Mekdam Holding Group Monday shot up as much as 50% upon debut but finally closed 45.64% higher when its 5.6mn shares came up for trading, thus becoming the second entity in the venture market (QEVM) of the Qatar Stock Exchange (QSE).

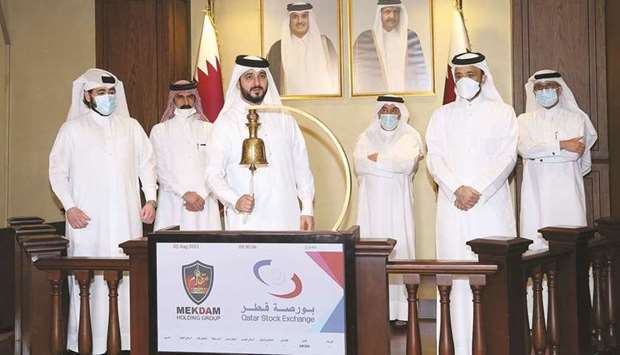

Using the direct listing option, the shares of Mekdam got listed with the symbol “MKDM”. Its entry was marked by the customary bell ringing by Mekdam chairman Sheikh Mohamed bin Nawaf bin Nasser al-Thani in the presence of senior officials of the both the company and the bourse.

The company's share price was floated on the first day of trading as it started at QR8.25 and closed at 8.01. The reference price was set at QR5.5 a piece with face value of QR1. A total of 5.6mn shares valued at QR45.5mn changed hands across 888 deals.

Nevertheless, its shares will be allowed to fluctuate by 10% up and down starting from today as it is the case with the other listed companies.

"The listing of Mekdam will help increase the liquidity in the market and provide new options for the investors,” QSE chief executive Rashid bin Ali al-Mansoori said.

Mekdam is traded in the same manner as those on the main market in terms of order types, corporate actions and settlement/clearing arrangements.

The pricing mechanism of Mekdam shares is exactly same as it is there for the stocks listed on the main market.

Investors do not need to obtain new investor number to trade in Mekdam shares and the orders in the QEVM are executed through the brokers licensed by the Qatar Financial Market Authority or QFMA.

Sheikh Mohamed encouraged other private and family companies to follow suit in transferring into public shareholding companies, which is an important step for listing on the QSE.

“Focusing on awareness campaigns, the QSE exerts intense efforts to increase the number of listed companies, and the listing of Mekdam is hoped to encourage private and family businesses to transfer into public shareholding companies with the aim of listing on the stock exchange,”, al-Mansoori said.

Abdulaziz Nasser al-Emadi, director of the QSE’s listing department, is confident that more companies will join the QEVM in the coming period.

The companies eligible to join the QEVM should benefit from rules designed to provide flexibility for mid-size companies and their owners, according to him.

“The launch of the new market was a result of the strategic initiatives and the intense efforts made by the QSE over the past years to develop Qatar’s capital market through continuous consultations with private and family-owned companies to identify their needs and offer them suitable solutions and incentives for listing in the market,” he said.

Mekdam Holding Group was established in March 2018 as a private company with limited liabilities and authorised and issued capital of QR50mn.

Standard and Poor’s, a global credit rating agency, had said a highly flexible cost structure and Qatar's economic growth are expected to help Mekdam’s profit margin to range between 15% and 18% over the next 12-18 months.

Using the direct listing option, the shares of Mekdam got listed with the symbol “MKDM”. Its entry was marked by the customary bell ringing by Mekdam chairman Sheikh Mohamed bin Nawaf bin Nasser al-Thani in the presence of senior officials of the both the company and the bourse.

The company's share price was floated on the first day of trading as it started at QR8.25 and closed at 8.01. The reference price was set at QR5.5 a piece with face value of QR1. A total of 5.6mn shares valued at QR45.5mn changed hands across 888 deals.

Nevertheless, its shares will be allowed to fluctuate by 10% up and down starting from today as it is the case with the other listed companies.

"The listing of Mekdam will help increase the liquidity in the market and provide new options for the investors,” QSE chief executive Rashid bin Ali al-Mansoori said.

Mekdam is traded in the same manner as those on the main market in terms of order types, corporate actions and settlement/clearing arrangements.

The pricing mechanism of Mekdam shares is exactly same as it is there for the stocks listed on the main market.

Investors do not need to obtain new investor number to trade in Mekdam shares and the orders in the QEVM are executed through the brokers licensed by the Qatar Financial Market Authority or QFMA.

Sheikh Mohamed encouraged other private and family companies to follow suit in transferring into public shareholding companies, which is an important step for listing on the QSE.

“Focusing on awareness campaigns, the QSE exerts intense efforts to increase the number of listed companies, and the listing of Mekdam is hoped to encourage private and family businesses to transfer into public shareholding companies with the aim of listing on the stock exchange,”, al-Mansoori said.

Abdulaziz Nasser al-Emadi, director of the QSE’s listing department, is confident that more companies will join the QEVM in the coming period.

The companies eligible to join the QEVM should benefit from rules designed to provide flexibility for mid-size companies and their owners, according to him.

“The launch of the new market was a result of the strategic initiatives and the intense efforts made by the QSE over the past years to develop Qatar’s capital market through continuous consultations with private and family-owned companies to identify their needs and offer them suitable solutions and incentives for listing in the market,” he said.

Mekdam Holding Group was established in March 2018 as a private company with limited liabilities and authorised and issued capital of QR50mn.

Standard and Poor’s, a global credit rating agency, had said a highly flexible cost structure and Qatar's economic growth are expected to help Mekdam’s profit margin to range between 15% and 18% over the next 12-18 months.