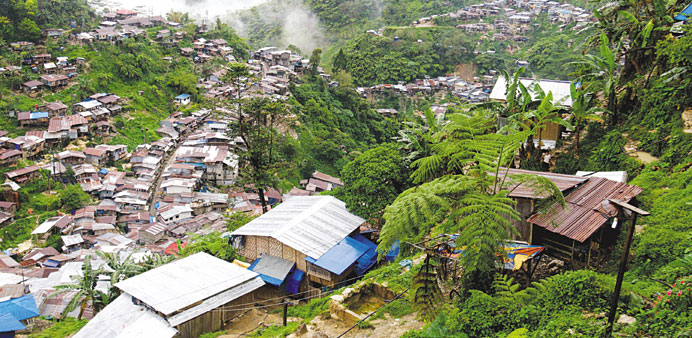

An elevated view shows the community settlement on Mount Diwata, Diwalwal, on Mindanao Island in the Philippines (file). To finance massive investments into infrastructure and industry, Mindanao will have to build up a capital market that provides the necessary liquidity – which, in turn, provides big opportunities for the Islamic finance sector.

By Arno Maierbrugger/Gulf Times Correspondent /Bangkok

The long-anticipated peace deal between the Philippine government and the main rebel group in the Muslim-dominated southern Philippine island of Mindanao will not only bring relief to a population that suffered from a decade-long insurgency, put also open the gates for foreign investment, especially from the Middle East.

Following four decades of fighting that has claimed tens of thousands of lives, the Moro Islamic Liberation Front (MILF) signed the peace deal with Philippine President Benigno Aquino’s government at a high-profile ceremony in Manila on March 27. The pact makes the MILF and the government partners in a plan to create a southern autonomous region called Bangsamoro for the Philippines’ Muslim minority with locally elected leaders by mid-2016.

Mindanao has long been one of the poorest regions in the Philippines, lacking infrastructure, employment opportunities and social development. With the peace deal, the region is now bound “to unleash its economic potential”, as the Makati Business Club, an influential business association in the Philippines, put it.

The club sees essential opportunities in agriculture and agribusiness investments, tourism and natural resource development in Mindanao, as well as desperately needed new power plants and reliable electricity distribution networks.

For Middle East investors this new situation provides interesting prospects. For example, Qatar as early as 2008 made steps to assist Mindanao in overcoming its economic problems by financing development projects, helping set up an Islamic banking sector and engaging in agricultural projects, but the insurgency disrupted these plans. With the peace deal, the growth trajectory for the province is now expected to be significant if the authorities manage to establish a conducive business climate for the region.

To finance massive investments into infrastructure and industry, Mindanao will have to build up a capital market that provides the necessary liquidity – which, in turn, provides big opportunities for the Islamic finance sector and with it sukuk issuances for larger projects, as well as loans and micro-finance to spur growth in the small and medium enterprise sector. This is a new window of opportunity for the Al-Amanah Islamic Bank, the first and only Islamic bank in the Philippines, headquartered in Zamboanga City, the commercial centre of Mindanao.

The Philippine government has long sought to privatise the bank, and QNB and two other Doha-based banks showed interest before but remained deterred by the political situation in the region. In the new environment, observers now expect renewed bids for the bank as its current owner, the Development Bank of the Philippines, said that it wants to divest itself of the bank since it does not have the expertise to handle an Islamic financial institution.

Apart from that, tourism could play a big role in Mindanao’s economic recovery, possibly supported by Middle East hotel and hospitality investments. The island with is clean beaches, rainforests, waterfalls and clear waters with colourful marine life should be a prime tourist destination in the Philippines, but has yet to work out its own tourism development plan and invite potential investors.

One part of the plan is to provide livelihood opportunities to ex-MILF rebels, essential for sustainable stability in the region.