Battery prices are forecast to drop next year, though it’ll be a smaller dip than 2025 due to high costs of raw materials and tariffs.

The average price for a battery pack is expected to fall 3% next year to $105 per kilowatt-hour, according to a new BloombergNEF survey. The report attributes the dip to a glut of manufacturing capacity in China, increased competition and an ongoing shift to products that use lower-cost and safer lithium-iron phosphate technology.

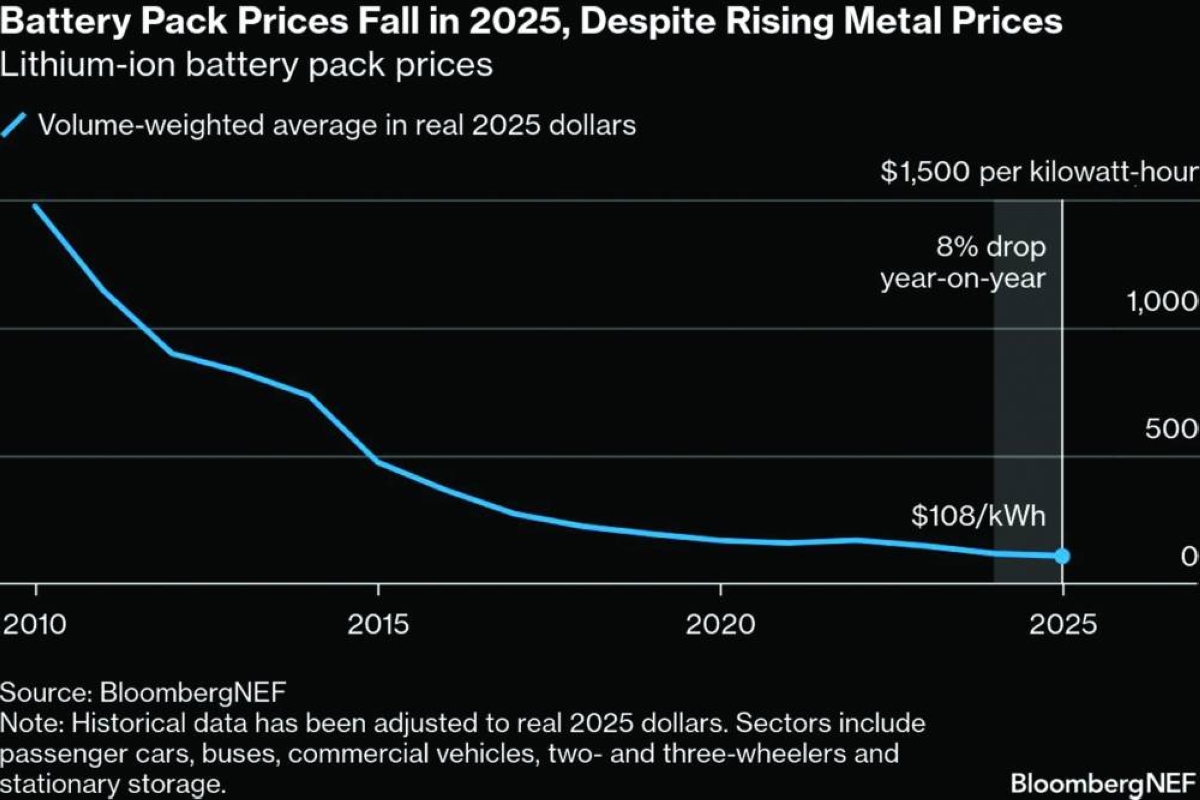

That projected drop isn’t as large as this year’s, though: Battery prices fell by 8% to $108 per-kilowatt-hour in 2025, the report said. That decrease came despite higher battery metal prices due to supply chain risks at Chinese lithium mines and restrictions on cobalt exports from the Democratic Republic of Congo that sent prices climbing 124% between January and October.

“Cutthroat competition is making batteries cheaper every year,” said Evelina Stoikou, head of the battery technology team at BNEF. “This is an important moment for the industry, as record-low battery prices create an opportunity to lower EV costs and accelerate the deployment of grid-scale storage to support renewables integration around the world.”

Efforts to keep lowering the price of batteries, which are the most costly part of electric vehicles, is helping accelerate the global adoption of electric automobiles, with China leading the way. The country’s annual EV sales are set to outpace the number of all vehicles sold in the US — including internal combustion models — according to BNEF.

Cheaper battery packs are also boosting the deployment of stationary energy storage systems that are increasingly backstopping intermittent solar and wind power as well as providing a resource to help meet rising demand from data centres. BNEF projects that global energy storage installations are projected to more than double over the next decade.

Continued investment in research and development, manufacturing efficiency and the expansion of supply chains will support further improvement in battery technology and additional cost reductions, BNEF said. New technologies such as silicon and lithium metal anodes, solid-state electrolytes, new cathode materials and cell manufacturing processes will also play a role in driving down future prices, according to the survey.