After telegraphing a more pragmatic stance on spending for months, Saudi Arabia is starting to make the tough decisions. In quick succession, the kingdom has ordered sweeping reviews at its most ambitious projects spread across Neom, Jeddah, and even Riyadh.

The week began with delays to the 2029 Asian Winter Games, a showpiece event central to the kingdom’s sporting ambition that was increasingly being hamstrung by the costs and logistics of building ski slopes in a desert. At the same time, officials have been considering overhauls at two other splashy projects — The Line, a pair of mirrored skyscrapers in Neom, and a cube called The Mukaab, planned to be big enough to fit 20 Empire State Buildings in the heart of Riyadh.

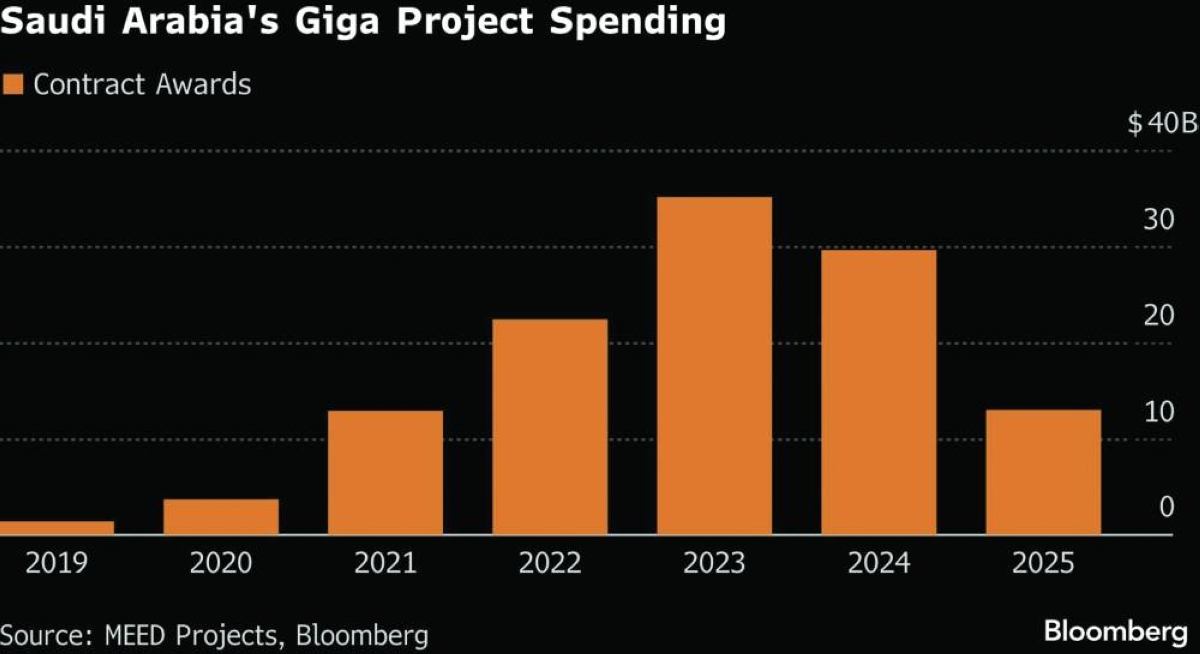

The moves accelerate a reckoning that began in late 2023, when the government first signalled potential delays to some projects. Multiple endeavours have since been curtailed as the kingdom seeks to shift course amid weak oil prices, a tighter lending environment and subdued foreign direct investment.

The latest review focuses on New Murabba, which was set to house the Mukaab building and envisioned as a sprawling new downtown in Riyadh.

Plans now being considered include ditching a stadium intended for the 2034 FIFA World Cup, according to people familiar with the matter. The developer has been asked by its owner, the Public Investment Fund, to submit proposals outlining what can be realistically completed over the next few years, the people said, asking not to be identified discussing private information.

Further afield at Neom, the future of The Line is also being weighed, according to some of the people. Envisioned to include a pair of mirrored towers spanning 106 miles (170 kilometres) and a World Cup stadium more than 350 meters (1,150 feet) in the air, that project is also on hold as its design is overhauled, according to some of the people.

The end result is likely to be a smaller project, similar to New Murabba, and The Line will likely no longer feature a World Cup stadium, the people said.

Elsewhere, the pullback has hit several developments near Jeddah, where many projects including a planned entertainment island called Qiddiya Coast are being reviewed, people familiar with the matter said. Plans for a World Cup stadium initially slated to be built there may not go ahead, they said. Qiddiya City in Riyadh is meanwhile proceeding with plans to build the Prince Mohammed bin Salman Stadium, the people added.

Qiddiya and the Public Investment Fund declined to comment. New Murabba and Saudi Arabia’s Ministry of Sport did not respond to a request for comment.

“We’re always looking at how to phase and prioritise our initiatives so that they align with national objectives and create long-term value,” a spokesperson for Neom said. “As a development that’s meant to span generations, Neom is advancing projects in line with strategic priorities, market readiness and sustainable economic impact.”

The retrenchment reflects a recalibration by the roughly $1tn PIF and the central government as they focus resources on infrastructure tied to immovable deadlines, such as the World Expo in 2030 and FIFA World Cup in 2034. Even then, officials are beginning to question earlier assumptions, including whether the kingdom really needs to build at least eight stadiums from scratch, and the strategy seems to be shifting to refurbishing existing ones.

To be sure, prior hosts also scaled back its original plans to build new stadiums. Russia did the same for the 2018 championship to cut costs and meet deadlines.

That debate captures what has emerged as the new mantra for Saudi government officials. Finance Minister Mohammed al-Jadaan summed it up at Davos last week as “optimal impact at the right cost,” signalling far tighter scrutiny after years of unfettered spending.

The shifts underscore Saudi Arabia’s balancing act — keeping a flow of investment to Crown Prince Mohammed bin Salman’s economic transformation plan, while dealing with lower oil revenue — and indicate more rigorous spending cuts and adjustments of priorities might be in the offing.

“Some of the projects that are now being delayed or scaled back were simply too ambitious,” said Azad Zangana, head of GCC macroeconomic analysis at Oxford Economics. “Authorities appear to be choosing to be more selective.”

Saudi officials haven’t publicly stated exactly which projects will stay and which may be cancelled, cut or delayed, though at least some areas of focus are becoming clearer. They will likely focus on work that can ultimately draw more public-private partnerships and foreign investment, for example, and lean more heavily into critical sectors like artificial intelligence, tourism and finance.

The PIF, for its part, has been ramping up its courtship of Saudi Arabia’s prominent families and others in the private sector in a bid to help ease the burden of spending on major projects. The kingdom has also raised billions of dollars from bond sales in recent years, ranking as one of the most active sovereign issuers in emerging markets.

Meanwhile, the government has accelerated its pace of reforms, opening up both real estate and capital markets to foreigners, to help lure more cash from abroad that can support everything from property developments to asset management and financial sector projects. These moves have spurred a 9% rally in the benchmark stock index so far this year, after a dismal 2025.

Any projects deemed unlikely to appeal to foreign capital, or those that don’t directly translate into immediate economic benefits under the Vision 2030 plan, will likely see fewer dollars invested in coming years.

“The recent decision to reprioritise some large investment projects has helped focus spending on areas where it matters most, while also mitigating the risk of economic overheating,” the International Monetary Fund said in December.

Economists including Farouk Soussa at Goldman Sachs Group Inc and Jean-Michel Saliba at Bank of America Corp echoed that view, while T. Rowe Price sovereign analyst Razan Nasser, said the recent changes are a “welcome confirmation” of the messaging the Saudis have been telegraphing for some time now.

The moves increase the chances of more efficient investment, and are important given many plans were developed at a time of higher oil prices, lower rates and easier global trade relationships, she said.

“Pragmatism is essential.”