Qatar’s foreign reserves, currently estimated at $35bn, cover more than a year of imports, BMI Research said and noted that the country’s current account deficit in 2016 poses little risk to its economic stability, with the deficit financed through its “tremendous” reserves and debt issuance.

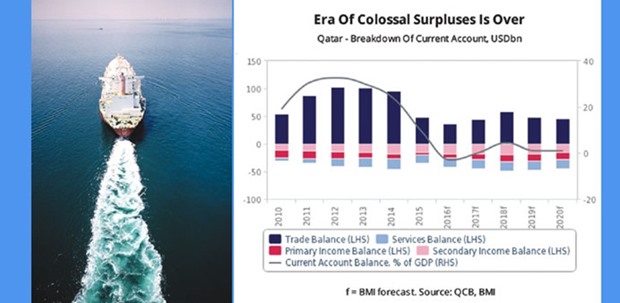

Qatar’s current account will return to surplus in 2017, after posting its first deficit since 1998, estimated at 3% of GDP in 2016. The country will benefit from the recovery in hydrocarbon prices, the Fitch Group company said in a report.

Nonetheless, the surpluses will be “modest” over the coming years, given low energy prices by historical standards, strong demand for imported goods in the lead-up to the 2022 FIFA World Cup, and continuing remittances outflows.

Qatar’s external position is “highly dependent” on the hydrocarbon sector, with oil and gas accounting for more than 75% of total exports over 2010-2014 and the remainder dominated by petrochemical products, also dependent on energy prices.

Therefore, BMI said, Qatar’s current account has “rapidly deteriorated” with the fall in oil prices from late 2014. With oil prices set to remain low by historical standards, it does not expect the country to post double-digit surpluses as it did in the past over the next five years, with current account surpluses averaging 21.2% between 2005 and 2014. “We believe that the worst is over for Qatar’s trade balance,” BMI said.

Oil prices bottomed in January 2016 and with BMI’s analysts forecasting Brent prices to average $55 per barrel in 2017, up from $45.5 in 2016, it will prove positive for Qatar’s trade balance, the main source of foreign currency earnings in the country.

Sustained demand for raw materials, machinery and capital equipment in preparation for the 2022 FIFA World Cup will put upward pressure on imports, limiting the improvements in Qatar’s trade balance. Other dynamics also run against a return to giant current account surpluses. Despite the economic slowdown, population growth remains robust, driven by demand for foreign labour in preparation for the World Cup.

With migrants making up more than 75% of Qatar’s population according to the World Bank, remittances outflows will remain a drag on Qatar’s external position, it said.

Remittances outflows came in at $12.2bn in 2015, an 8.6% increase from 2014. With population growth averaging 8.3% year-on-year in the first half of 2016, BMI does not expect remittances outflows to ease in 2016 and beyond.

However, BMI noted that the future of Qatar’s overseas investment raises more questions. Qatar’s large external surpluses over the past decade have financed the accumulation of a vast amount of foreign assets, mostly through the Qatar Investment Authority (QIA). Lower revenues will result in the QIA adopting a more conservative investment approach.

But as the government seeks to diversify its revenues away from hydrocarbon revenues, investment revenue is expected to play a major role, which will reinforce Qatar’s position as a major global financial investor, BMI Research said.

Qatar’s external position is u201chighly dependentu201d on the hydrocarbon sector, with oil and gas accounting for more than 75% of total exports over 2010-2014 and the remainder dominated by petrochemical products, also dependent on energy prices