With less than a month left, Canada’s ETF industry is heading for a blowout year with inflows poised for a record and assets crossing the C$200bn ($151bn) mark.

Exchange traded funds attracted C$4.5bn of investments in November – the biggest monthly increase for the year – pushing inflows to C$23bn in 2019 and inching closer to the record set two years ago at C$26bn, , according to National Bank of Canada. The iShares S&P/TSX 60 Index ETF, which tracks top stocks, brought in almost C$700mn in November, according to data compiled by Bloomberg.

“We saw for the first time in a while where equities brought in a lot more money than fixed income,” said Mark Noble, senior vice president for ETF strategy at Horizons ETFs Management (Canada) Inc. “The market seems to have found a little bit more confidence.” It’s little wonder, stocks surged 3.4% in November, the biggest gain since January. The S&P/TSX Composite Index has climbed 19% this year and on a total returns basis, it’s up 22%.

That helped push assets under management across C$200bn in the month, National Bank of Canada data show. The industry has doubled its assets in three and a half years, said Daniel Straus, vice president of ETFs and financial products research at the firm.

“A lot of pent up demand for investment found its way back into the market,” he said. Investors had tiptoed back into passive investing this year after the global rout at the end of 2018. “Investor demand was finally released in concert with the holiday season and then you end up having this kind of blind optimism across the board.”

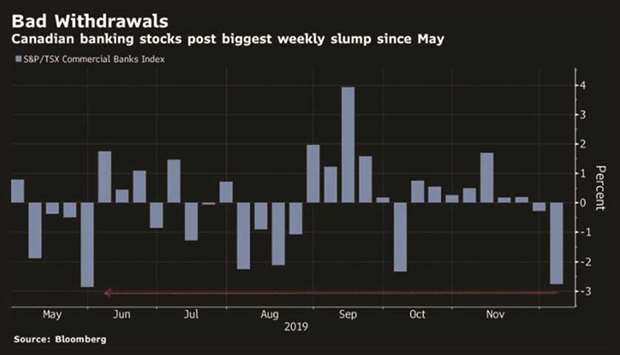

The S&P/TSX Composite Index pared its weekly loss after strong US jobs data lifted sentiment south of the border. Banks led declines after quarterly profits came in below expectations for most lenders.

The inverted yield curve may be here to stay after surprise job loss numbers sowed doubts on Canada’s resilient economy. The Canadian two-year yield fell to 1.66% on Friday, while the 10-year yield slipped to 1.58%. The Canadian currency managed to eke out a gain this week despite weakening Friday after the nation registered the biggest monthly drop in employment in a decade.

Prime Minister Justin Trudeau delivered his Throne Speech where he called on lawmakers to find common ground and said he’d be open to new ideas in order to work with other parties. He also cited climate change and efforts to “strengthen the middle class” as two of the main messages sent by votes in the divisive election in which he lost his majority.

Earlier in the week, Donald Trump called Trudeau “two-faced” after a hot-mic video captured the Canadian prime minister joking about the US president’s extended remarks to reporters at a Nato summit this week.

Canada posted its biggest monthly job loss in a decade, setting up a test of the Bank of Canada’s resolve to hold off lowering interest rates. Just days earlier, the nation’s central bank stood pat on interest rates, citing a resilience in the nation’s economy that allowed it to “chart its own course in monetary policy.”

Separately, a shipment of paintings and sculptures potentially worth hundreds of millions of dollars helped drive an increase in exports in October, Statistics Canada said on Thursday. That resulted in the northern nation’s widest surplus with its biggest trading partner since the 2008 financial crisis.

October new housing price data are due on December 12 and Bank of Canada governor Stephen Poloz – who announced on Friday he won’t seek a second term at the helm of the central bank – will be speaking at an event in Toronto that day.

.