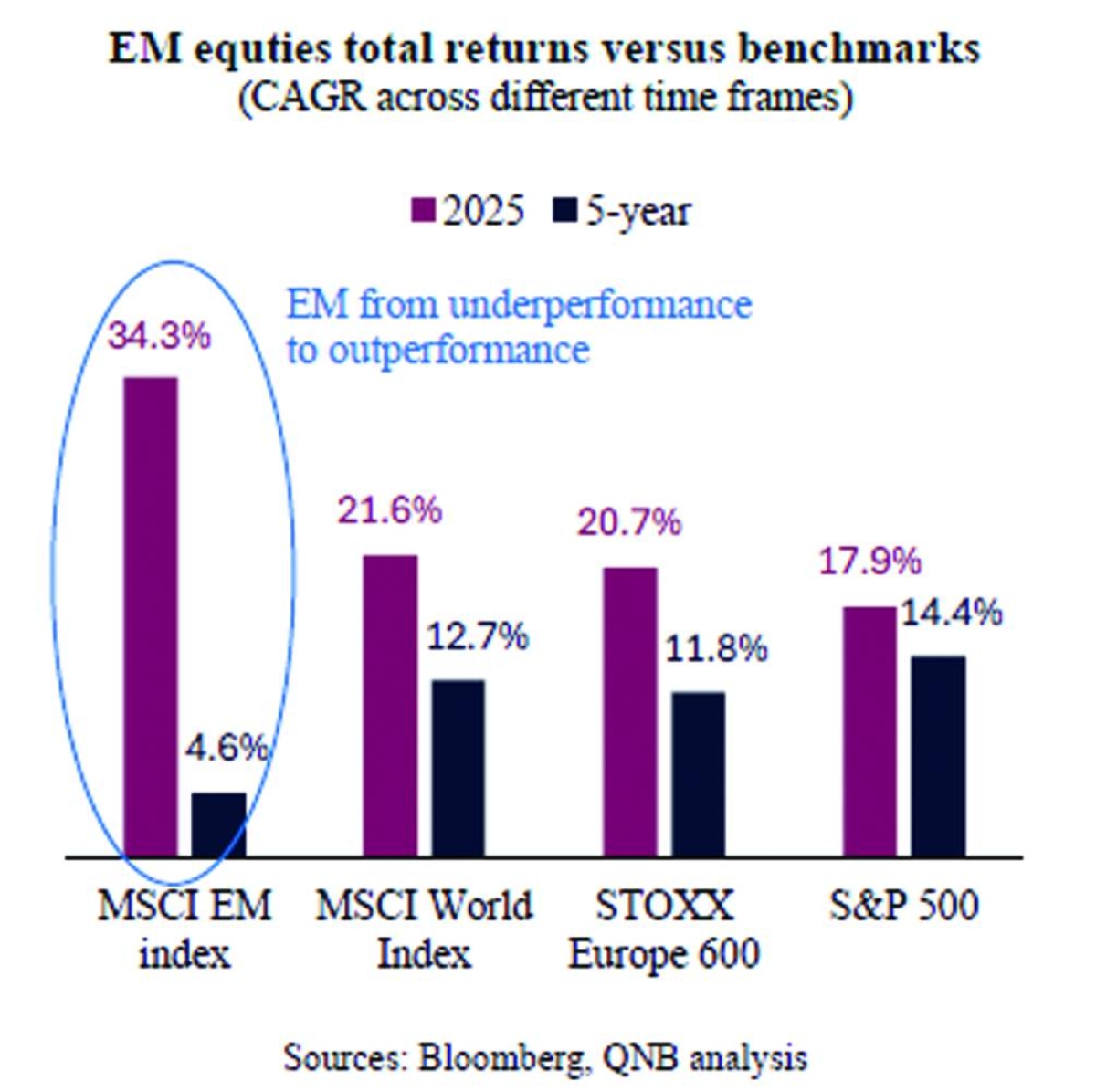

After a prolonged period of underperformance, 2025 marked an important turning point for emerging market (EM) assets, according to QNB’s latest economic report.

QNB stated that strong capital inflows, improving macro-financial conditions, and a more supportive global backdrop allowed EM equities to outperform US and other advanced market assets for the first time in several years.

According to the Institute of International Finance (IIF), portfolio inflows to EM accelerated to $223bn during 2025, supporting total returns of more than 34% in EM equities. This rebound was driven by a weaker US dollar, easing global monetary conditions and resilient growth across several large EM economies.

“Looking ahead, we believe that 2026 is likely to be another constructive year for EM assets. While idiosyncratic risks remain elevated and dispersion across countries is set to persist, the global macro environment continues to generate powerful ‘push factors’ in favour of EM allocations. In our view, three global forces are particularly relevant,” QNB stated.

The first, QNB noted, is that the global cycle appears to be turning in a way that is historically supportive for EM. After a period of synchronised slowdown and what many observers described as a “manufacturing recession”, leading economies are showing early signs of cyclical recovery. At the same time, there is growing evidence of the start of a new, capital-intensive investment cycle, underpinned by powerful structural trends.

QNB stated that these include the rapid deployment of artificial intelligence technologies, rising geopolitical competition in strategic sectors, renewed infrastructure spending and the acceleration of the green energy transition.

Such capital-heavy growth phases have traditionally been favourable for EM through several channels, QNB noted, adding that they tend to support demand for commodities and intermediate goods, improve EM terms of trade and lift export revenues.

They also raise global risk appetite and encourage cross-border capital flows into non-traditional markets. Importantly, many large EM economies enter this phase with relatively sound macro fundamentals, credible policy frameworks and, in several cases, positive real interest rates, which help anchor investor confidence, QNB also stated.

According to QNB, the second is that foreign exchange and interest rate dynamics remain broadly supportive for EM assets. Despite its recent depreciation, the US dollar remains overvalued according to standard real exchange rate metrics. Structural forces, including efforts to rebalance the US economy and reduce external deficits, suggest continued medium-term pressure on the greenback. A weaker US dollar reduces currency risk for foreign investors, eases debt-servicing burdens in EM and lowers risk premia across the asset class, QNB stated.

In parallel, monetary policy in advanced economies is set to become more accommodative. Market pricing and consensus forecasts point to additional easing by the Federal Reserve, with the policy rate expected to decline towards 3% by end-2026, stated QNB.

Lower US yields reduce the opportunity cost of investing in EM assets and tend to encourage carry trades into higher-yielding EM currencies. This dynamic has already been visible in 2025, with inflows concentrated in countries offering high real rates and credible policy frameworks, such as Brazil, Mexico, Indonesia and South Africa, QNB stated.

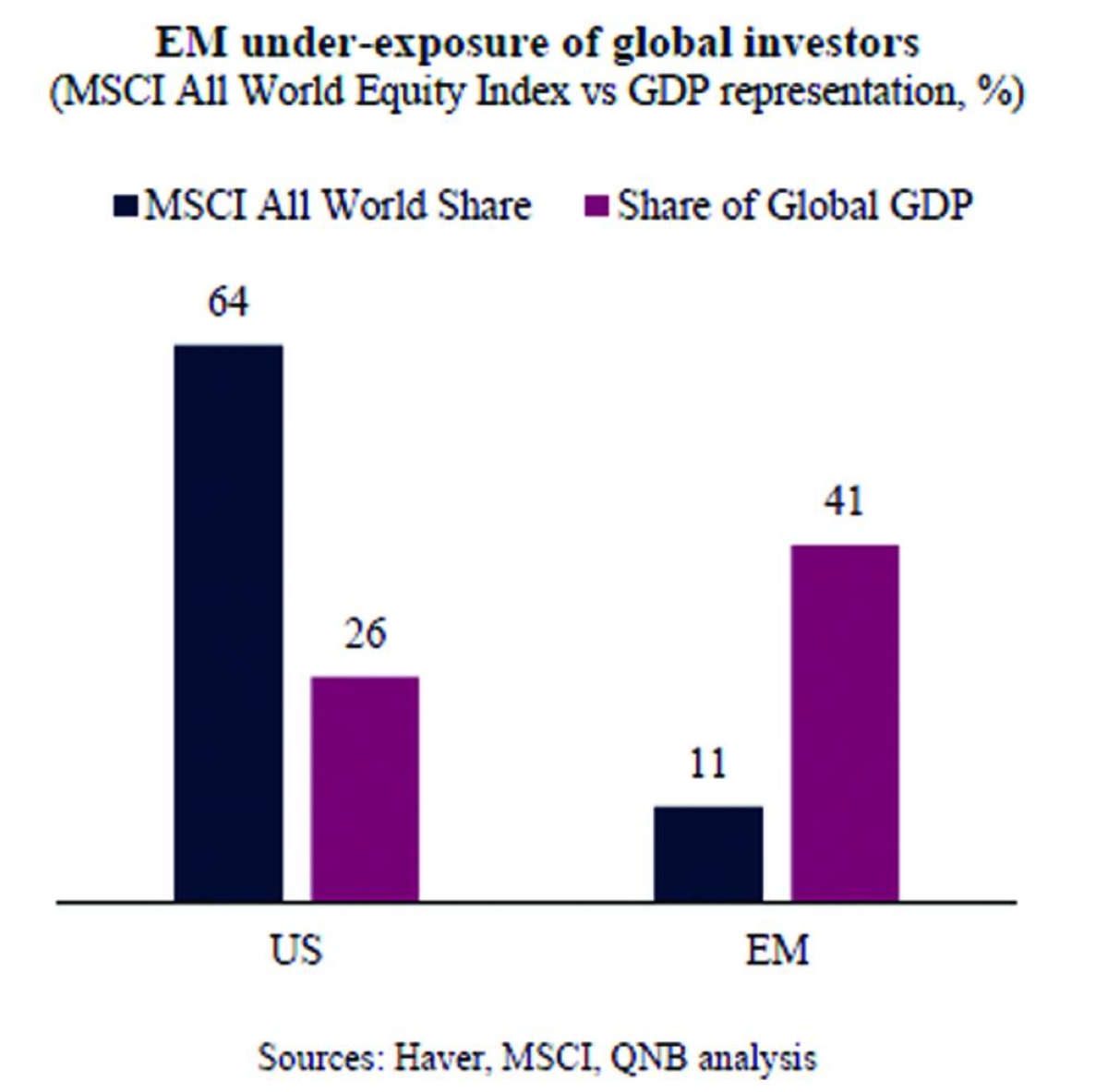

The third, QNB stated, is that investor’s overall positioning suggests that portfolio rebalancing could favour increased capital allocations to EM. Over the past decade, global portfolios have become highly concentrated in US assets, reflecting a long period of US economic outperformance, strong US equity market returns and the central role of US Treasuries in global finance.

As a result, many global investors are structurally overweight US assets, while allocations to EM remain comparatively low. For example, the weight of US equities in the benchmark MSCI All World is 64%, much above the country’s share of global GDP of 26%. In contrast, the weight of EM equities is only 11%, despite EM GDP accounting for 41% of global activity.

QNB stated that this concentration creates asymmetric risks and opportunities. Even relatively small changes in global asset allocation, such as marginal reductions in US exposure for diversification or risk-management purposes, could translate into sizeable capital flows towards under-allocated asset classes, including EM.

“Importantly, this does not require a negative view on US assets, but rather a normalisation of portfolio weights after an extended period of US dominance. EM assets stand out as natural beneficiaries of portfolio rebalancing, offering diversification, higher growth potential and, in many cases, more attractive valuations than their advanced-economy peers.

“All in all, while volatility and selectivity will remain defining features of EM investing, the macro environment entering 2026 continues to look supportive for the asset class. The global investment cycle, favourable FX and interest rate dynamics, and structural portfolio rebalancing all point towards sustained capital inflows into EM. Against this backdrop, we expect EM assets to remain well-positioned for another year of solid performance and potential outperformance relative to advanced markets,” QNB stated.