Financial Technology (fintech), ‘agtech’, ‘foodtech’, and ‘medtech’ are among the new sectors that would help boost trade opportunities between Australia and Qatar, according to Moin Anwar, Trade and Investment Commissioner (Middle East) at New South Wales Government, Australia.

Anwar made the statement in a presentation titled ‘Sectors of Focus between NSW and Qatar and the Customer Engagement with Qatar Given the Current Travel Restrictions’ during a webinar hosted recently by Doha Bank.

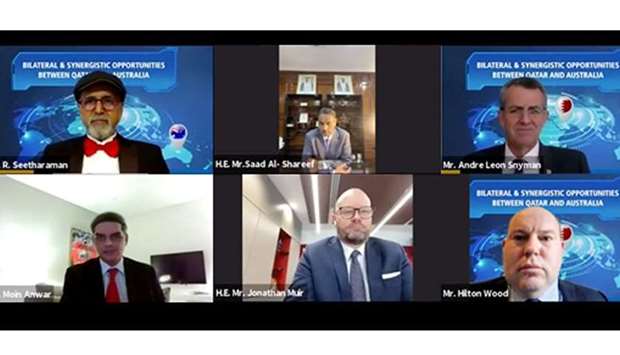

The webinar, ‘Bilateral and Synergistic Opportunities between Qatar and Australia’, was moderated by Doha Bank CEO Dr R Seetharaman in the presence of Saad aI-Shareef, Qatar’s ambassador to Australia; Jonathan Muir, Australia’s ambassador to Qatar; and Hilton Wood, chief representative, Doha Bank Australia Representative Office.

In his presentation, Anwar noted that opportunities to further grow Qatar-Australia trade are in the food and beverage (F&B), building and construction, education, and healthcare sectors.

He said, “We are working with Doha Bank to facilitate trade and investment between Qatar and Australia…NSW is the recipient of agriculture investment from Qatar that includes logistics and infrastructure. Investments are also received from Qatar Investment Authority (QIA). The game-changer was Qatar Airways’ non-stop flight to Sydney. Qatar provides opportunities for Australian exports in food, construction, and much more.”

Anwar added: “From an investment perspective, NSW has recently created Special Activation Precincts (SAPs) where investors can look for opportunities in logistics, manufacturing, and energy. The Western Sydney Aerotropolis will become an economic centre. The new Sydney Airport is set to begin operations in 2026.

“The food, manufacturing, and other sectors are expected to provide opportunities from these developments…staying connected is vital to promote bilateral opportunities. Technology will attract bilateral investment between countries.”

In a speech, al-Shareef said: “Today, Qatar stands as an attractive choice for foreign investors. There are many synergies that exist between Qatar and Australia, and businesspeople can explore and capture the potentials for post-pandemic economic recovery.”

Muir also lauded Qatar Airways’ “aggressive crisis strategy,” saying this allowed the State’s national airline to take “a greater share of both the passenger and cargo market globally.”

He also said QIA is seeking to expand its footprint in Australia: “As part of this, QIA recently established an Asia regional office in Singapore, making it even easier for Australian investors to engage.”

On reduced non-tariff barriers for Australian goods and services, Muir said: “Australia will continue to press Qatar to increase the shelf life of Australian vacuum-packed beef from 90 to 120 days to be in line with GCC standards.”

Seetharaman said, “Qatar-Australia trade exceeded AUS$2bn in 2019-2020. Qatar Airways brought Australians home during Covid-19. Australia is an important market for Qatar Airways. Agriculture is one of the largest areas of Qatari investments in Australia. Other attractive sectors include infrastructure, roads, railways, and airports. Huge potential is looming in real estate, office buildings, and luxury hotels.”

“Qatar’s trade surplus had surged year-on-year in June 2021. The promising investment sectors in Qatar include fintech, healthcare, logistics, and education,” Seetharaman also said.

Anwar made the statement in a presentation titled ‘Sectors of Focus between NSW and Qatar and the Customer Engagement with Qatar Given the Current Travel Restrictions’ during a webinar hosted recently by Doha Bank.

The webinar, ‘Bilateral and Synergistic Opportunities between Qatar and Australia’, was moderated by Doha Bank CEO Dr R Seetharaman in the presence of Saad aI-Shareef, Qatar’s ambassador to Australia; Jonathan Muir, Australia’s ambassador to Qatar; and Hilton Wood, chief representative, Doha Bank Australia Representative Office.

In his presentation, Anwar noted that opportunities to further grow Qatar-Australia trade are in the food and beverage (F&B), building and construction, education, and healthcare sectors.

He said, “We are working with Doha Bank to facilitate trade and investment between Qatar and Australia…NSW is the recipient of agriculture investment from Qatar that includes logistics and infrastructure. Investments are also received from Qatar Investment Authority (QIA). The game-changer was Qatar Airways’ non-stop flight to Sydney. Qatar provides opportunities for Australian exports in food, construction, and much more.”

Anwar added: “From an investment perspective, NSW has recently created Special Activation Precincts (SAPs) where investors can look for opportunities in logistics, manufacturing, and energy. The Western Sydney Aerotropolis will become an economic centre. The new Sydney Airport is set to begin operations in 2026.

“The food, manufacturing, and other sectors are expected to provide opportunities from these developments…staying connected is vital to promote bilateral opportunities. Technology will attract bilateral investment between countries.”

In a speech, al-Shareef said: “Today, Qatar stands as an attractive choice for foreign investors. There are many synergies that exist between Qatar and Australia, and businesspeople can explore and capture the potentials for post-pandemic economic recovery.”

Muir also lauded Qatar Airways’ “aggressive crisis strategy,” saying this allowed the State’s national airline to take “a greater share of both the passenger and cargo market globally.”

He also said QIA is seeking to expand its footprint in Australia: “As part of this, QIA recently established an Asia regional office in Singapore, making it even easier for Australian investors to engage.”

On reduced non-tariff barriers for Australian goods and services, Muir said: “Australia will continue to press Qatar to increase the shelf life of Australian vacuum-packed beef from 90 to 120 days to be in line with GCC standards.”

Seetharaman said, “Qatar-Australia trade exceeded AUS$2bn in 2019-2020. Qatar Airways brought Australians home during Covid-19. Australia is an important market for Qatar Airways. Agriculture is one of the largest areas of Qatari investments in Australia. Other attractive sectors include infrastructure, roads, railways, and airports. Huge potential is looming in real estate, office buildings, and luxury hotels.”

“Qatar’s trade surplus had surged year-on-year in June 2021. The promising investment sectors in Qatar include fintech, healthcare, logistics, and education,” Seetharaman also said.