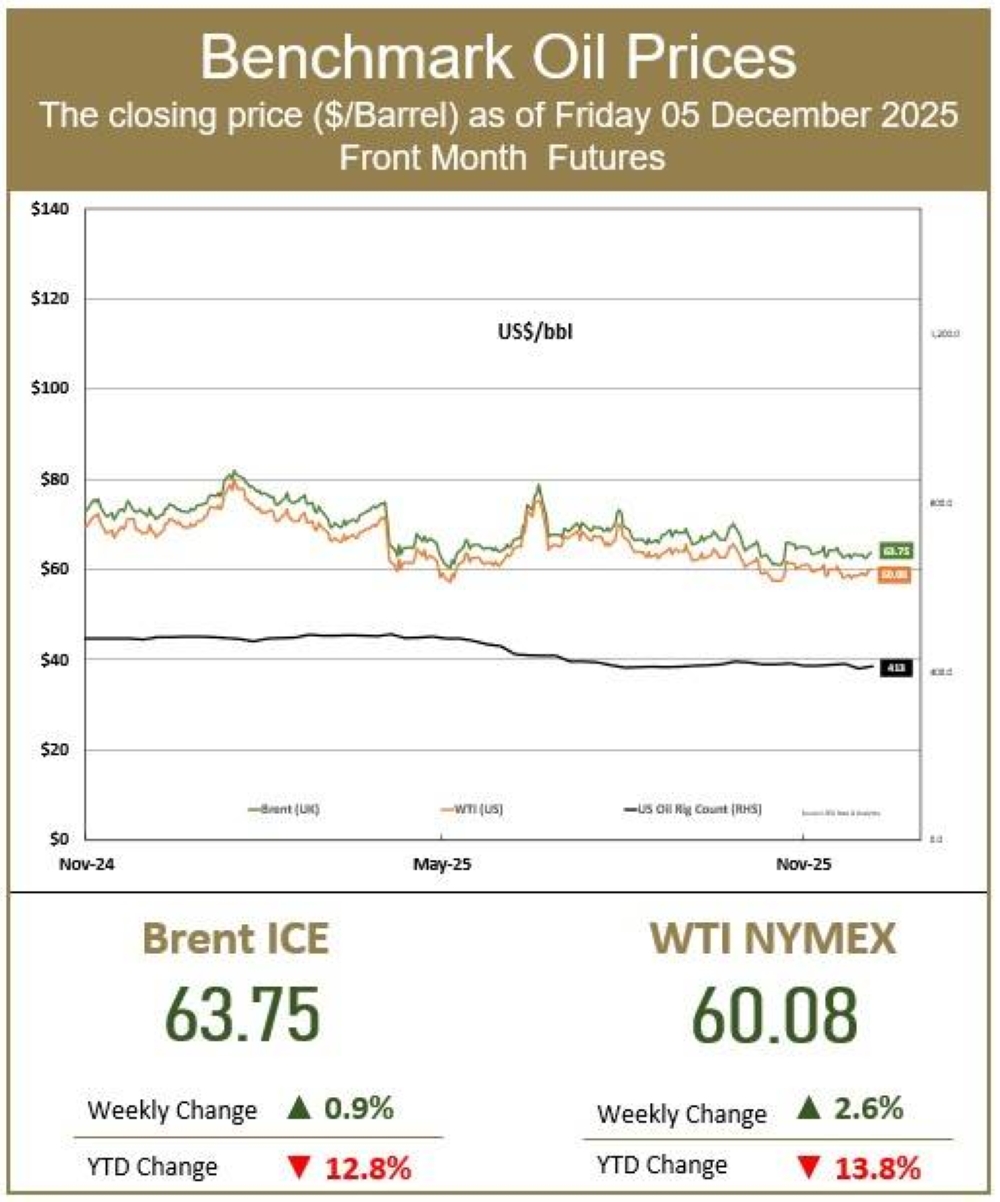

Oil prices have been falling as the market faces the prospect of a growing surplus.This year is set to culminate in the first major glut since 2020. The International Energy Agency forecast in November that global supply will outweigh demand by 2.4mn barrels a day, and expects the gap to expand to a record 4mn barrels a day next year.Sustained lower prices will put pressure on governments and businesses that are dependent on oil revenue, while others stand to benefit. What’s driving the oil surplus? Oil demand growth is faltering. The trade policies of US President Donald Trump are weighing on the outlook for the global economy, and China, the second-largest crude consumer, is struggling with a property market downturn and weak consumer spending.On the supply side, Opec+, the coalition of producers led by Saudi Arabia, has been unwinding past output cuts. Countries outside this group, in particular those in the Americas, are churning out more barrels, too.Supply from Russia, the world’s third-biggest producer, remains a wild card. On the one hand, the country faces new US sanctions that threaten to disrupt its exports. But the Trump administration’s renewed effort to secure a deal to end the war in Ukraine has raised the prospect of some international sanctions being unwound, which could ease the flow of Russian barrels into the market. Who are the winners in a world with an oversupply of oil? Oil-importing nationsA low-oil price environment is good for buyers, especially large net importers such as China, which has been filling up its strategic reserves, and India, which has faced US pressure to stop buying Russian crude.India is the world’s third-biggest consumer of oil. It ramped up its purchases from Russia following the 2022 invasion of Ukraine, as Russian exporters offered big discounts to offset the loss of traditional European buyers. A drop in global prices could make it less painful for India to avoid sanctioned Russian barrels and switch to suppliers in the Middle East, whose medium and heavy crude grades are similar to Russia’s Urals export blend. TrumpCheaper oil can translate into lower fuel prices. Trump likes to use the price of gasoline as an economic barometer and during last year’s election pledged to bring it below $2 a gallon.Just over 10 months into his second term, the national average price of gasoline had dropped by about 12 cents, although it had yet to fall beneath $3 a gallon, a level last seen in 2021. Further reductions in fuel prices could be limited by outages at key oil refineries in Asia and Africa, as well as permanent closures across Europe and the US.Lower oil prices come with a catch for Trump. If they decline too much, crude extraction could become uneconomical in the US, undermining the president’s “drill, baby, drill” agenda and squeezing his political supporters that rely on the oil industry. Oil refinersCheaper crude can boost the margins that refiners make from turning oil into products such as gasoline, diesel and jet fuel. In mid-November, US refiners’ margins hit their highest seasonal level since 2022.As global refining capacity is relatively constrained, this limits how much extra oil can be processed and means refined product prices are likely to fall less steeply than for crude. Lower oil prices are therefore more beneficial for countries that import and refine crude themselves, rather than relying on inflows of refined products. Oil tradersIn the run-up to the oil surplus, the “put skew” for the US oil benchmark West Texas Intermediate — a measure of how much more traders are willing to pay for bearish put options over bullish calls — reached its highest level in a month. That’s a sign speculators are geared up for a price drop.Meanwhile, just before the US blacklisted Russian oil giants Rosneft PJSC and Lukoil PJSC in October, money managers were the least bullish on US crude on record, according to the most up-to-date investor positioning data, which was delayed by the government shutdown.As futures prices finally reflect the sombre outlook for the market, many investors see this as vindication of their longstanding bearish view. They point to two things as proof they’ve been on the right side of the trade all along: total US crude stockpiles (excluding the Strategic Petroleum Reserve) climbed to their highest level in five months in November, while the volume of crude aboard tankers at sea continues to hit fresh records, suggesting supply is outstripping demand.US strategic oil reserveLow oil prices offer an opportunity for the US to replenish its store of emergency crude, which was only around 60% full as of mid-November. The Strategic Petroleum Reserve remains diminished after the Biden administration released supply into the market to try to tame the gasoline price spike that followed Russia’s full-scale invasion of Ukraine.Trump vowed during his inaugural address to fill the SPR “right to the top.” Taking advantage of low oil prices, the Energy Department awarded contracts worth almost $56mn in November to procure 900,000 barrels for this stockpile.However, as part of Trump’s sweeping tax-and-spending law passed over the summer, Congress only appropriated $171mn for oil purchases for the SPR between 2025 and 2029 — a limit the government could hit very quickly. That sum equates to less than 3mn barrels at current prices, which is a far cry from the roughly 300mn barrels needed to bring the SPR to full capacity. Who are the losers when there’s a global excess of oil? PetrostatesFor fossil-fuel exporters whose economies are heavily dependent on the oil industry, subdued prices could weigh on their revenue and put pressure on their fiscal budgets.Saudi Arabia, the world’s second-largest oil producer after the US, is seeking to diversify its economy through the Vision 2030 programme. However, the massive investments being made in mega construction projects, such as the flagship Neom development, as well as other initiatives to build Red Sea tourism resorts, electric-vehicle factories and data centres, have arguably left it even more dependent on oil revenue.While the kingdom has been rejigging its mega-project spending — delaying and scaling back some developments and accelerating others — it’s still expecting a national budget shortfall for the next few years. Bloomberg Economics estimated in November that the Saudi government needs an oil price of $98 a barrel to balance its budget and $115 when including domestic spending by its sovereign wealth fund, the Public Investment Fund. That’s well above this year’s average of $69 a barrel for Brent, the global benchmark, through the start of December.RussiaWestern sanctions have made Russian oil exporters heavily dependent on buyers in China and India, who have demanded discounts to keep importing this seaborne crude. In the absence of a peace deal to end the war in Ukraine, the new US sanctions and an oversupplied global market could force Russian producers to cut their prices even further.As the US ban on dealings with Rosneft and Lukoil started to come into force in November, Russia’s flagship Urals blend was more than $20 a barrel cheaper than Brent, according to data from Argus Media. While that gap is significantly smaller than in the earlier years of the war in Ukraine, it’s still markedly wider than the historical discount of $2 to $4.Taxes from Russia’s oil and gas industry account for about a quarter of the federal budget. Even before the new sanctions were announced, the government expected tax revenue from the sector this year to drop to the lowest level since 2020 due to the global crude price slump and a stronger rouble.Russian authorities have downplayed the potential economic impact of the fresh US restrictions, saying the country will adapt quickly and find workarounds, allowing discounts on its oil to narrow within a couple of months. In the meantime, the volume of Russian oil aboard tankers has increased, suggesting that buyers are, at least in the short term, less willing to take delivery of these cargoes. US shale industryThe US shale industry has been the world’s engine for oil-production growth in recent years, but the momentum is now slowing. Many producers need an oil price of around $65 a barrel to turn a profit and have been looking to increase their output at less than 5% annually as crude prices hover near the break-even threshold.A global oil surplus that knocks prices down to about $50 a barrel would prompt US shale producers to idle their drilling rigs and park their frack fleets as operations become economically unviable.Their output is holding up for now, but more than 10% of oil-focused rigs have been taken offline since the start of the year, according to data from Baker Hughes Co. The decline will likely accelerate in the coming months if oil prices stay low, which could put pressure on oilfield services companies.Sustained lower oil prices could prompt more consolidation in the US shale patch. Mid-sized producers could scoop up struggling smaller players to add scale as some of the best drilling spots have already been tapped. Big OilLow oil prices are bad for producers, although integrated oil majors with refining and trading businesses are less vulnerable than pure upstream companies that focus only on extraction.The profits of the five Western oil supermajors — Exxon Mobil Corp, Chevron Corp, Shell Plc, TotalEnergies SE and BP Plc — have more than halved from three years ago and are poised to decline further. Still, the current oil price downturn isn’t as bad as in 2014 or 2020. Big Oil executives saw this decline coming and announced plans to cut share buybacks and costs earlier this year.Some executives are even talking up possible opportunities. Exxon, for example, is on the lookout for potential acquisitions. Meanwhile, Occidental Petroleum Corp Chief Executive Officer Vicki Hollub said in mid-October that low prices today will deter the investments needed for the future and tighten supply, making her “very bullish” on a price rebound from 2027. The energy transitionRoad transport is the biggest source of oil demand. Consumers are used to a certain amount of volatility in fuel prices, but a prolonged reduction could make them less inclined to switch to an electric vehicle. That said, in areas where there are high taxes on diesel and gasoline, such as Europe and California, there could be limited relief at the pump from lower oil prices.The buildout of clean power sources is less likely to be impacted by a crude surplus. In most regions, other than places such as the Middle East, renewables are usually competing against coal and natural gas for utility-scale electricity generation rather than oil.