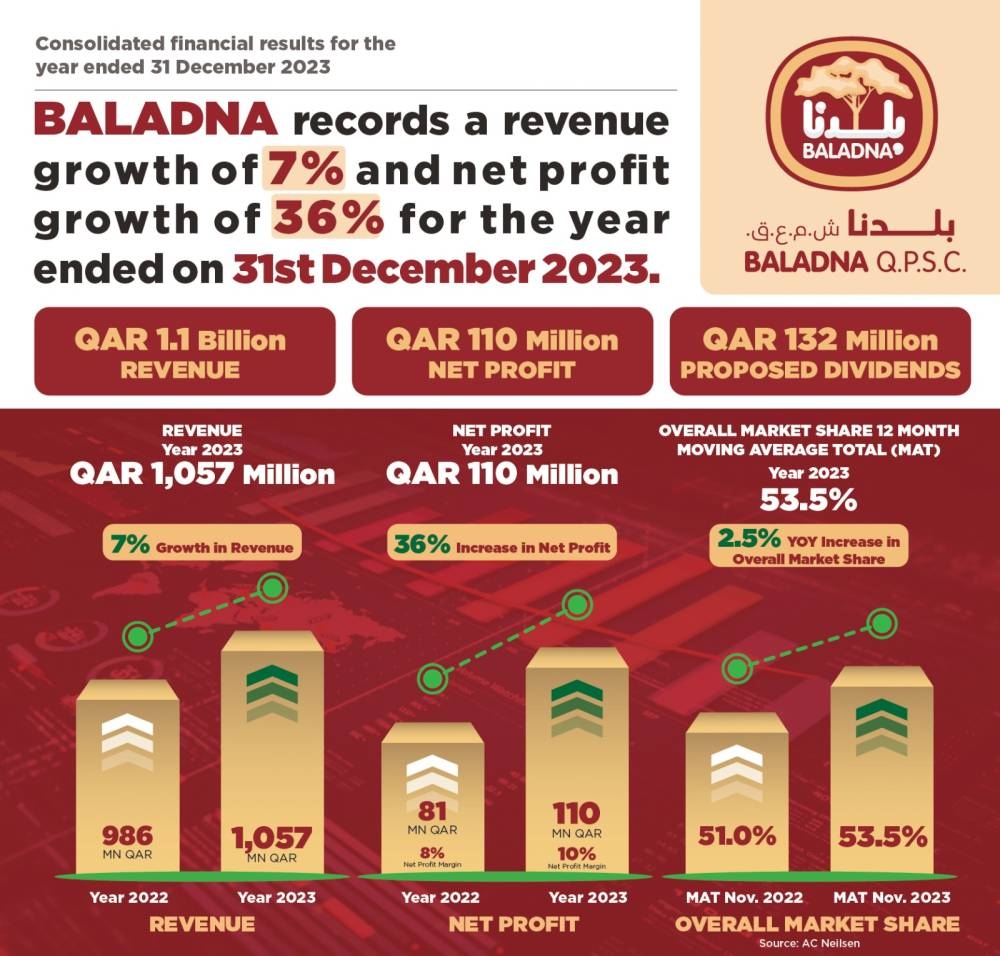

Baladna disclosed Sunday its annual financial results for the year ended on 31st December 2023, Baladna reported strong growth in revenue and net profit compared to the same period last year.

Baladna has reported the following:

• Baladna achieved a 7% increase in revenues compared to last year, increasing from QR986million to QR1,057million.

• Net profit marked a significant increase of 36%, amounting to QR110million which represents a net profit margin of 10%. Earnings per share were recorded at QR0.058

• Remarkable growth recorded in both the HORECA and retail channels, contributing to the revenue expansion

• Increased market share across most product categories. Overall market share rose to 53.5%, recording 2.5% market share gain over last year

• The strong growth reported in net profit is mainly attributed and driven by the following:

− Higher sales volumes across HORECA and retail channels,

− Strategic and efficient cost controls measures,

− Fair value gain on share investments,

− Stabilisation of commodity prices,

− Focus on operational excellence,

During the fourth quarter of 2023, Baladna achieved a revenue of QR284million and net profit of QR45million. This represents a revenue growth of 3% and net profit growth of 80% compared to same quarter last year.

During FY 2023, Baladna has re-organized its sales operation to effectively capitalize on market dynamics, with strategic collaboration with its customers. The increase in sales volumes resulted in top-line growth by 7% to QR1.057Billion in 2023. Surpassing the revenue millstone of QR1billion is a remarkable achievement for Baladna.

The increase in market value of investment in securities, strategic cost control measures, efficiency improvement in the entire value chain, and the relative stabilization of commodity prices contributed to the FY 2023 net profit achievement.

Baladna is continuously assessing opportunities to enhance its product mix by developing and introducing new, innovative products and strategically optimizing its product portfolio. During the year, Baladna has managed to introduce a number of new SKUs to the market including Evaporated Milk and Sterilized Cream which were historically imported to the country. Furthermore, Baladna launched its first domestic production of an international brand and produces spreadable cheese for Bel Group under the brand names of La Vache Qui Rit and Jibnet Abu Al Walad.

During FY 2023, Baladna increased its equity stake in Juhayna Food Industries, the largest dairy producer in Egypt to a substantial 15%, which contributed to notable dividends and fair value gain contributions to further strengthen the bottom line of Baladna.

Baladna reported positive advancement in its forthcoming Algerian project targeting milk production facilities, anticipating significant shareholder value creation, and marking another milestone in Baladna’s global growth journey.

Driven by a commitment to operational efficiency and a firm control on overhead costs, Baladna’s management continues to underscore its primary focus on fortifying Qatar’s food security and self-sufficiency. The company remains resolute in its commitment to its shareholders, striving to create value through superior product delivery, broadening its product range, and emphasizing efficiency across its value chain.

Proposed Dividend for 2023

Baladna said it is pleased to announce the proposed dividend payment to its shareholders with the strong financial results of the year 2023. The Board of Directors decided to propose QR132 million (QR 0.0695 per share) dividends to the upcoming General Assembly for approval.