In part, the report noted, this could be “owing to the timing of Ramadan”, which tends to depress traffic growth. Capacity rose 14.3%, which caused load factor to dive 4.4 percentage points to 69.9%, IATA said in its passenger traffic data for June.

Nonetheless, IATA said “there remains little sign of a marked easing” in the "strong upward trend" in traffic in the Middle East region.

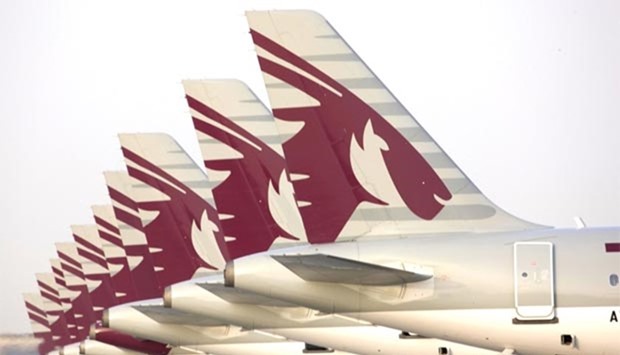

All segment-based passenger routes to and from the Middle East saw “solid gains” during the first five months of 2016. Obviously, the region’s growth was lifted off by the three big GCC carriers – Qatar Airways, Emirates and Etihad.

That said, the rise in passenger capacity continues unabated; annual growth in Middle Eastern international revenue passenger kilometre (RPKs) has now lagged behind that of capacity for 19 of the past 21 months, resulting in the load factor slipping back.

Globally, IATA said the passenger traffic data for June showed that demand (measured in revenue passenger kilometres or RPKs) rose by 5.2% compared to the year-ago period. This was up slightly from the 4.8% increase recorded in May (revised).

However, the upward trend in seasonally-adjusted traffic has moderated since January. June capacity (available seat kilometres or ASKs) increased by 5.6%, and load factor slipped 0.3 percentage points to 80.7%.

Industry-wide RPKs grew by 6% year-on-year in the first half of 2016 – slightly ahead of the 5.9% increase seen in the same period in 2015.

Admittedly, growth this year was flattered somewhat by the leap year.

But even after correcting for the extra day in February, IATA still estimates that traffic grew by 5.4% year-on-year over the period–broadly in line with the average pace seen over the past decade.

Annual growth in RPKs ticked up to 5.2% in June, from an upwardly-revised 4.8% in May. But as IATA noted over the past few months, there are ongoing signs that passenger growth has shifted down a gear.

The upward trend in seasonally-adjusted volumes has moderated since January; the market has grown at annualised rate of around 3.5% since the start of the year –the weakest showing since 2011.

The loss of momentum can be attributed partly to the ongoing and cumulative impacts of recent high-profile terrorist attacks, which have weighed on international — European traffic in particular.

“Typically, the impact of such shock events is just transitory, but the repeated nature of recent events suggests that the effects may be longer-lasting this time. More generally, the fragile and increasingly uncertain global economic backdrop continues to present a headwind to passenger demand as well.

“Heightened uncertainty following the ‘Brexit’ vote in the UK only increases the downside risks in this regard,” IATA said.

Nonetheless, IATA said “there remains little sign of a marked easing” in the "strong upward trend" in traffic in the Middle East region.

All segment-based passenger routes to and from the Middle East saw “solid gains” during the first five months of 2016. Obviously, the region’s growth was lifted off by the three big GCC carriers – Qatar Airways, Emirates and Etihad.

That said, the rise in passenger capacity continues unabated; annual growth in Middle Eastern international revenue passenger kilometre (RPKs) has now lagged behind that of capacity for 19 of the past 21 months, resulting in the load factor slipping back.

Globally, IATA said the passenger traffic data for June showed that demand (measured in revenue passenger kilometres or RPKs) rose by 5.2% compared to the year-ago period. This was up slightly from the 4.8% increase recorded in May (revised).

However, the upward trend in seasonally-adjusted traffic has moderated since January. June capacity (available seat kilometres or ASKs) increased by 5.6%, and load factor slipped 0.3 percentage points to 80.7%.

Industry-wide RPKs grew by 6% year-on-year in the first half of 2016 – slightly ahead of the 5.9% increase seen in the same period in 2015.

Admittedly, growth this year was flattered somewhat by the leap year.

But even after correcting for the extra day in February, IATA still estimates that traffic grew by 5.4% year-on-year over the period–broadly in line with the average pace seen over the past decade.

Annual growth in RPKs ticked up to 5.2% in June, from an upwardly-revised 4.8% in May. But as IATA noted over the past few months, there are ongoing signs that passenger growth has shifted down a gear.

The upward trend in seasonally-adjusted volumes has moderated since January; the market has grown at annualised rate of around 3.5% since the start of the year –the weakest showing since 2011.

The loss of momentum can be attributed partly to the ongoing and cumulative impacts of recent high-profile terrorist attacks, which have weighed on international — European traffic in particular.

“Typically, the impact of such shock events is just transitory, but the repeated nature of recent events suggests that the effects may be longer-lasting this time. More generally, the fragile and increasingly uncertain global economic backdrop continues to present a headwind to passenger demand as well.

“Heightened uncertainty following the ‘Brexit’ vote in the UK only increases the downside risks in this regard,” IATA said.