Doha stands out in the Gulf Co-operation Council (GCC) due to its "prudential" measures to bulwark the economy during the challenging times, according to a senior researcher with the Investment Promotion Agency Qatar (Invest Qatar).

"Qatar stands out (in the Gulf region), thanks to prudential measures that have been implemented over the recent years, which have allowed it to have substantial resources to support the economy during challenging times," Gokhan Celik, senior manager, Research and Policy Advocacy, Invest Qatar, said in an article 'Untold story of GCC in IMF's regional economic growth projections'.

He said, according to the IMF (International Monetary Fund) World Economic Outlook (WEO) projections, Qatar will maintain a stronger fiscal position compared with its counterparts, as evidenced by the amount of financial assets available for lending.

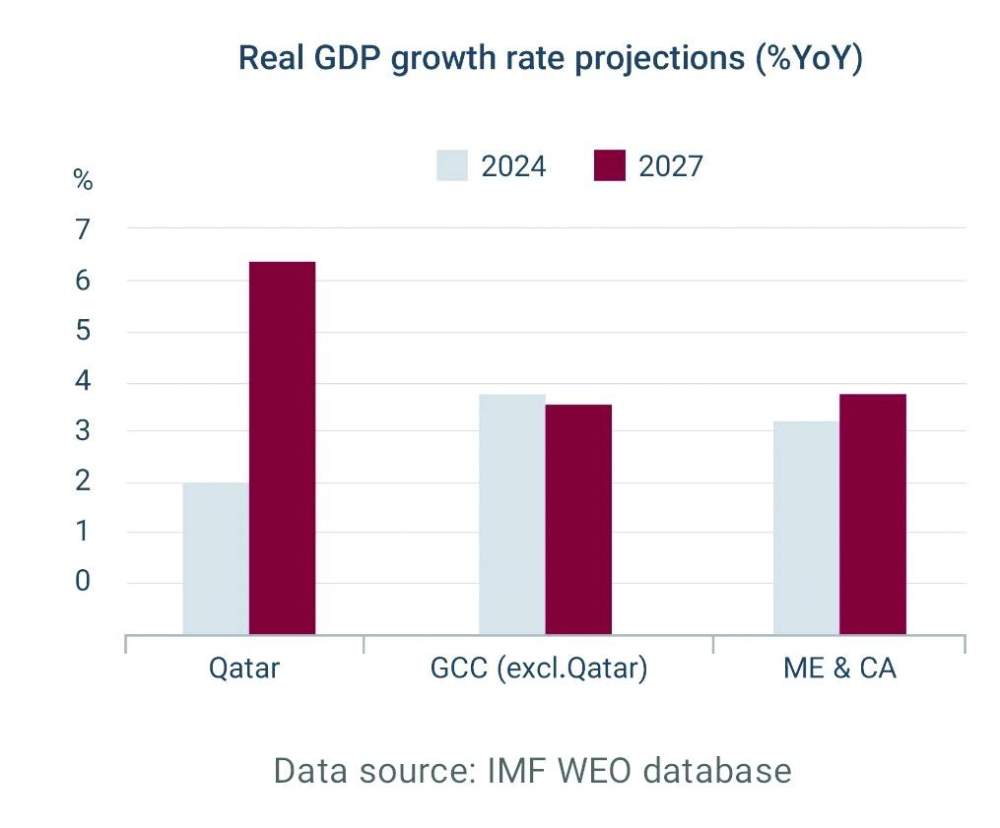

The consolidated projections indicate that, despite the slowdown in 2023, the GCC economy is poised to maintain growth in the following years at an approximate rate of 4%.

"A noteworthy upward trend is evident in Qatar’s medium-term projections," he said.

The organisation (IMF) expects Qatar’s growth to accelerate with an impressive rate exceeding 6% in 2027, driven by the North Field Expansion, a historical development aimed at significantly increasing liquefied natural gas production.

In the GCC, the IMF emphasises the importance of corrective policies in mitigating potential risks associated with the disinflationary process and slowing economies.

"Implementing fiscal measures to support economic activity and protect vulnerable segments comes at a cost and not all countries are ready to shoulder this burden," he said.

Besides, the IMF highlights the growing concerns on soaring debts and advises the emerging economies to pursue deeper fiscal consolidation.

"The positive outlook of the GCC economy strongly relies on the continuation of the structural reforms, which are crucial for reviving medium-term growth prospects, particularly given the restricted policy manoeuvre," Celik said.

In 2024, ME&CA (Middle East and Central Asia), is estimated to grow at a slower pace compared with emerging markets, despite the robust performance of the GCC countries within the region, estimated to grow 3.7%, following the emerging markets trend.

Within ME&CA, the GCC is included alongside other nations that exhibit diverse economic structures and conditions, he said, adding unlike the other countries within this category, the GCC is expected to perform differently due to dedicated pursuit of economic diversification, an ambitious vision that has been developed over several years.

The analysis of aggregate performance of the GCC reveals that the IMF has consistently upgraded the GCC’s longer-term outlook since the Covid-19 pandemic.

"The upgrades are primarily tied to the commodity market and, to a lesser extent, development projects. More compellingly, the upward revisions occurred despite unavoidable monetary policy tightening, as the GCC economies are bound by currency pegs to follow the US monetary policy decisions," the researcher said.

“As we enter the final quarter of 2023, global economy activity remains slow and falls short of its pre-pandemic trajectory," he said, referring to the WEO projection that forecast global growth to decline from 3.5% in 2022 to 3% in 2023 and 2.9% in 2024.