Qatar’s industrial real estate sector is expected to “excel” in the next few years as the majority of world cup related projects will be nearing completion, increasing the urgency to source materials on time, ValuStrat has said in a report.

According to ValuStrat, the demand for industrial real estate has largely been driven by the growth of the manufacturing and construction sectors. ValuStrat is a regional service provider of strategic advisory, industrial valuation and asset divestment.

Consequently, ValuStrat said there will be a surge in demand for logistics and storage of materials, for example, Qatar Public Works Authority forecasts that projects in the pipeline will require a growing total of 495mn tons of limestone and 126mn tons of gabbro out to 2022.

Furthermore, it is expected that manufacturing output will pick up in the short run with the opening of a new refinery in Ras Laffan in December 2016, which is expected to increase the production of refined products, fertilisers and petrochemicals. While the expansion of North Field, the largest natural gas source in Qatar, is projected to enhance manufacturing output in the longer term.

With the aim of facilitating supply chain and supporting local industries, the government of Qatar has made substantial investments in the industrial sector in the past, which has provided a solid base for future expansion, pointed out Anum Hasan, market research analyst at ValuStrat.

“Due to the current geopolitical situation, Qatar temporarily had to face logistical challenges in terms of finding new suppliers and adjusting supply chain through alternative routes. However, this has also presented opportunities for third-party logistics companies to explore connectivity with new countries or increase business volumes with existing connections,” Hasan said.

Another positive spillover of the situation has been in the manufacturing sector where local manufacturers specialising in food and construction materials, have witnessed an increase in demand for their goods. In order to capitalise on these opportunities and ease pressures on state revenues, the government will have to continue providing initiatives to the private sector such as the “Own your factory in Qatar in 72 hours’ (which is an initiative that allows foreign or local investors to obtain industrial licenses within 72 hours) and incentives, which allow expansion of industrial real estate sector.

Qatar’s industrial sector has gradually evolved over the past couple of years. As one of the largest suppliers of natural gas in the world, Qatar has been not only developing industrial facilities to support hydrocarbon sector, but is also now subsidising expansion of industrial establishments in the non-hydrocarbon sector.

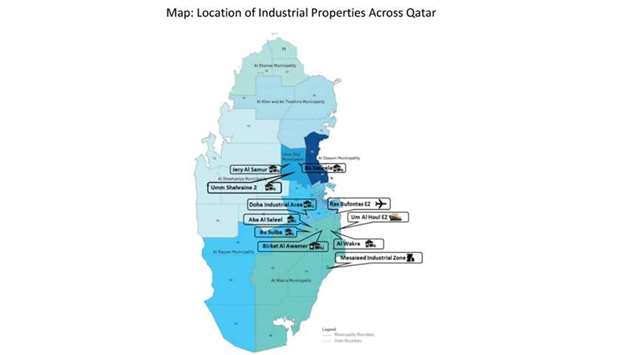

Thanks to prior government efforts, the current supply of industrial realty is composed of diverse types of industrial properties ranging from special economic zones, industrial cities to storage and logistics parks. Each of these has been designated to facilitate specific industries and serve as logistic and distribution centres that hold and distribute goods to customers.

Doha Industrial Area is one of the oldest industrial areas in Qatar that cater to light and medium industries, sustaining a majority of warehouses/light manufacturing factories, estimated to be nearly 13mn sq m of Gross Leasable Area (GLA).

Hasan said it was a key part of the government’s plan to boost the number of SME’s and they continued to improve its connectivity with the rest of Qatar by upgrading its roads.

Three special economic zones were launched by the government in 2014 with the same aim of fostering SMEs and for supporting local industries. Ras Bufontas Special Economic Zone, planned over an area of 4sq km near to Hamad International Airport will in majority cater to businesses offering air freight and logistical services.

Along with the above, the government plans to develop integrated warehousing and logistical centres in partnership with private firms in order to improve storage and distribution capacities.

In 2015, Manateq introduced logistical parks in four strategic locations namely Al Wakrah, Birkat Al Awamer, Aba Saleel and Jery Al Samur together forming an estimated 3.8mn sq m GLA of warehousing space to be added once fully developed. Moreover, in the same year, Manateq launched four warehousing parks in partnership with four private companies, which upon completion will add approximately 800,000sq m GLA in North and South of Doha.