Gulf countries accelerated bond issuance in January as investors shifted toward emerging markets. The increase was partly driven by Asian demand, with Chinese banks making it to the roster of deal managers amid waning influence from US lenders.

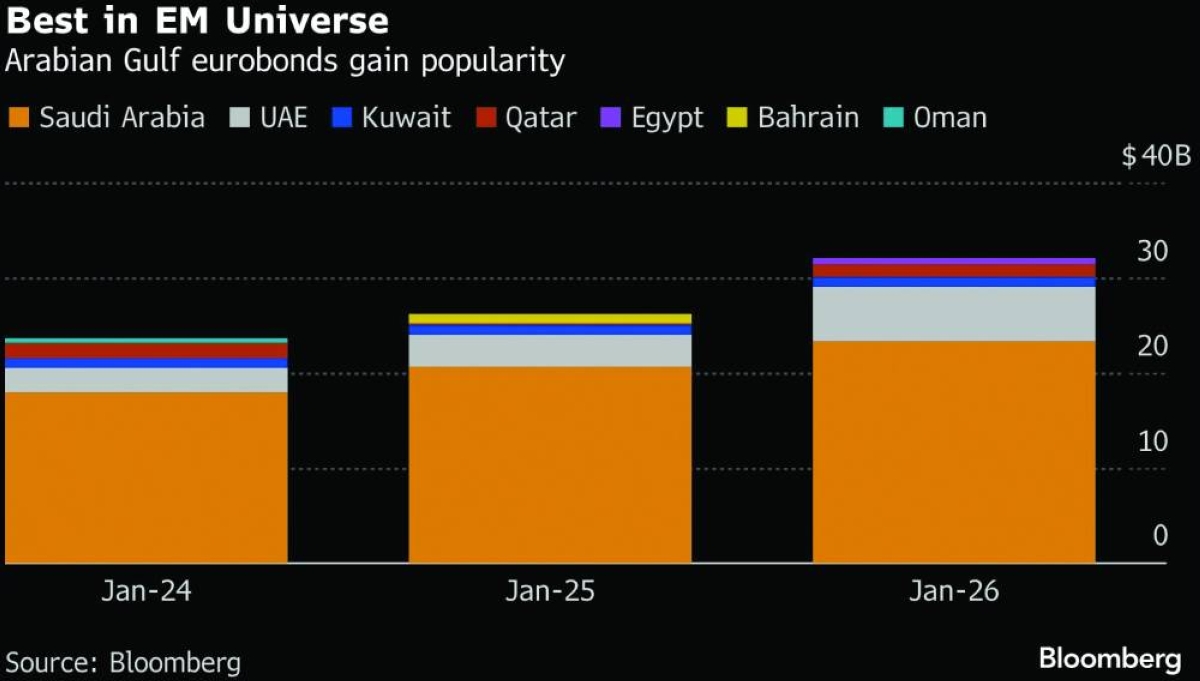

Countries in the Gulf Co-operation Council issued $32.3bn of international bonds since the start of the year, about 25% more than in January 2025, according to Bloomberg calculations.

This is happening due to diversification goals and yield hunting, according to fixed-income strategist at Bloomberg Intelligence Basel al-Waqayan. “Preferences shifted away from developed market debt and into higher growth EM markets, particularly GCC,” he said.

As Gulf countries strengthen ties with China, competition with the US in the region’s bond markets is intensifying. Chinese banks are expanding their presence, gaining positions as placement managers, alongside UAE banks.

Bank of China and Industrial & Commercial Bank of China were substantially more active in Gulf eurobond issuance, while major US banks lost ground compared with a year earlier.

Saudi Arabia sold more than $20bn of international bonds since the start of the year, a record for a January as companies and banks join government fund raising.

Banks are increasingly turning to debt markets in response to tightening liquidity conditions, as slowing deposit growth and tougher capital rules make it harder to meet strong credit demand driven by the kingdom’s Vision 2030 agenda. Higher capital requirements due to come into effect this year will force banks to keep more funds on their balance sheets.

Companies are also taking advantage of attractive pricing and rising demand from Asian investors to reinforce their finances.

“Favourable market conditions in terms on rates and spreads, still strong demand and rising Asian investor interest” are among reasons for rising Saudi borrowings, al-Waqayan said.

The Saudi government raised $11.5bn in early January through a dollar bond sale that attracted demand of $28bn. Saudi Electricity and Saudi Telecom followed with $2.4bn and $2bn Sukuk bonds. Saudi National Bank, Riyad Bank and Al Rajhi Bank raised at least $1bn each.