*The country’s growth is expected to accelerate to 2.6% this year from 1.6% in 2018, Kuwait-based banking major NBK said in a recent macroeconomic outlook

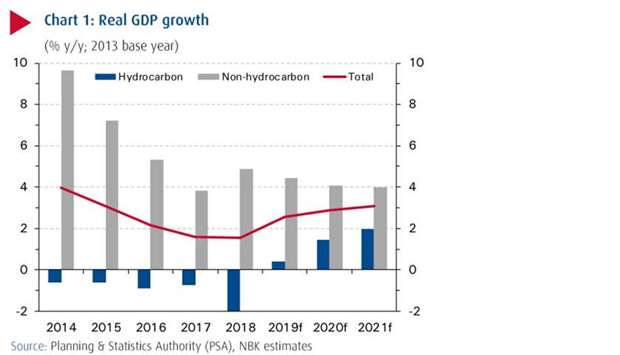

Qatar’s non-oil activity has been buoyed by government investment and the country’s growth is expected to accelerate to 2.6% this year from 1.6% in 2018, banking major NBK has said in a macroeconomic outlook.

The country’s growth is driven by a recovery in the hydrocarbon sector output (0.4%) and ongoing gains in non-hydrocarbon activity (4.4%) as the government’s expansive public investments bear fruit, it said.

Over the medium term, as infrastructure projects related to the FIFA World Cup 2022 and work on the broader Qatar National Vision 2030 advances, non-oil growth is expected to moderate to around 4% by 2021, NBK said.

By this time, the private sector should have assumed a greater role in driving diversification through greater-value add — in sectors such as manufacturing, services, transportation and real estate—as per 2018’s Qatar National Development Strategy 2018-2022 (NDS-2), NBK said in its July outlook.

NDS-2 also prioritises raising the average productivity of its local and foreign workers, which partly explains last year’s decision to offer long-term, skilled expats permanent residency and permit 100% foreign ownership across all business sectors.

The hydrocarbon sector, meanwhile, should get a welcome boost in 2020 from the commissioning of the delayed $10bn Barzan gas production facility, NBK noted.

“This should raise gas output by 12% (2 bncf/d) and drive higher condensates and NGLs volumes. The most significant contribution, however, will come over the medium-to-long term when LNG capacity expands by over 40% to 110mn tonnes per year (mn tpy), with the addition of four new LNG trains by 2024,” NBK said.

Qatar’s fiscal position has strengthened since the authorities began the process of fiscal reform and consolidation (merging ministries, liberalising fuel prices etc.) after the oil price downturn and as energy prices began to recover from their 2016 nadir. Qatar recorded a surplus in 2018 (2.2% of GDP); that should improve further to 3.2% by 2021 amid continued spending restraint and stable energy prices, NBK said.

“The improvement in government finances will also have a positive bearing on public debt. While the authorities accessed the debt markets in 2018 and early in 2019 — securing favourable rates amid considerable investor demand—to the tune of $24bn, debt levels are expected to fall from 53% of GDP in 2018 to 41% of GDP by 2021,” NBK’s macroeconomic outlook showed.

The external current account (CA) balance, which moved back into surplus in 2017 and reached an estimated 8.3% of GDP in 2018 should remain in surplus over the forecast period. Notwithstanding a slight deterioration in 2019 to 6.4% of GDP on softer oil and gas prices, the CA will benefit in the medium-to-long term from higher gas exports and returns from the Qatar Investment Authority’s overseas assets.

Qatar’s banking sector, NBK noted, “has overcome the shock” of non-resident capital flight and tighter liquidity associated with the 2017 blockade. Foreign deposits have returned (+29% year-on-year), private sector credit growth is at a near-three year high (+12.6% y-o-y) and overall liquidity has improved.

But, NBK cautioned, volatile energy prices and LNG competition are the main risks Qatar faced.

It said the country faces several challenges including continued sensitivity to volatile global energy prices and capital flows as well as increasing LNG competition (especially from Australia and the US), which could put downward pressure on prices.

The country’s growth is driven by a recovery in the hydrocarbon sector output (0.4%) and ongoing gains in non-hydrocarbon activity (4.4%) as the government’s expansive public investments bear fruit, it said.

Over the medium term, as infrastructure projects related to the FIFA World Cup 2022 and work on the broader Qatar National Vision 2030 advances, non-oil growth is expected to moderate to around 4% by 2021, NBK said.

By this time, the private sector should have assumed a greater role in driving diversification through greater-value add — in sectors such as manufacturing, services, transportation and real estate—as per 2018’s Qatar National Development Strategy 2018-2022 (NDS-2), NBK said in its July outlook.

NDS-2 also prioritises raising the average productivity of its local and foreign workers, which partly explains last year’s decision to offer long-term, skilled expats permanent residency and permit 100% foreign ownership across all business sectors.

The hydrocarbon sector, meanwhile, should get a welcome boost in 2020 from the commissioning of the delayed $10bn Barzan gas production facility, NBK noted.

“This should raise gas output by 12% (2 bncf/d) and drive higher condensates and NGLs volumes. The most significant contribution, however, will come over the medium-to-long term when LNG capacity expands by over 40% to 110mn tonnes per year (mn tpy), with the addition of four new LNG trains by 2024,” NBK said.

Qatar’s fiscal position has strengthened since the authorities began the process of fiscal reform and consolidation (merging ministries, liberalising fuel prices etc.) after the oil price downturn and as energy prices began to recover from their 2016 nadir. Qatar recorded a surplus in 2018 (2.2% of GDP); that should improve further to 3.2% by 2021 amid continued spending restraint and stable energy prices, NBK said.

“The improvement in government finances will also have a positive bearing on public debt. While the authorities accessed the debt markets in 2018 and early in 2019 — securing favourable rates amid considerable investor demand—to the tune of $24bn, debt levels are expected to fall from 53% of GDP in 2018 to 41% of GDP by 2021,” NBK’s macroeconomic outlook showed.

The external current account (CA) balance, which moved back into surplus in 2017 and reached an estimated 8.3% of GDP in 2018 should remain in surplus over the forecast period. Notwithstanding a slight deterioration in 2019 to 6.4% of GDP on softer oil and gas prices, the CA will benefit in the medium-to-long term from higher gas exports and returns from the Qatar Investment Authority’s overseas assets.

Qatar’s banking sector, NBK noted, “has overcome the shock” of non-resident capital flight and tighter liquidity associated with the 2017 blockade. Foreign deposits have returned (+29% year-on-year), private sector credit growth is at a near-three year high (+12.6% y-o-y) and overall liquidity has improved.

But, NBK cautioned, volatile energy prices and LNG competition are the main risks Qatar faced.

It said the country faces several challenges including continued sensitivity to volatile global energy prices and capital flows as well as increasing LNG competition (especially from Australia and the US), which could put downward pressure on prices.