BMI Research projects the Opec basket price to average $43.5 a barrel this year. Its energy analysts expect resistance to higher oil prices over the remainder of 2016 and into 2017, reflecting a relatively robust supply picture, a lacklustre demand story, and a priced-in below-consensus view on China and emerging markets as the growth story slows, translating into less robust global demand for oil.

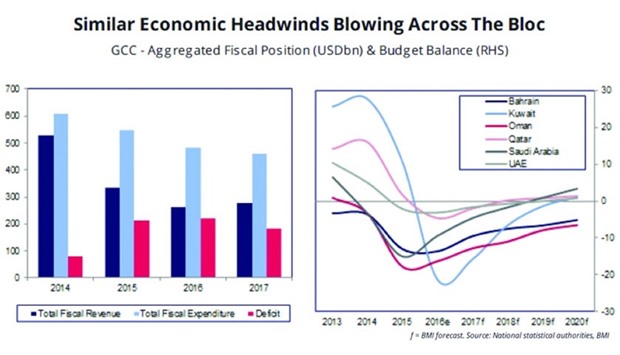

The fiscal space available to Mena's net energy exporters has been drastically reduced, it said. BMI Research estimates see the GCC posting an average budget deficit of 11% of GDP this year and 8% in 2017.

Liquidity is tightening, with Gulf banks – particularly in countries with the weakest external positions such as Oman and Bahrain – suffering from a sustained decline in the pace of deposit growth and reduced access to dollars, BMI Research said in its recent ‘GCC Economic Roundup’.

Economic activity is slowing across the region, and corporate margins will be under sustained pressure over the coming quarters. Austerity is set to remain the norm over the rest of the current decade for several states, including Saudi Arabia, Oman, and Bahrain.

All GCC member-states are now looking to restrain their public sector wage bills, reform their subsidy systems, mothball or cancel longer-term or more secondary infrastructure projects, and diversify their revenue sources.

Saudi Arabia's 2016 budget outlines wide-ranging economic reforms which the government has long shied away from, including spending cuts across most economic sectors, a drive to implement new taxes and launch a privatisation programme, and energy and utility price reform.

Even Qatar, which enjoys a more robust fiscal position, is curbing internal spending in a range of state-owned enterprises and government-linked organisations, notably in the energy, health and cultural sectors, BMI Research noted.

“We also expect the Gulf states to increasingly turn to the external bond markets for financing, in order to rebalance deficit coverage away from foreign exchange reserves while easing the pressure on domestic banks,” BMI Research said.

Saudi Arabia is reportedly seeking to borrow up to $8bn from international banks before the end of the year, and BMI expects the country to rapidly emerge as the preeminent debt issuer of the Mena region over the coming years.

However, reliance on foreign debt will increase even as financing conditions across the region harden, on the back of a continued stream of downgrades to the Gulf states' credit profiles from the major credit rating agencies, the Fed's interest rate hikes, and more modest support from local investors. More positively, BMI believes that efforts towards structural and fiscal reform will continue over the coming years.

Heightened competition in the global energy market and the limits of the Gulf's current fiscal model will spur greater efforts by the region's governments to reform their economies and open up to foreign investment, it said.

The oil price slump will prompt greater efforts to attract private investment in infrastructure projects – providing a way to lessen the pain of government cuts to capital expenditure.

BMI expects to see the public-private partnership (PPP) model gain traction in several sectors, including transport and power, after decades in which governments have had a clear preference for funding projects directly.

BMI Research estimates see the GCC posting an average budget deficit of 11% of GDP this year and 8% in 2017.

An increase in the forecast Opec basket price to $54 a barrel in 2017 will give some respite to the GCC countries, BMI Research said, even as the Fitch Group company expects an aggregate fiscal deficit of $183bn for the region next year.