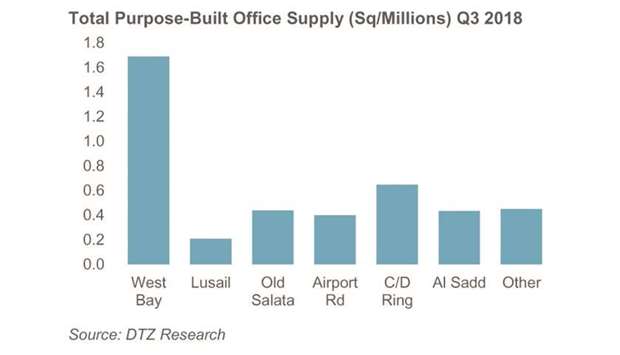

West Bay remains Doha’s principal commercial district, comprising nearly 30% of all purpose-built commercial office accommodation in Doha, a new report has shown.

Total office supply in West Bay currently stands at approximately 1.7mn sq m, according to research and consultancy DTZ Qatar.

But, DTZ Qatar said the “office leasing market remained subdued” in the third quarter (Q3).

The majority of recent demand has been generated by companies relocating within Doha, the most notable being beIN Sports’ move to Al Asmakh Tower on Majlis Al Taawon Street.

Outside of West Bay, QNB became the first company to move into Msheireb, having secured more than 2,500 sq m in Doha’s newest prime office location, it said.

QP District in West Bay will, on completion, increase supply by more than 200,000 sq m, however most of the new supply in the current pipeline will be delivered in the Marina District of Lusail in the next few years.

While new demand from larger corporate occupiers remains weak, the fall in office rents has generated activity within Doha as tenants strive to secure more attractive lease terms, DTZ Qatar said.

There has been a significant increase in demand for small business units or serviced office suites in Qatar in 2018. This demand has largely been generated by companies based in the region, who now require a full-time presence in Doha; however, this has not yet translated into a significant absorption of available office accommodation in West Bay or other prime areas. West Bay typically commands rental levels of between QR130 and QR150 per sq m a month on a floor-by-floor basis, although rents in excess of QR200 per sq m per month can be achieved for smaller fully fitted suites, the report noted.

Offices in secondary locations are now available at monthly rents of between QR70 and QR100 per sq m, depending on size, quality, fit-out and location, DTZ Qatar said.

Current office rents have reflected a fall of 20% to 25% since the height of the market in 2015.

“The current oversupply has also resulted in more flexibility among landlords in order to attract and retain tenants,” DTZ Qatar noted.

Rent free periods of between two and three months are now “commonplace” for new leases, while rents on lease renewals increasingly reflect current market levels rather than the inflated rents that had been agreed between 2013 and 2015, it said.

Graph 3