has worked for the past 25 years may not work as well over the next 25 years,” said JPMorgan’s Lebovitz. “The core concept of diversification still holds, but investors today have many more levers that they can pull.”

Monday, February 16, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.