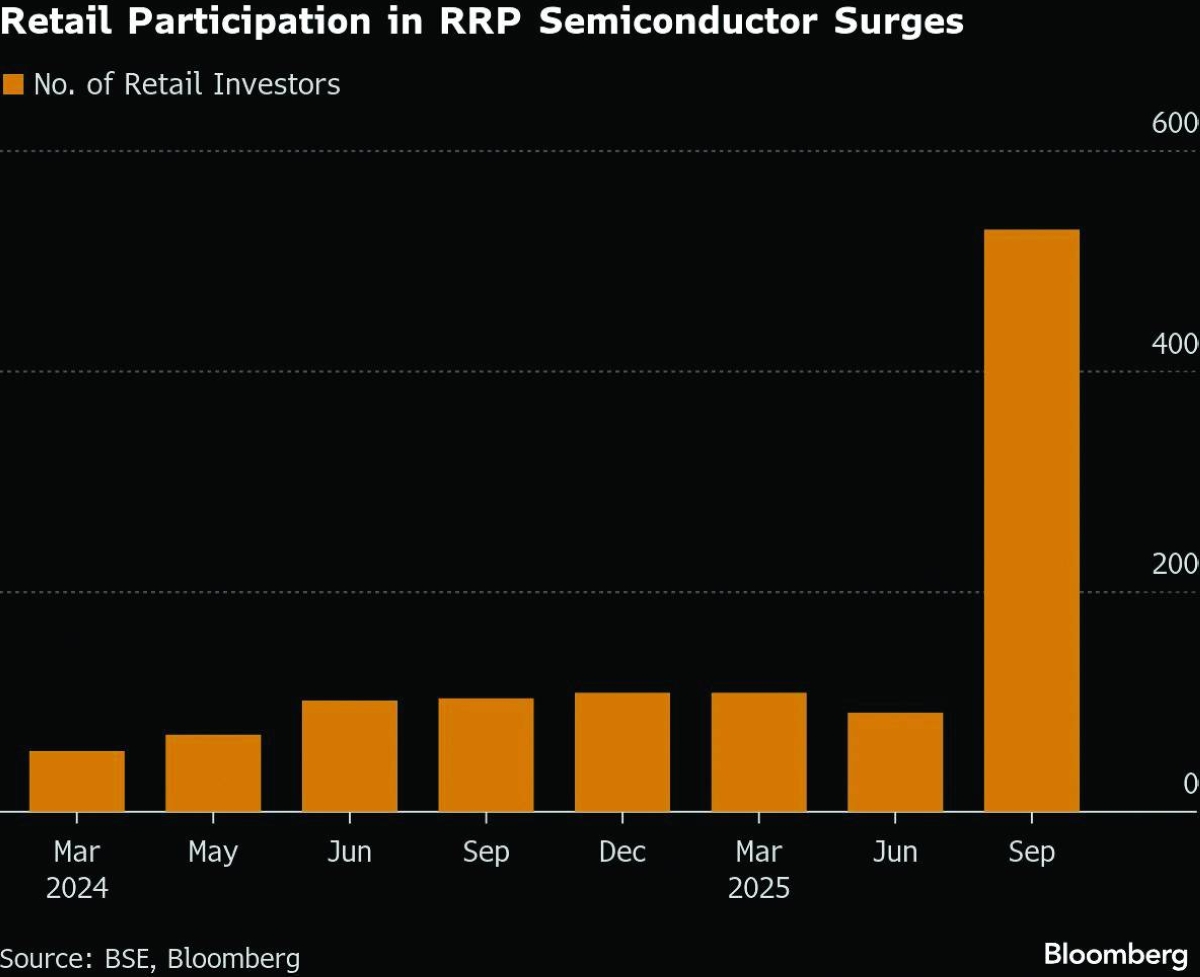

The world’s best-performing stock is turning into a cautionary tale for investors chasing outsized returns from the artificial-intelligence boom.Little-known until recently even within its home market of India, RRP Semiconductor Ltd became a social-media obsession as its shares surged more than 55,000% in the 20 months through December 17 — by far the biggest gain worldwide among companies with a market value above $1bn.That’s despite posting negative revenue in its latest financial results, reporting just two full-time employees in its latest annual report, and boasting only a tenuous link to the semiconductor spending boom after shifting away from real estate in early 2024. A mix of online hype, a tiny free float and India’s swelling base of retail investors drove 149 straight limit-up sessions, even as exchange officials and the company itself cautioned investors.The rally is now showing signs of strain — and regulators are taking a closer look. The Securities and Exchange Board of India has begun examining the surge in RRP’s shares for potential wrongdoing, according to a person familiar with the matter who asked not to be identified discussing confidential information. The $1.7bn stock, recently restricted by its exchange to trading just once a week, has fallen by 6% from its November 7 peak.**media[394993]**While RRP’s trajectory is unlikely to have much bearing on the broader AI rally that has added trillions of dollars in value to global heavyweights such as Nvidia Corp, it highlights how extreme gains have become in pockets of the market — particularly in India, where an absence of listed chipmakers has left retail investors eager for any proxy exposure to the global boom. For some observers, the case also underscores the challenge for regulators seeking to protect retail investors from speculative excess.“Semiconductors have been really hot and people are willing to buy any name given India has limited stocks to offer,” said Sonam Srivastava, founder at Wryght Research & Capital Pvt. With global worries around AI valuations, cases like RRP suggest investors aren’t likely to rush into these stocks.Exchanges and chipmakers in Asia have started to warn investors about the risks of chasing hot AI trades. In Shanghai, Moore Threads Technology Co — a newly listed AI-chip startup — saw shares slump 13% on Dec. 12 after flagging trading risk, even though the stock remains more than 500% up since its market debut earlier this month. In South Korea, SK Hynix Inc fell after the country’s main exchange raised its risk alert on Dec. 11, after the shares more than tripled in 2025.A spokesperson for BSE Ltd — where RRP is listed — said all its surveillance actions related to the stock were communicated through market circulars. RRP Electronics, owned by RRP Group founder Rajendra Chodankar, declined to comment on Bloomberg News’ questions about the stock surge and regulatory steps, citing an ongoing legal appeal.RRP’s transformation began in early 2024, when Chodankar — whose background includes offering niche products like thermal imaging systems and weapon-drone cameras — struck a deal to take over G D Trading and Agencies Ltd by repaying an 80 million-rupee loan owed to its founders for equity.On April 23, the board approved selling him and several others shares at 12 rupees each, 40% below market price. The move gave Chodankar 74.5% ownership and reduced the founders’ stake to under 2%. The company also agreed to rename itself RRP Semiconductor.Two months earlier, Chodankar had incorporated RRP Electronics Pvt to build an outsourced semiconductor assembly and testing facility in Maharashtra — a link that may have helped fuel the narrative around the listed company and his private venture.**media[394994]**At a September 2024 event for RRP Electronics’ new unit in Navi Mumbai, Chodankar told a media briefing: “India is going to be a superhuman, it’s established beyond doubt.” Maharashtra Chief Minister Devendra Fadnavis and cricket legend Sachin Tendulkar were also present, according to YouTube videos posted by RRP.Prime Minister Narendra Modi’s 2021 semiconductor push — a 760bn-rupee incentive program — has drawn $18bn in announced investments from Micron Technology, Tata Group, Foxconn and HCL Technologies.RRP Semiconductor lists RRP Electronics as a related party because both are owned by Chodankar, though it does not hold any direct ownership stake, according to exchange filings.Still, some investors began viewing RRP Semiconductor as a play on the chip boom. That enthusiasm masked how little of its stock actually trades: about 98% of shares are held by Chodankar and a small circle of associates, many of whom also appear across other RRP-linked companies, including RRP Defense, Indian Link Chain Manufacturers, RRP Electronics and RRP S4E Innovation, according to filings with the BSE and the corporate affairs ministry.In April this year, the exchange withdrew approval for the company’s share sale, a decision RRP has challenged in an appeals court with the outcome still pending. In October, it cautioned investors a year after placing the stock under its strictest surveillance.The rejection followed a September 2024 reminder from SEBI that the company was barred from accessing the securities market because it belonged to the founder group of Shree Vindhya Paper Mills, a firm delisted by the BSE in 2017 for non-compliance, triggering a 10-year market ban.A person familiar with developments at the BSE said the stock exchange suffered an “internal lapse” in processing the offering and may seek SEBI’s guidance on extending the lock-in on the shares until the appeal is resolved.A spokesperson for BSE said in RRP’s original application, the company stated the firm, its founders and directors were not barred — directly or indirectly — from accessing the market, and that the exchange’s approval was based on this disclosure.As the stock took off from 20 rupees in April 2024, the company’s biggest shareholder, Chodankar, resigned from the board, and the chief financial officer quit before returning as company secretary. RRP filed a police complaint against a social-media influencer over alleged rumour-mongering about its supposed links to cricketer Tendulkar and to state-allotted land for chipmaking.In a November 3 exchange filing, the company said it “has yet to start any sort of semiconductor manufacturing activities,” has made no applications under government programmes, and denied any celebrity association.Financials offered little comfort. RRP reported negative revenue of 68.2mn rupees and a net loss of 71.5mn rupees in the quarter ended September.The negative revenue is a result of the company reversing sales booked in the three months ended December 2024 from a 4.4bn-rupee order won in November from Telecrown Infratech Pvt. The order was later cancelled over “contractual disagreements,” the company said in an exchange filing, adding that it also clawed back 80mn rupees of revenue in the March quarter.The weak financials come at a delicate time for the stock. With the hype around AI fading and regulatory scrutiny tightening, the downside now sits with investors who piled in — and with Chodankar, who controls nearly the entire float.