Emerging stocks struggled higher yesterday but were on track to end the month with hefty losses, and Turkish stocks and the lira headed for their biggest monthly fall in 2-1/2 years.

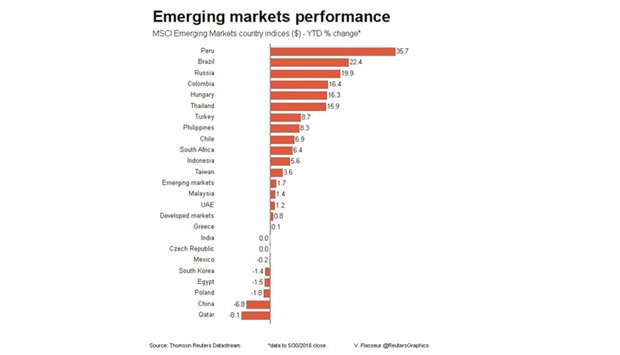

MSCI’s emerging market index rose 0.3% on the day but looked poised to snap a two-month winning streak with losses of 3.5% in May.

Turkish stocks have fallen 7.5% last month - its first such loss since the start of the year.

Currencies got a drubbing in May, with Turkey’s lira showing the biggest monthly weakening since December 2013 against the dollar, while South Africa’s rand tumbled the most in three years.

Russia’s rouble is also firmly in the red.

Turkish markets have been hit particularly hard after a new prime minister was ushered in, following President Tayyip Erdogan’s drive to create a full presidential system in a move that clipped the wings of several reformist figures.

Markets have also grown more wary of interest rate hikes from the US Federal Reserve in June or July.

This would add to the pressure on emerging economies with current account deficits such as South Africa or Turkey.”

The landscape is now shifting alongside escalation of near term risks of Fed tightening, a less hopeful (second half of the year) for Chinese growth, and renewed (renminbi) depreciation pressures,” Societe General analysts wrote in a recent note.”This is not good news for emerging market currencies, which have been decidedly trading in a risk on-off manner over the past couple of years.”

With the dollar trading close to two-month highs, the yuan edged lower against the greenback and was on track for it second largest monthly fall on record as the central bank fixed the currency’s midpoint at a new five-year low.

Chinese stocks posted their biggest daily gain in three months to close at three-week highs.

The rally was fuelled by bets that index provider MSCI will add mainland shares to its index for the first time at its review in June.

China has been gradually easing foreigners’ access to its capital markets and on Friday regulators said foreign institutions investing in its interbank debt market would be allowed to remit funds freely.

In emerging Europe, Poland’s zloty rose 0.4% against the euro as data confirmed Poland’s economy grew by 3.0% in the first quarter of the year, though this is down from 4.3% at the end of 2015.”There is still some downside risk there,” said Dominic Bunning, FX strategist at HSBC.”

The market has got to the view that Poland won’t cut rates any further but we’ve got a change of governor coming in a few months, and the language the central bank has been using has turned slightly more dovish compared to a few months ago.”

fed