Baladna Q.P.S.C., Qatar’s leading dairy and juice company, announced its full year and fourth quarter results for the period ended 31 December 2025. Performance for the year reflected strong growth, primarily attributed to returns from the Strategically Diversified Investment Portfolio and the continued execution of the Company’s international expansion strategy, as Baladna advanced its long-term vision of expanding beyond the domestic market. Results highlight the Company’s ability to deliver record financial performance while progressively building a diversified international platform.Financial highlightsBaladna delivered record financial results for the year ended 31 December 2025, achieving its highest revenue, EBITDA, and net profit to date.Full year revenue reached QAR 1.27 billion, up 11% year on year, driven by higher volumes across key channels, with HoReCa contributing significantly and recording a 30% growth.Fourth quarter revenue increased to QAR 326.5 million, compared to QAR 286.2 million in the same period last year. The improvement was driven primarily by higher revenue contribution from the evaporated milk segment, supported by seasonal demand, increased visitor activity during the FIFA Arab Cup Qatar 2025 held in December.Profitability improved materially during the year. Full year EBITDA rose to QAR 770.1 million, with a margin of 60.7%, while net profit reached QAR 538.8 million, with a margin of 42.6%. Performance mainly reflected returns from the Strategically Diversified Investment Portfolio, implemented as part of the Company’s plan for geographic and sectoral diversification, alongside the increasing contribution from international investments and overseas operations. Earnings per share increased to QAR 0.252, compared to QAR 0.086 in 2024.Operational highlightsBaladna continued to deliver across its core operations while actively extending its commercial reach beyond the domestic market. The Company expanded its export activities with the commencement of regular shipments of selected long-life dairy products to Syria through a local distribution partner, leveraging Baladna’s established production capabilities and strengthening its regional presence. Across the domestic business, demand was supported during the fourth quarter by increased activity associated with the FIFA Arab Cup Qatar 2025, alongside continued portfolio management across core dairy and juice categories. Throughout the year, Baladna expanded its portfolio to 267 SKUs, adding over 33 new products. The Company now operates more than 149 sales routes, reinforcing its number one market position in Qatar. Product portfolio activity remained focused on performance and consumer demand, with selective product introductions and ongoing optimization supporting mix quality and operational priorities. Strategic highlightsBaladna continued to advance its international growth strategy, building a phased and scalable international footprint.In Algeria, the integrated agri-industrial project continued to record strong execution progress during 2025, advancing from planning into active on-ground development. During the 4th quarter, 186 drilling permits were secured, 45 wells completed, irrigation and pivot systems installed, and the first crop cycle successfully initiated, laying the foundation for feed self-sufficiency. Industrial development progressed with completion of the main laboratory concept design, optimization of the Central Utilities Building, and updates to the site masterplan, while major engineering milestones, including high-pressure and low-pressure boiler systems, compressed air and nitrogen plants, water treatment, and refrigeration plant designs, were completed and submitted for contractor review. Site utilities and wastewater drainage planning are under development, supporting operational readiness for the processing facilities. The project also advanced regulatory engagement on livestock imports, and road access coordination with authorities ensured connectivity to this remote site, supporting ongoing construction and infrastructure activities. By Q4 2025, the project had achieved visible site progress and remained on track with its phased development plan, reinforcing Baladna’s long-term objectives toward first milk production and contribution to local food security by 2027. The Algeria project represents the cornerstone of Baladna’s international expansion strategy and a key driver of long-term growth beyond Qatar.Building on this foundation, Baladna progressed its expansion into Syria, where preparatory activities continued for the planned integrated industrial project, encompassing arable farming, dairy and juice processing plant, a plastic packaging facility and warehousing infrastructure. In parallel, the Company has established an on-ground commercial presence through exports, supporting market development alongside ongoing project planning. In Egypt, the Company’s fully operational back-office hub supported international operations and investment activities, providing a platform to facilitate the execution of Baladna’s expanding regional footprint.Together, Algeria, Syria and Egypt form the initial phases of Baladna’s broader international expansion roadmap, as the Company continues to evaluate additional markets in a measured and selective manner. These initiatives reflect Baladna’s continued progress in executing its international growth strategy under its long-term “From Qatar to the World” vision, supported by returns from its Strategically Diversified Investment Portfolio. Capital IncreaseThe Extraordinary General Assembly approved an increase in the Company’s paid-up share capital by 24%, from QAR 2,143,984,962 to QAR 2,658,541,352, through the issuance of 514,556,390 new ordinary shares at an issue price of QAR 1.01 per share. The capital increase will be implemented through a rights issue, with priority granted to eligible shareholders registered with Edaa as at the end of the trading session on 10 March 2026, subject to the approval of the relevant regulatory authorities. For the complete financial statements, please visit https://baladna.com/corporate or email [email protected]

Business

Wednesday, February 11, 2026

Wednesday, February 11, 2026

Wednesday, February 11, 2026

Thursday, February 12, 2026

Wednesday, February 11, 2026

What a weaker US dollar means for the economy

Wednesday, February 11, 2026

Qatar Free Zones Authority CEO meets Panama’s minister of commerce and industry

Tuesday, February 10, 2026

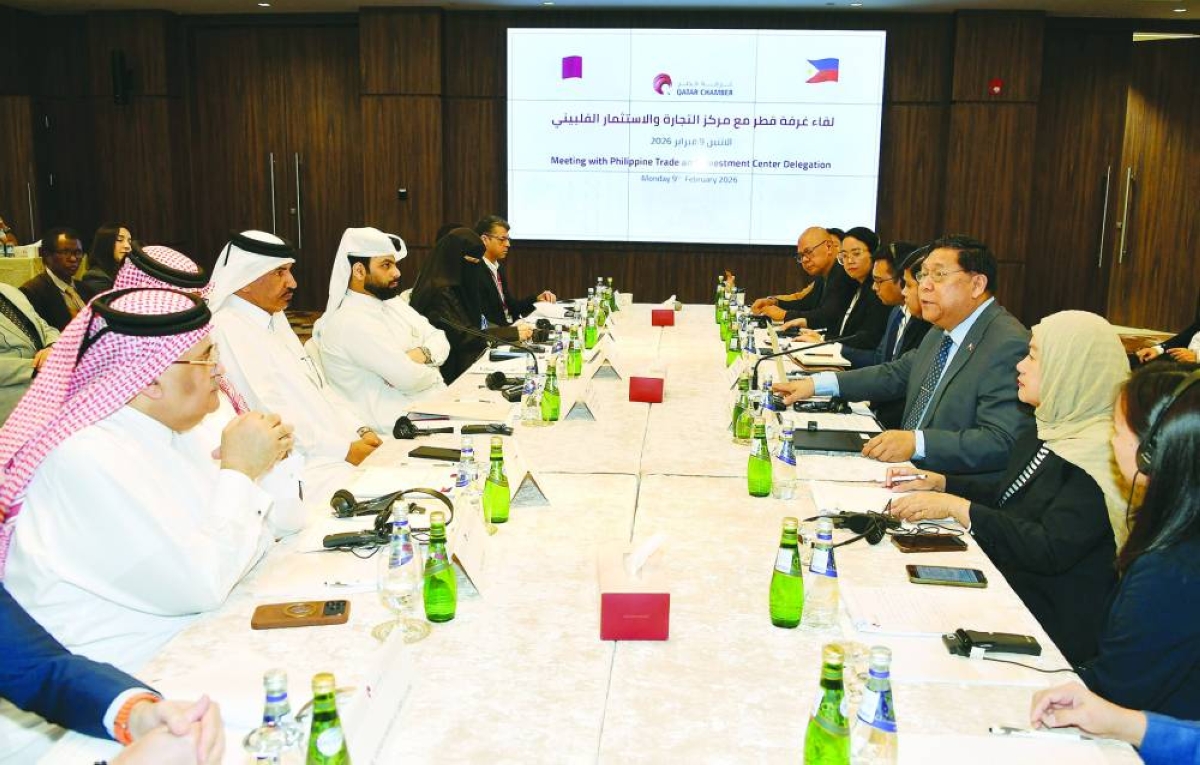

Philippines eyes stronger trade links with Qatar in food, personal care sectors

Monday, February 09, 2026

Commercial Bank wins 2 accolades at World Finance Digital Banking Awards 2025

Monday, February 09, 2026