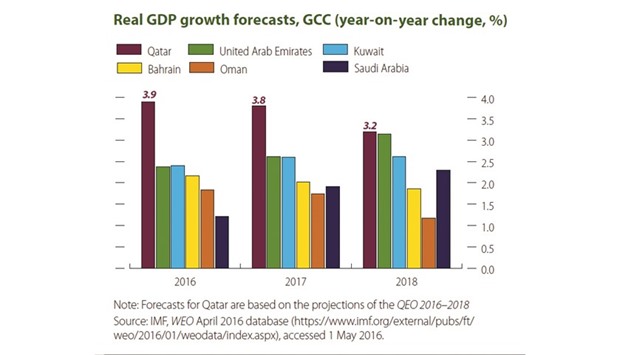

Despite the decline in global oil prices last year, Qatar’s economic growth will remain healthy at 3.9% in 2016 and 3.8% in 2017, according to the Ministry of Development Planning and Statistics (MDPS).

Qatar’s real GDP growth is forecast to average 3.6% over 2016-2018, on the back of continued expansion in the non-hydrocarbon economy, which although moderating, remains strong, MDPS said in its latest “Qatar Economic Outlook 2016 – 2018”. The non-hydrocarbon economy encompasses all economic activity other than upstream oil and gas production and other mining activities, it said.

Construction will continue to expand through to 2018, though its pace of growth will ebb as existing projects are completed and no additional new assets are built.

The service sector will continue to post solid growth and is expected to be the largest contributor to growth, but its pace of expansion, too, will slow, if the foreseen moderation in population growth comes about in 2017 and 2018.

In 2016 and 2017, Qatar’s real GDP growth will be supported also by the hydrocarbon economy, which is expected to grow over the three years.

The new gas field Barzan, after some technical delays, is now set to come onstream in the latter half of this year and reach full capacity in 2017, MDPS said.

The new Ras Laffan II condensates refinery, set to become operational in late 2017, will add to hydrocarbon output in 2017 and 2018.

“But despite the uptick to overall growth over the near term, the contribution of the hydrocarbon sector to real growth, which is already low, will continue to diminish,” MDPS said.

In his foreword, HE the Minister of Development Planning and Statistics, Dr Saleh bin Mohamed al-Nabit said, “Over the projection horizon, the non-hydrocarbon sector will continue to account for most of the economy’s expansion. Real growth will be further supported by increased activity in the hydrocarbon sector, which will benefit from added output from the new Barzan gas project.

“But as infrastructure investments plateau and projects are de-scoped, and as population growth slows, activity in the non-hydrocarbon sector will begin to taper, and overall growth will moderate to 3.2% in 2018.”

On the fiscal side, the minister noted that given lower oil and gas revenues and large expenditure outlays, the fiscal balance is anticipated to register its first deficit in over 15 years.

The external current account balance is also expected to be adversely affected by lower oil prices and will register a small deficit in 2016, but the balance will return to positive territory in 2017 and 2018 as oil prices recover.

“The main risk to the outlook is the possibility that oil prices will not track higher in 2017 and 2018, as the forecasts assume,” al-Nabit said.

QATAR G