Middle Eastern carriers saw air freight demand expand by 3.2% and capacity rise 9.5% in May compared to the same period last year, an IATA report said yesterday.

Despite carriers in the region reporting the fastest growth in aggregate, demand conditions have weakened considerably. Annual growth in May 2016 was one-fifth of the pace registered in May 2015.

“This reflects both an easing in network expansion by the region’s main carriers over the past six months and weak trading conditions,” IATA said.

Indeed, the strong upward trend in Middle Eastern Freight tonne kilometres (FTKs) that was the norm from the start of 2009 onwards has weakened markedly; annual growth in May 2016 was less than one-fifth of the pace registered in May 2015.

The slowdown coincides with an easing in annual network expansion growth (airport pairs served) by the main carriers in the region since the second quarter of 2015, but it is also indicative of the broader weak patch in the industry, IATA said.

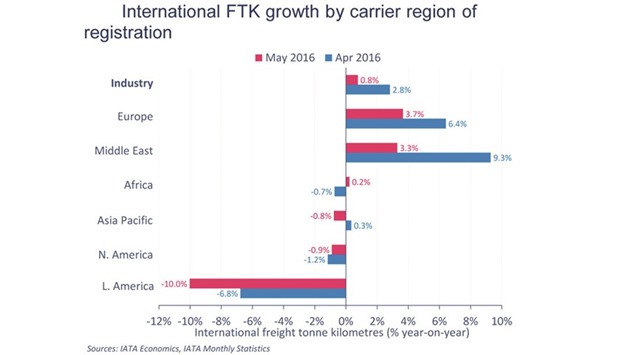

Global air freight data released by IATA showed that demand measured in freight tonne kilometres (FTKs) slowed in May with growth falling to 0.9% year-on-year.

Yields remained pressured as freight capacity measured in available freight tonne kilometres (AFTKs) increased by 4.9% year-on-year.

Freight demand decreased or flat lined in May across all regions with the exception of Europe and the Middle East. These regions recorded growth in air cargo volumes of 4.5% and 3.2%, respectively, in May, compared to the same period last year.

Broad weakness in world trade volumes, which have largely tracked sideways since the end of 2014, accounts for about 80% of air freight’s sluggish performance.

The soft patch for air cargo corresponds with broader weakness in global trade growth. (Developments in global trade volumes explain four-fifths of the weakness in air freight traffic.)

As IATA noted last month, global trade volumes declined in year-on-year terms in Q1, 2016 for the first time since the end of 2009.

Admittedly, annual world trade growth increased to an eight month high in April, it said.

Moreover, given that May 2015 marked the nadir in trade volumes last year, the favourable annual comparison is likely to see world trade growth climb higher in May too.

Nonetheless, the bigger picture is that world trade volumes have broadly tracked sideways since the end of 2014, and the relationship between global output and trade has undergone a structural shift.

IATA director-general and CEO Tony Tyler said, “Global trade has basically moved sideways since the end of 2014 taking air cargo with it. Hopes for a stronger 2016 are fading as economic and political uncertainty increases. Air cargo is vital to the global economy. But the business environment is extremely difficult and there are few signs of any immediate relief.”

MIDEAST