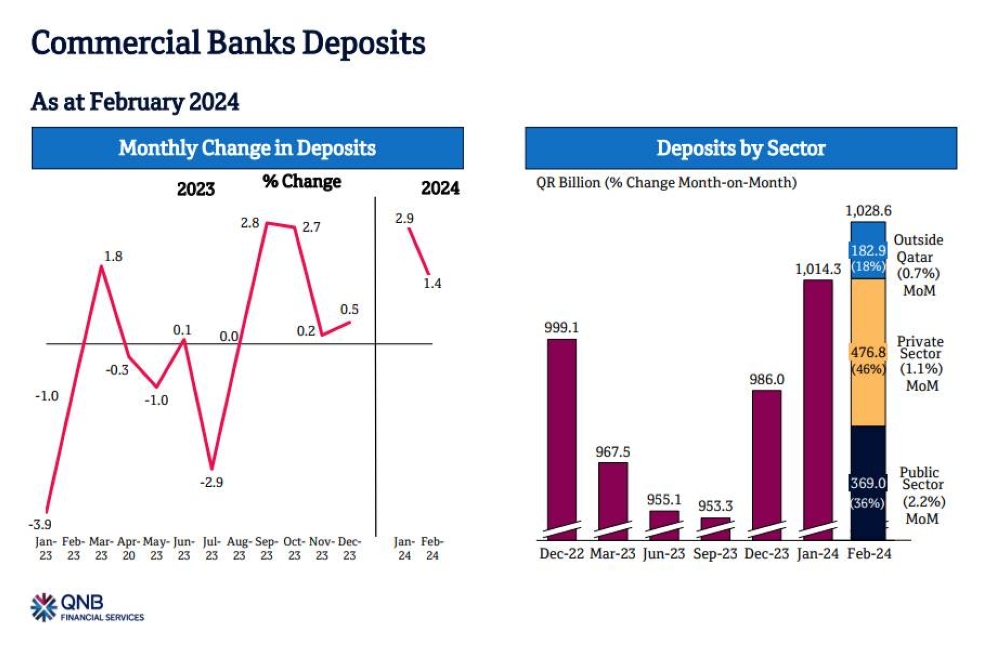

Qatar banking sector deposits increased 1.4% during February to reach QR1,028.6bn, driven by both the public and private sectors, according to QNB Financial Services (QNBFS).

Deposits growth in February was mainly due to an increase by 2.2% in the public sector and 1.1% in the private sector

Deposits grew by an average 4.1% over the past five years (2019-2023), QNBFS said in its ‘Qatar monthly key banking indicators’.

The overall loan book went down 0.5% in February to QR1,312.9bn.

The loans decline in February was mainly due to a drop by 0.4% in the private sector and 0.7% in the public sector.

Loans increased by 1.9% in 2024, compared to a growth of 2.5% in 2023. Loans grew by an average 6.5% over the past five years (2019-2023)

Loan provisions to gross loans stood at 3.8% in February and 4% in January, QNBFS said.

Total assets edged down by 0.2% during February to QR1.97tn.

The total assets loss in February was mainly due to a slide by 0.4% in domestic assets.

Total assets was marginally higher in 2024, compared to a growth of 3.4% in 2023. Assets grew by an average 6.8% over the past five years (2019-2023)

Liquid assets to total assets was at 30.6% both in February and January 2024, QNBFS said.

In terms of overall deposits, the government institutions’ segment (represents 55% of public sector deposits) went up by 2.3% MoM (+5.6% in 2024), while the semi-government institutions’ segment rose by 5.1% MoM (+1.6% in 2024).

The government segment (represents 30% of public sector deposits) moved up by 0.7% MoM (+15.2% in 2024) in February.

Private sector deposits expanded 1.1% MoM (+2.7% in 2024) in February. On the private sector front, the consumer segment increased by 1.2% MoM (+3.4% in 2024), while the companies and institutions’ segment gained by 0.9% MoM (+1.9% in 2024).

Non-resident deposits added 0.7% MoM (+2.1% in 2024) in February.

The overall loan book went down 0.5% in February 2024. Total private sector loans moved lower by 0.4% MoM (+0.5% in 2024). Consumption and others, general trade and real estate were the main drivers for the private sector loan drop.

Consumption and others (contributes 21% to private sector loans) fell 1.5% MoM (+0.3% in 2024), while general trade (contributes 21% to private sector loans) moved down 0.5% MoM (+1% in 2024), and the real estate segment (contributes 20% to private sector loans) slid 0.4% MoM (+0.4% in 2024).

However, the services (contributes 32% to private sector loans) moved up 0.6% MoM (+1% in 2024) in February.

Outside Qatar loans edged down by 0.2% MoM (-1.1% in 2024) during February.

Total public sector loans contracted 0.7% MoM (+5.7% in 2024) in February 2024. The government segment (represents 31% of public sector loans) was the main catalyst for the public sector with a drop by 3.2% MoM (+12.3% in 2024).

However, the semi-government institutions’ gained 4.2% MoM (+4.8% in 2024) and the government institutions’ segment (represents 63% of public sector loans) rose marginally MoM (+2.8% in 2024).

Qatar banking sector’s loan provisions to gross loans was at 3.8% in February, compared to 4% in January, QNBFS noted.

An analyst told Gulf Times: “The banking sector continued to make sizeable gains in overall deposits, with both the public and private sector gaining by 2.2% and 1.1%, respectively. The public sector was pushed higher mainly by government institutions and semi-government institutions, while the private sector was lifted up by both the personal and companies and institutions”.

Business

Qatar banks make sizeable gains in overall deposits driven by public and private sectors: QNBFS

Qatar banking sector deposits increased 1.4% during February to reach QR1,028.6bn, driven by both the public and private sectors, according to QNB Financial Services