Long-dated bonds are facing renewed selling pressure, ramping up borrowing costs around the world and creating a headache for investors and policymakers.

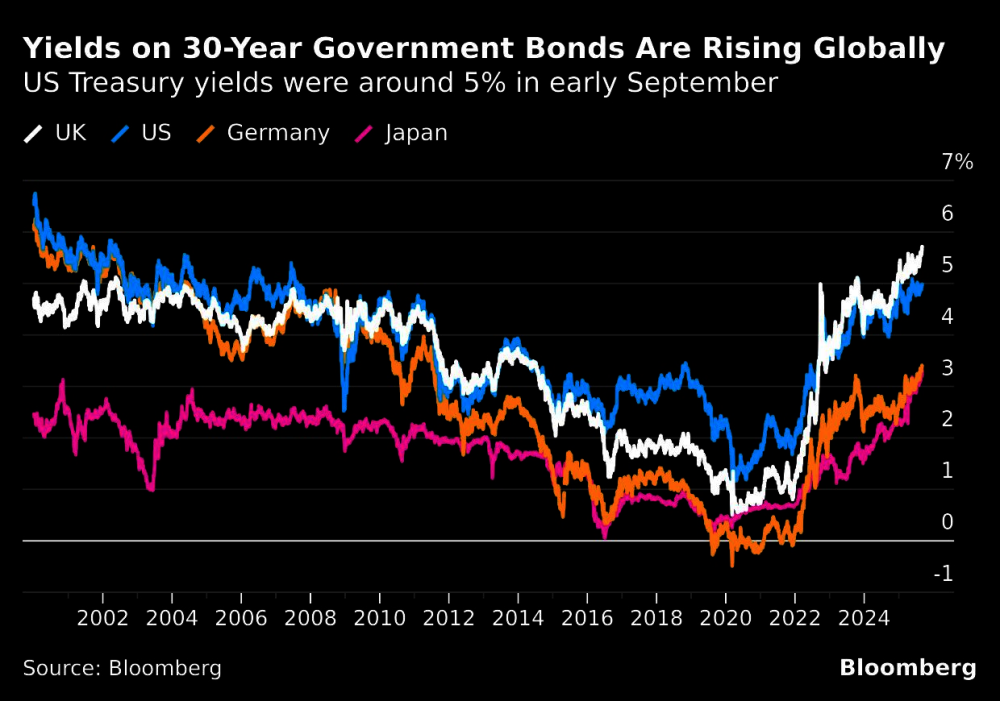

Yields on 30-year US Treasuries were around 5% in early September, a level last reached in July. Those on Japan’s 20-year notes climbed to their highest since 1999, while yields on 30-year UK gilts jumped to levels last recorded in 1998. French and Australian government bonds are among the others experiencing a selloff too.

The rising yields signal investors are demanding extra compensation for holding government debt in the face of spiralling budget deficits and sticky inflation. The mounting worry is that politicians lack the ambition, or even the ability, to rein in their countries’ debt, while central banks may struggle to combat the mix of sustained price pressures and ebbing economic growth.

What’s been happening with long-dated bonds?

Traders usually buy and sell bonds based on the relative appeal of their fixed coupon payments. The longer there is until a bond “matures,” the more that can go wrong in the interim. Long-term bonds with a duration of between 10 and 100 years tend to offer higher interest rates than shorter-term treasury bills that are repaid in less than a year, to compensate buyers for the additional risk.

When a country’s economic outlook worsens, bond yields typically fall. This is because a weaker economy encourages central banks to shift their focus from combating inflation to stimulating economic activity. That means a bias toward lowering benchmark interest rates, boosting the relative appeal of bonds versus cash in the bank.

But lately, yields for long bonds have been rising. In the US, that’s in part because the economy has slowed, not collapsed, and inflation has remained stronger than forecast.

Why are there concerns about debt and deficits?

Governments across the world loaded up on cheap debt after the 2008 global financial crisis, then borrowed even more to cope with Covid-19 lockdowns and accompanying recessions. Global debt reached a record $324tn in the first quarter of 2025, driven by China, France and Germany, according to the Institute of International Finance.

A surge in inflation since the pandemic made that scale of borrowing harder to sustain. Major central banks raised interest rates and wound down their bond-buying programs, known as quantitative easing, which were designed to lower borrowing costs. Some central banks are now even actively selling the debt they accumulated via quantitative easing back into the market, adding further upside pressure to yields.

The concern is that if bond yields stay high and governments fail to get their fiscal houses in order, the cost of servicing some of that debt will just keep climbing.

In the US, the cost of President Donald Trump’s sweeping tax-and-spending law is a further worry for bond investors. The One Big Beautiful Bill Act could add $3.4tn to the US deficit over the next decade not accounting for dynamic effects such as the potential growth impact according to the Congressional Budget Office, which provides nonpartisan analysis of US fiscal policy.

Moody’s Ratings stripped the US of its last-remaining top credit score in May, citing fears that the ballooning national debt and deficit will damage the country’s standing as the preeminent destination for global capital.

What’s been driving the recent bond selloff?

As well as the lingering debt strains, politics have been a major factor.

After criticising Federal Reserve Chair Jerome Powell for not cutting interest rates more quickly, Trump’s move to oust Fed Governor Lisa Cook has deepened concerns around the central bank’s independence. The worry is that Trump succeeds in replacing Cook and others with officials more inclined to lower borrowing costs regardless of inflation risks.

A deluge of corporate debt sales isn’t helping either, as this can sometimes siphon demand from government bonds. Both companies and sovereign borrowers across the world sold at least $90bn in investment-grade debt in early September, as parts of global credit markets neared or toppled records in one of the busiest weeks this year.

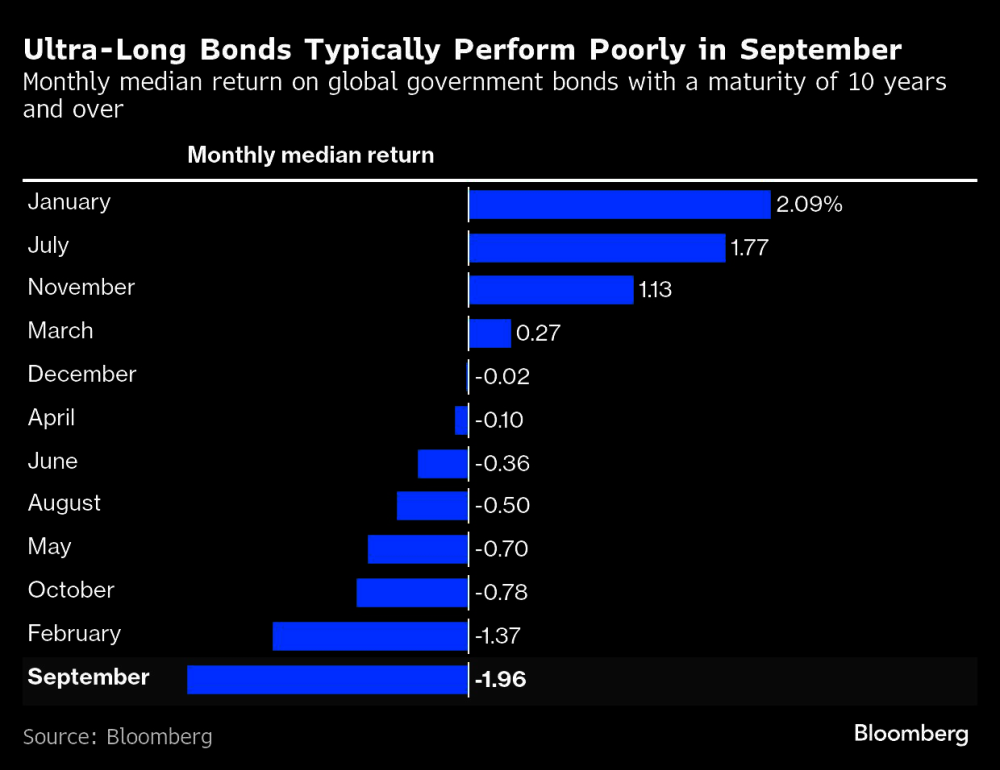

September is also a traditionally bad month for longer-dated bonds as traders return from their summer break and readjust their portfolios. Government debt globally with maturities of over 10 years posted a median loss of 2% in September, according to data compiled by Bloomberg.

The mix of risks is pushing the so-called “term premia” what investors demand for the uncertainty of holding bonds for longer ever higher.

Why is a spike in long bond yields a problem?

Investors want the bond market to be safe and boring, as these assets are what many of them hold to ensure a rock-solid stream of income to balance out the volatility of higher-risk, higher-reward investments such as technology stocks.

When longer-term yields jump, they feed into mortgages, auto loans, credit card rates and other forms of debt, squeezing households and companies, and thus broader economies.

And if long bond yields stay high for longer, it will gradually affect how much it costs a government to borrow money. That, and any accompanying deterioration in economies, could mean a “doom loop” in which debt levels climb even higher no matter what governments do with tax and spending.

At times, rebellions in markets can even lead to the fall of governments as seen in the UK in 2022 after then-Prime Minister Liz Truss’s mini-budget, which included billions in unfunded commitments, roiled the bond market and led investors to drive up borrowing costs. In the early 1990s, so-called bond vigilantes were said to be powerful enough to force President Bill Clinton to rein in US debt.

Where could things go from here?

It’s not clear what a prolonged period of higher borrowing costs would mean for the mountain of long-term debt that governments binged on during 15 years of ultra-low interest rates. The upward shift in yields is already leading to new phenomena with unpredictable consequences.

One example: Japan’s government bonds used to have such low yields that they acted as a kind of anchor by adding downward pressure on yields the world over. But they’ve shot higher in recent months, adding to the volatility in global bond prices and attracting foreign investors to Japanese debt in significant numbers. This could mean fewer buyers for debt sold by other nations.

In the UK, the pressure is mounting on Chancellor Rachel Reeves to show she’s on top of the nation’s finances in an upcoming budget.

In the US, there’s still concern that post-pandemic inflation isn’t yet under control and that Trump’s tariffs could add further inflationary pressure that exacerbates the bond yield spike. On the other hand, his trade war may also dampen economic activity, leading the Fed and other central banks to cut interest rates.

Or both could happen, whereby there’s a surge in prices accompanied by falling economic output or zero growth a situation known as stagflation. This would add to the uncertainty over monetary policy, forcing the Fed to choose between supporting growth or suppressing inflation.

Is this a taste of the future for long bond yields?

Jamie Rush, Tom Orlik and Stephanie Flanders of Bloomberg Economics argue that politics and structural forces could potentially make 10-year Treasury yields of 4.5% the new normal.

That comes as decades of decline in the “natural” interest rate the real interest rate that would prevail if the economy were operating at full employment with stable inflation have already ended, and partially reversed.

“In the years ahead, the natural rate is set to edge higher still,” Rush, Orlik and Flanders wrote in a book, The Price of Money, published in August 2025. “If risks from debt, climate, geopolitics, and technology crystallise, it could rise quite a lot.”

A street sign for Wall Street is seen outside the New York Stock Exchange. Moody’s Ratings stripped the US of its last-remaining top credit score in May, citing fears that the ballooning national debt and deficit will damage the country’s standing as the preeminent destination for global capital.