Cheap oil and ambitious infrastructure-building programmes have set the scene for a record year for Islamic bond sales. The top arranger of the notes says these dynamics will keep driving issuance into 2018.

Arabian Gulf governments have tapped Shariah-compliant debt markets to plug revenue shortfalls caused by persistently low crude prices. Saudi Arabia led the way with a $9bn global offer in April, while Oman and Bahrain have also sold sukuk. In Malaysia, the world’s biggest market for the bonds, funding for rail and other projects is driving ringgit issuance by state- owned companies.

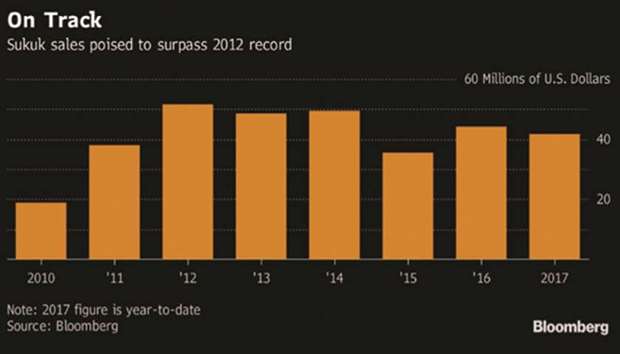

Sukuk sales have reached $42.2bn so far this year, closing in on the all-time high of $51.6bn in 2012, according to data compiled by Bloomberg. CIMB Islamic Bank Bhd, which has arranged the most Islamic note sales by value this year, is anticipating a record year and “this momentum will be continued through to 2018,” said Mohamed Rafe Mohamed Haneef, the lender’s Kuala Lumpur-based chief executive officer.

“With energy prices still relatively low, governments in the Gulf are facing issues balancing their budgets,” said Apostolos Bantis, a credit strategist at Commerzbank in Dubai. “Saudi Arabia, which still has a low debt-to-GDP ratio, could sell more bonds comfortably for the next one to two years without being penalised by rating agencies.”

Apart from the Saudi offer, the biggest sales so far this year are:

n Hong Kong sold $1bn of dollar Islamic notes in February

n Indonesia sold $3bn of global sukuk in March and Turkey sold $1.25bn of the debt in the same month

n Oman sold $2bn of sukuk in May and said in August it was planning more debt sales this year

n Bahrain sold $850mn of sukuk in September

n In Malaysia, state-owned companies DanaInfra Nasional Bhd and Prasarana Malaysia Bhd – which are building MRT and LRT projects in Kuala Lumpur – have been among the biggest corporate issuers this year.

Fakrizzaki Ghazali, head of fixed income at Sedco Capital in Jeddah, said he was forecasting total sales of $55bn to $60bn for 2017. Supply dynamics should remain favourable in 2018, but issuance may drop if oil prices recover and the Federal Reserve turns more aggressive in raising US interest rates, he said.

The travails of Dana Gas – a UAE company that stunned investors and the Islamic finance community when it announced in June that it had reviewed its own bonds and found they were not Shariah-compliant – could also sap demand, Fakrizzaki said.

Islamic bonds use a variety of structures to link returns to assets to comply with the ban on interest. The securities were pioneered in Malaysia in the 1980s and in recent years their popularity has seen them spread beyond Muslim-majority countries with the UK and Luxembourg selling the notes.

Malaysia has accounted for around two-thirds of worldwide sales this year, said Angus Salim Amran, head of financial markets at RHB Investment Bank Bhd in Kuala Lumpur, who is forecasting full-year issuance of $56.3bn.

“A higher number of Malaysian asset managers increasing their fund allocation into Shariah-compliant investments will also act as a strong pull factor for sukuk and anchor higher issuance going forward,” he said.

Demand is also strong in the Arabian Gulf, with a “captive audience of Islamic banks searching for new securities to buy,” Commerzbank’s Bantis said.