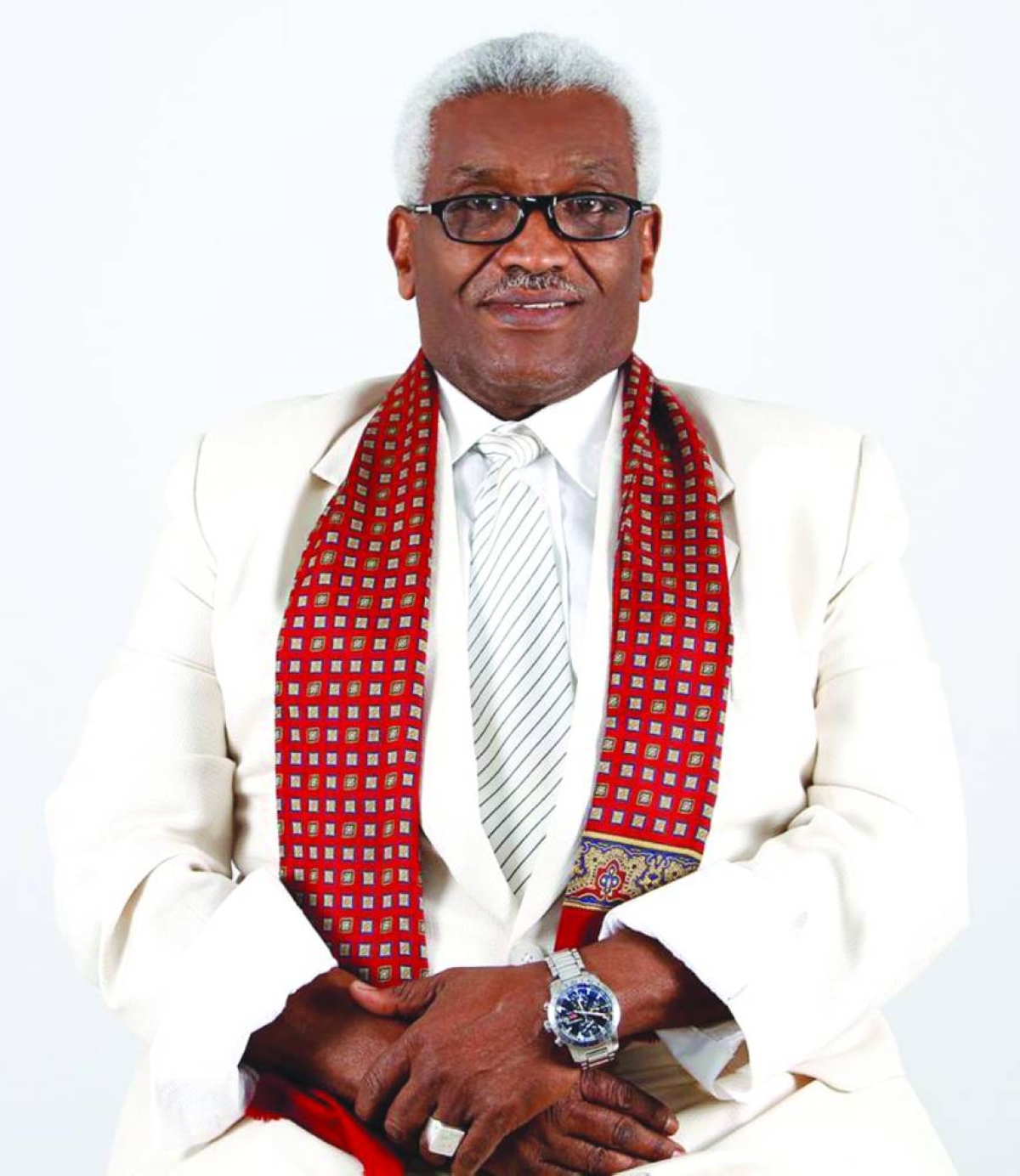

Electrification and efficiency are seen to be central to Qatar’s sustainability drive, a top official of Schneider Electric has observed, noting that investment in technology and digitalisation is essential to cut emissions and strengthen the economy.Qatar’s resources and partnerships can accelerate a more sustainable and inclusive future for the Middle East and Africa, stated Walid Sheta, president of Middle East and Africa region, in an exclusive interview.Sheta emphasised that sustainability is not a short-term project but a long journey requiring investment, technology, and intelligence. He said, “The path to sustainability is a long one that requires investments and energy to fuel the intelligence that will bring efficiency to the economy.At the same time, Sheta underscored electricity as the most effective driver of economic activity. “We believe that the most effective force to exert on an economic activity is electricity, so electrification is a road to sustainability,” Sheta explained.However, Sheta noted that electrification alone is not enough, pointing out that efficiency must accompany it to reduce carbon emissions.“For electrification, it’s not enough to electrify all the processes; you also need to have a lot of efficiency,” he further explained.According to Sheta, this dual approach — electrification and efficiency — forms the cornerstone of Schneider Electric’s vision for Qatar and the wider region. He emphasised that efficiency depends on technology and data-driven intelligence. “To do that, you need technology, and technology is driven by intelligence in data centres, for example,” he noted.Sheta noted that digitalisation is key to optimising energy consumption across industries and buildings. “You need energy and you need investment capabilities to upskill technology; digitalisation, to be able to bring efficiency to the consumption of energy in any economy. And that reduces the CO2 footprint,” he stressed.He also explained that Schneider Electric’s approach is to operate locally while bringing in global expertise. “When we operate in a country, we are very proud to be the most local of global companies,” he said.Sheta noted that partnerships are vital: “We are proud to have different initiatives with many of our global customers to make sure that we are bringing the competencies that are necessary for the industrial revolution toward digitalisation and sustainability to Qatar’s economy,” he said, adding that his emphasis on electrification, efficiency, and digitalisation resonates with Qatar’s national vision, which seeks to balance economic growth with environmental responsibility.

Business

India, Brazil sign mining pact as Modi targets $20bn trade in five years

Saturday, February 21, 2026

Friday, February 20, 2026

Friday, February 20, 2026

Saturday, February 21, 2026

Thursday, February 19, 2026

Wednesday, February 18, 2026

Qatar's hospitality sector to focus on selective high-quality projects than broad expansion: CWQ

Friday, February 20, 2026

Dell Technologies and Ooredoo in pact to advance AI innovation and deepen cooperation

Thursday, February 19, 2026

Milaha to continue fleet expansion, deepen trade flows between Asia and Mideast

Wednesday, February 18, 2026