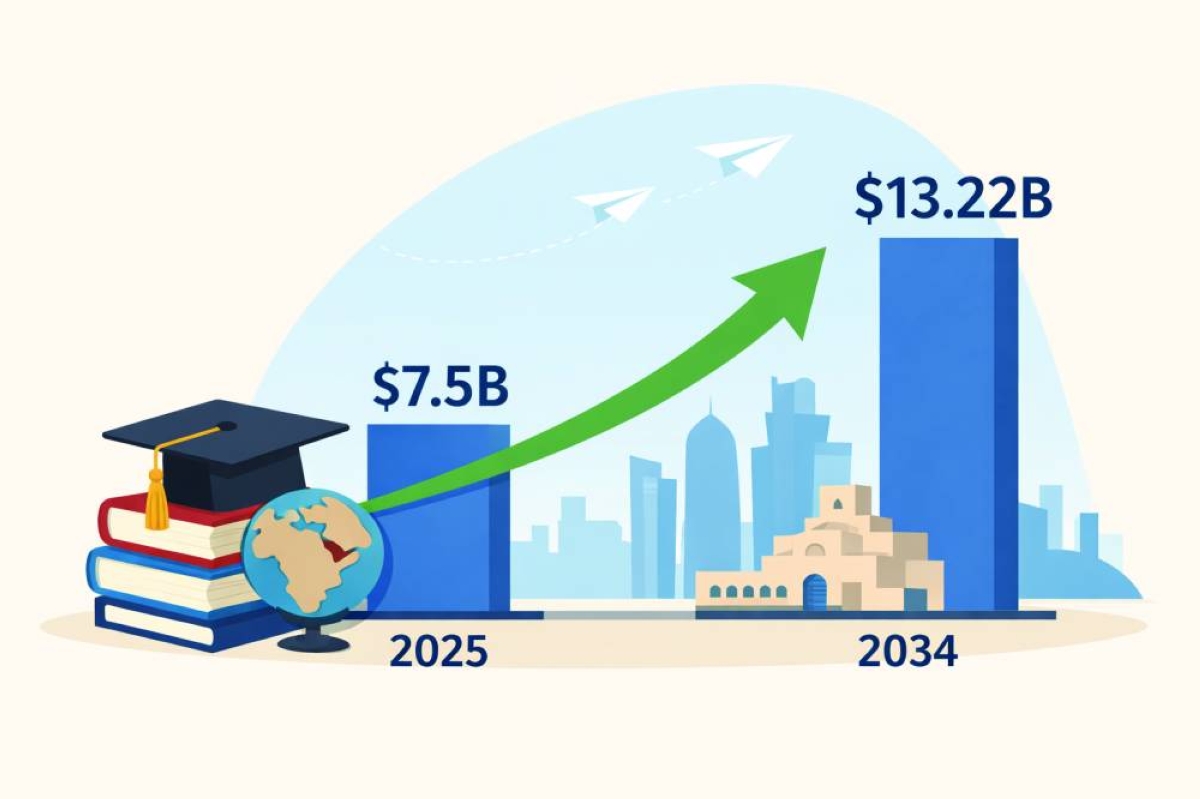

A global report projects that Qatar education market is poised to grow at a compound annual growth rate of 6.50% during 2026–2034.Report Cube, an international market research firm, in its latest edition highlights that Qatar education market is valued at $ 7.5bn in 2025 and is expected to reach $13.22bn by 2034.“This growth is supported by sustained government investment in education, rising expatriate population, increasing private and international school enrolments, and accelerated adoption of digital learning solutions,” the report says.Education remains a strategic priority under Qatar National Vision 2030, with a strong focus on developing a knowledge-based economy.Report Cube notes that continuous investments in K–12 education, higher education institutions, and vocational training programmes are strengthening the overall education ecosystem in the country. The presence of global universities and international schools has further elevated education quality and diversity.The report highlights: “The rapid integration of online and blended learning models, driven by EdTech platforms and digital curricula, is reshaping education delivery across the country. As workforce upskilling and lifelong learning gain importance, the Qatar education market is expected to maintain steady expansion throughout the forecast period.”Several developments in the last two years have helped the Qatar education market in a big way, according to the report. In 2025 there was an expansion of international school capacity to meet rising expatriate student demand and 2024 witnessed increased adoption of digital learning platforms across higher education and corporate training.Similarly, Qatar National Vision 2030 has placed greater emphasis on education quality, innovation, and workforce readiness, while the education regulatory framework ensures curriculum standards, accreditation, and private-sector participation.The report points out that the primary driver of Qatar education market is sustained government investment aimed at building a world-class education system. Strategic partnerships with international universities and education providers further enhance academic standards and global competitiveness of Qatar’s educational institutions.A key takeaway in the report is the growth of international curricula and digital learning in the country. A major trend shaping the market is the growing preference for international curricula and these programmes cater to Qatar’s diverse expatriate population. In parallel, online and blended learning models are gaining traction across K–12, higher education, and professional training, supported by EdTech platforms and learning management systems.Other findings of the report say that in Qatar, K–12 education accounted for the largest share of the market in 2025, driven by population growth and rising enrolment in private and international schools. Higher education continues to expand steadily, supported by global university campuses and research initiatives and vocational and technical education is emerging as a fast-growing segment due to workforce development needs.Another finding is that public institutions have significant share of overall enrolment, while private and international schools contribute significantly to revenue growth. EdTech providers are gaining momentum as digital adoption accelerates across education levels. On-campus education remains the primary delivery mode; however, blended and online learning models are expanding rapidly due to flexibility and scalability and these models are particularly prominent in higher education, professional training and test preparation.The report also underlines the expansion of vocational training and workforce upskilling as a major opportunity. “The growing demand for skilled labour across construction, energy, healthcare, and technology sectors presents a significant opportunity. Vocational and technical education programmes aligned with industry needs are gaining prominence. Corporate training and certification services are expected to contribute increasingly to market revenue,” added the report.

Friday, February 20, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.