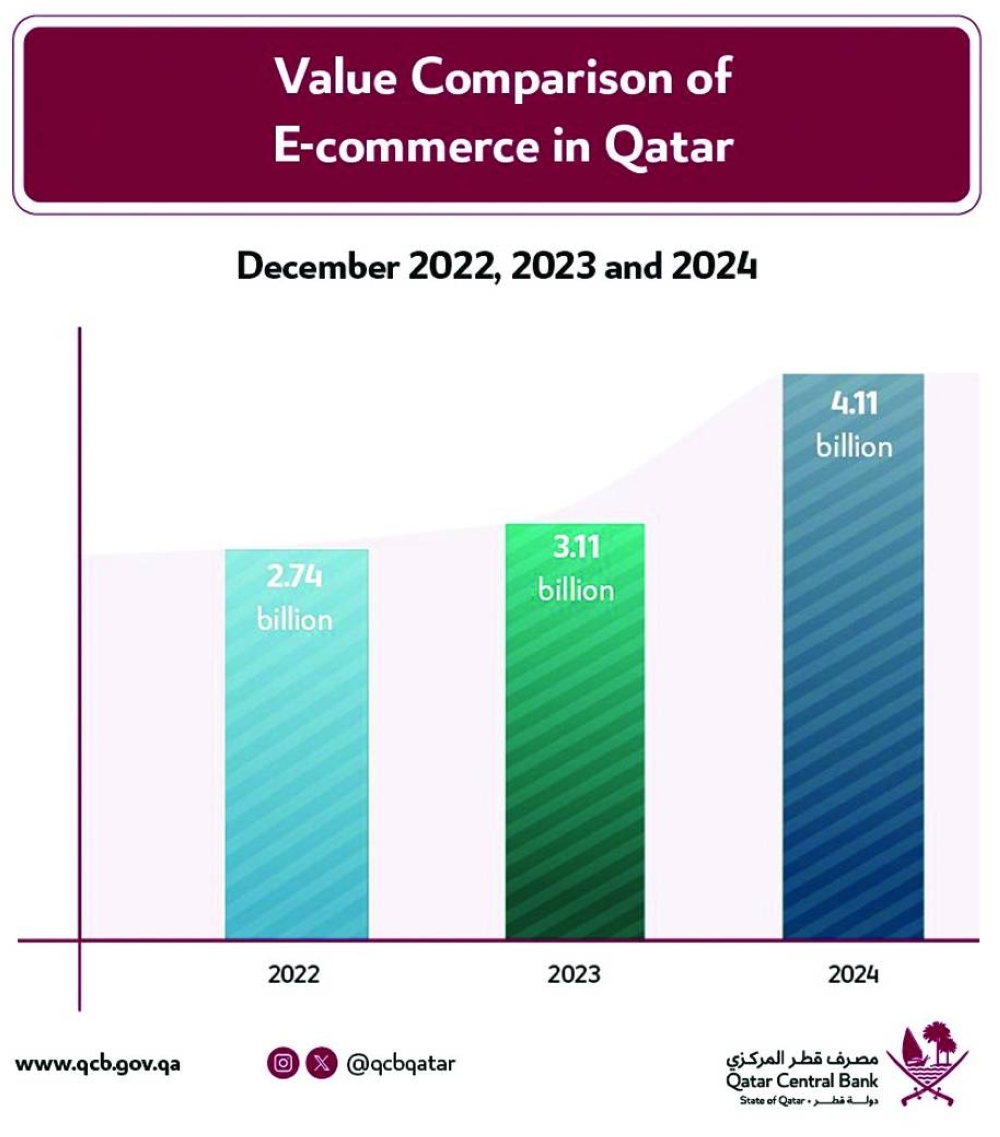

E-commerce transactions totalled QR4.11bn in Qatar in December last year, according to the Qatar Central Bank.

This represents a significant increase compared to the same period in 2022 and 2023, the QCB said.

In December 2022, e-commerce transactions were valued at QR2.74bn while it stood at QR3.11bn in December 2023.

QCB data indicate there has been a huge increase in the volume of e-commerce transactions in the country in the last three years.

In December 2024, the volume of e-commerce transactions stood at 8.59mn compared to 4.97mn (December 2022) and 5.98mn (December 2023).

In terms of bank cards, debit cards outnumbered both credit and pre-paid cards in Qatar, according to the QCB.

The number of debit cards in the country totalled nearly 2.45mn in December, 2024. The number of credit cards was 766,649 and pre-paid cards 774,099 in December last year.

POS (point of sale) transactions accounted for QR9.49bn in December 2024 compared to QR7.55bn in December 2022 and 7.9bn in December 2023.

The number of POS devices in Qatar stood at 75,779 in December 2024 compared to 64,675 in December 2022 and 68,032 in December 2023.

The QCB introduced the National Network System for ATMs and Points of Sale (NAPS), which is the central payment system, in 1996 to facilitate the acceptance of cards transactions (debit cards and prepaid) on ATM, PoS and e-commerce terminals throughout the GCC region and Egypt.

Additionally, the system accepts cards issued by the QCB, GCC and Egypt regulated banks.

According to the QCB, NAPS is one of the first switches in the region to achieve full (EMV) compliance both as an acquirer and issuer.

The system was upgraded in 2023 in line with the latest global standards in cards industry. It is a round-the-clock service, which supports card tokenisation and card-less payments. All banks in Qatar are members of the National Network System for ATMs and Points of Sale.

The Qatar Central Bank