Qatar banking sector total assets have increased 0.3% month-on-month (up 5.9% YTD) to QR1.78tn in August, QNB Financial Services said in its latest ‘Monthly Banking Sector Update’.

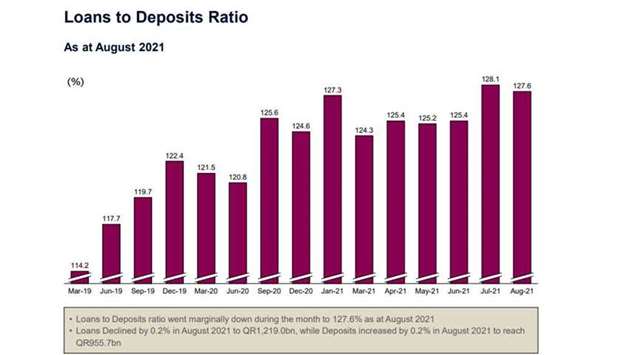

The loan book declined by 0.2% MoM (up 8.0% YTD) to QR1,219bn in August while deposits increased by 0.2% MoM (+5.5% YTD) to reach QR955.7bn in August, QNBFS said.

As deposits went up by 0.2% in August, the loan-to-deposit ratio (LDR) went down to 127.6% compared to 128.1% in July, QNBFS noted.

Loans’ decline in August this year was mainly due to a drop by 1.5 % from the public sector.

Loans grew by 8% YTD for 2021, compared to a growth of 8.6 % in 2020. Loans grew by an average 8.5 % over the past five years (2016 - 2020).

Total domestic public sector loans went down by 1.5% MoM (up 15.2% YTD). The government segment’s loan book declined by 3.3% MoM (+30.9% YTD 2021), while the government institutions’ segment (represents nearly 51% of public sector loans) remained flat MoM (+6.5% YTD).

Even the semi-government institutions’ segment stood stagnant MoM (-8.3% YTD).

Private sector loans gained by 0.5% MoM and are up 5.9% YTD. Consumption and others mainly contributed toward the private sector loan growth for August.

Consumption and others segment (contributes nearly 21% to private sector loans) increased by 2% MoM (0.6% YTD).

Real estate (contributes nearly 22% to private sector loans) increased by 0.7% MoM (5.0% YTD).

General trade (contributes nearly 21% to private sector loans) remained flat MoM (+6% YTD).

However, services (contributes nearly 28% to private sector loans) went down marginally by 0.1% MoM (+9.1% YTD) during August.

Deposits growth in August was mainly due to an increase in non- resident deposits by 1.3 %, QNBFS said.

Deposits grew by 5.5 % YTD for 2021, compared to a growth of 6.6 % in 2020. Deposits grew by an average 7% over the past five years (2016 - 2020).

Non-resident deposits increased by 1.3% MoM (+13.4% YTD 2021) driving the overall deposits growth. Private sector deposits went up by 0.1% MoM (-0.2% YTD 2021).

On the private sector front, the consumer segment moved up by 0.1% MoM (up 2.7% YTD) while the companies and institutions’ segment went up by 0.2% MoM (-3.5% YTD 2021).

Public sector deposits declined by 0.7% MoM (+6.8% YTD) for the month of August 2021.

Looking at segment details, the government institutions’ segment (represents nearly 55% of public sector deposits) declined by 7.1% MoM (-1.8% YTD 2021).

The semi-government institutions’ segment grew by 14.2% MoM (+16.8% YTD 2021). The government segment moved up by 6% MoM (up 20.5% YTD).

On the banking sector overall loan book declining in August, an analyst told Gulf Times that public sector (Government finances) have improved due to higher energy prices and resulted in less reliance on bank borrowings.

Asked why the private sector deposits with Qatar’s banks were going up, the analyst said, “With the rapid infrastructure developments and overall business environment improving, there is increasing consumer confidence and activity in the private sector.”

Business / Business

Qatar banks' total assets increase 0.3% month-on-month to QR1.78tn in August: QNBFS