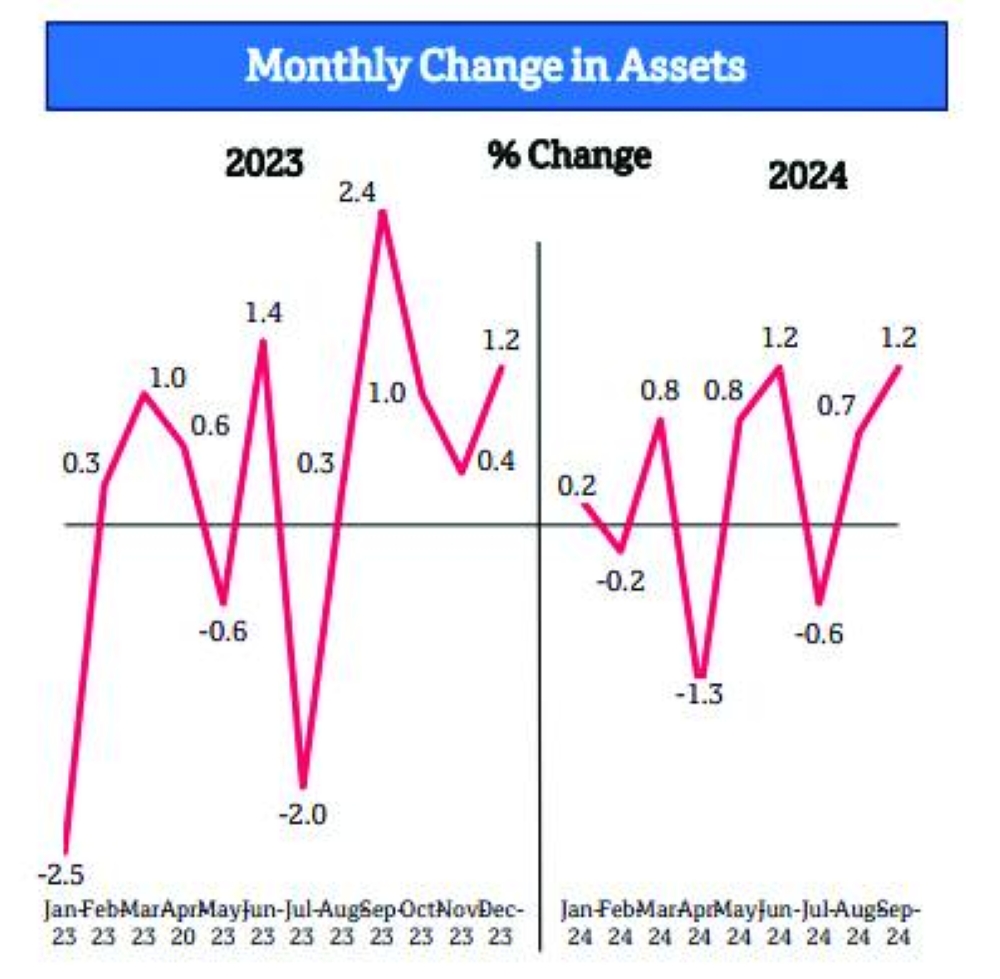

Global oil market apprehensions and concerns on the key US economic data had their reflection in the Qatar Stock Exchange (QSE), which saw its key index plummet 113 points and capitalisation erode QR7.57bn as three-fourth of traded constituents were in the red this week.The foreign funds were seen net profit takers as the 20-stock Qatar Index knocked off 1.07% this week which saw QSE showcase listed companies in New York and said foreign institutional investors are increasingly looking at it with them typically accounting for 30-40% of average daily turnover in the recent past.The industrials and consumer goods and services sectors witnessed higher than average selling pressure this week which saw Aamal Company assume full ownership of Advanced Pipes and Casts.The Gulf institutions turned bearish in the main market this week which saw an agreement between Milaha and Qatar Free Zones Authority relating to QR80mn Yachts and Ships Yard at Marsa Port in Umm Alhoul Free Zone.The Arab funds were seen net profit takers, albeit at lower levels, in the main bourse this week which saw Mekdam Holding Group receive a letter of award for a contract worth QR181mn from the country's hydrocarbon behemoth QatarEnergy.The Arab individuals’ weakened net buying had its influence in the main market this week which saw Qatar's banking sector’s total assets reach QR2.03tn in September 2024, an increase of 1.2% month-on-month and 2.9% year-on-year.However, the domestic funds were seen net buyers in the main bourse this week which saw the global credit rating agency Standard and Poor's view that banks in the Gulf Cooperation Council region are expected to do well and be profitable in 2025 amidst lower interest rates.The local retail investors turned bullish in the main market this week, which saw the Qatar Central Bank assistant governor Hamad Ahmed al-Mulla reveal that the country's Islamic banking assets total QR576bn in September.The Gulf individuals were seen net buyers in the main bourse this week which saw a total of 0.12mn Masraf Al Rayan-sponsored exchange-traded fund QATR worth QR0.28mn trade across 34 deals.The foreign retail investors’ weakened net selling had its impact in the main market this week which saw as many as 0.01mn Doha Bank-sponsored exchange-traded fund QETF valued at QR0.06mn change hands across seven transactions.The Islamic index was seen declining slower than the other indices in the main market this week which saw the industrials and banking sectors together constitute more than 53% of the total trade volumes.Market capitalisation eroded 1.21% to QR619.51bn on the back of large and midcap segments this week, which saw no trading of treasury bills.Trade turnover and volumes were on the increase in both the main and venture markets this week, which saw no trading of sovereign bonds.The Total Return Index shed 1.07%, the All Share Index by 1.03% and the All Islamic Index by 0.96% this week which saw the Institute of International Finance forecast Qatar’s public foreign assets to reach $500bn or 240% of gross domestic product by 2025.The industrials sector index tanked 2.04%, consumer goods and services (1.09%), real estate (1.05%), banks and financial services (0.81%), insurance (0.66%) and transport (0.6%); while telecom was up 0.07% this week.Major losers in the main bourse included Al Faleh Educational Holding, Qatar German Medical Devices, Industries Qatar, Commercial Bank, Dlala, QNB, QIIB, Dukhan Bank, Woqod, Baladna, Meeza, Qatar National Cement, Qatar Electricity and Water, Gulf International Services, Mesaieed Petrochemical Holding, Qamco, Qatar Insurance, Ezdan, Mazaya Qatar and Nakilat. In the venture market, Al Mahhar Holding saw its shares depreciate in value this week.Nevertheless, Widam Food, Doha Bank, Al Khaleej Takaful, Gulf Warehousing and Doha Insurance were among the gainers in the main market. In the junior bourse, Techno Q saw its shares appreciate in value this week.The foreign funds were net sellers to the tune of QR200.48mn against net buyers of QR53.37mn the week ended November 7.The Gulf institutions turned net sellers to the extent of QR51.1mn compared with net buyers of QR5.34mn a week ago.The Arab institutions were net profit takers to the tune of QR0.03mn against no major net exposure the previous week.The Arab individuals’ net buying decreased noticeably to QR10.35mn compared to QR15.83mn the week ended November 7.However, the domestic funds turned net buyers to the extent of QR191.34mn against net sellers of QR10.72mn a week ago.The local retail investors were net buyers to the tune of QR47.45mn compared with net sellers of QR45.03mn the previous week.The Gulf individuals turned net buyers to the extent of QR3.03mn against net sellers of QR2.11mn the week ended November 7.The foreign retail investors’ net profit booking weakened markedly to QR0.55mn compared to QR16.67mn a week ago.The main market witnessed a 51% surge in trade volumes to 707.16mn shares and 93% in value to QR2bn on more than doubled deals to 75,873 this week.In the venture market, trade volumes more than doubled to 3.91mn equities and value more than doubled to QR9.5mn transactions more than doubled to 310.

Santhosh V. Perumal

Santhosh V. Perumal, a postgraduate in Econometrics with an advance qualification in Capital Markets and Financial Services, is Gulf Times' journalist. His coverage areas are debt and equity, hydrocarbons, international trade, environment, banks, insurance and real estate. Previously, he was in New Delhi, India as Senior Finance Correspondent of PTI.

Most Read Stories