Oil

Oil prices settled more than 2% lower on Friday as investors weighed the prospect of a global supply glut, while also monitoring the possibility of a Ukraine peace deal ahead of talks this weekend between the presidents of Ukraine and the United States.

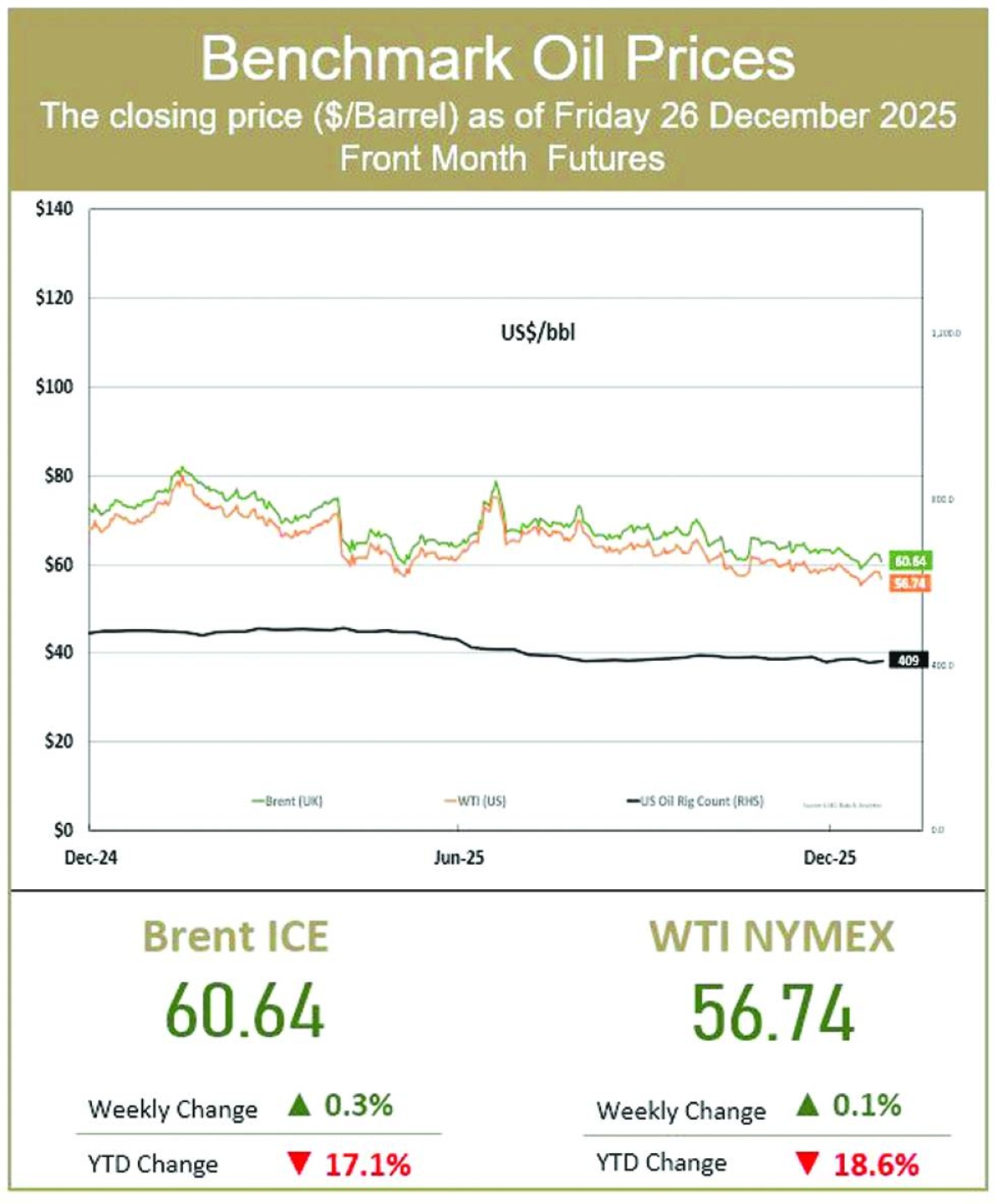

Brent crude futures settled at $60.64, while US West Texas Intermediate (WTI) crude finished at $56.74. For the week, Brent rose 0.3% and WTI rose 0.1%.

While supply disruptions have helped oil prices rebound in recent sessions from their near five-year low on December 16, they are on track for their steepest annual decline since 2020. Brent and WTI are down 19% and 21% respectively on the year, as rising crude output caused concerns of an oil glut next year.

Meanwhile, geopolitical premiums have provided near-term price support but have not materially shifted the underlying oversupply narrative.

Gas

Asian spot liquefied natural gas prices edged up this week as forecasts for colder weather boosted demand in South Korea, but overall weak buying in China left prices down 34% since the start of 2025.

The average LNG price for February delivery into north-east Asia was $9.60 per million British thermal units (mmBtu), up from $9.50 per mmBtu the week before.

The market remains under pressure from continuous soft demand across Asia, driven by weak economic indicators and ample alternative supplies like coal in China.

However, colder spells over the coming week in South Korea and China might increase demand.

In Europe, the Dutch TTF gas price settled at $9.70 per mmBtu, posting a weekly gain of 0.2%. Consumption is expected to remain elevated due to a sharp drop in temperatures, although strong supply from Norway and LNG imports is likely to cap any significant rise in prices.