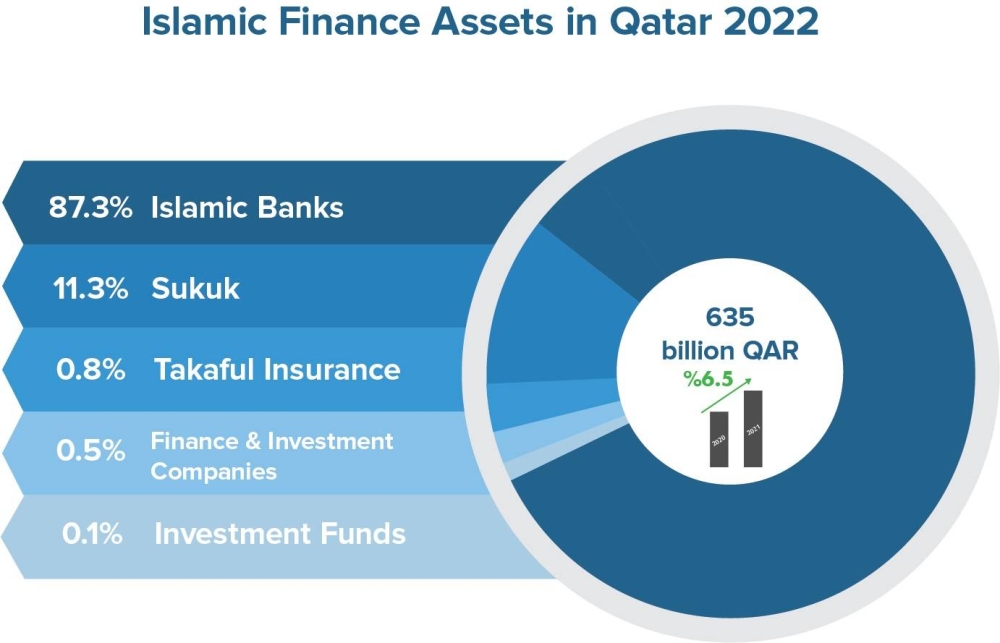

Islamic finance assets in Qatar grew 6.5% reaching QR635bn last year, ‘Islamic Finance in Qatar Report 2022’ by research firm Bait Al-Mashura Finance Consultations has shown.

Islamic banks accounted for 87% of such assets, while Islamic sukuks accounted for 11.3%, Bait Al-Mashura noted.

According to the report, the assets of Islamic banks’ grew 7.3% in 2022, reaching QR544.3bn, deposits grew 1.6%, totalling QR317.8bn and financing increased by 12.3% amounting to QR380.5bn.

In the takaful insurance sector, the assets of such companies amounted to approximately QR5bn, registering a growth of 11.9%.

Policyholders’ assets amounted to approximately QR2.6bn with a growth of 8.9%. Insurance contributions reached QR1.5bn, an increase of 9.3%.

The business of takaful insurance companies “varied” between achieving insurance surpluses amounting to approximately QR73.4mn and an insurance deficit amounting to QR5.7mn.

In Islamic finance companies, the assets amounted to QR2.5bn, down by 1.9%. Financing provided by these companies last year decreased by 3.3%, amounting to QR1.69bn.

Revenues amounted to QR224.5bn, up 2%, revenues from financing and investment activities accounted for 90% of such total revenues. In Islamic investment companies, their assets grew by 1.3%, amounting to QR509mn last year.

Their revenues amounted to QR62.3mn, a growth of 52.8%, and their profits exceeded QR16mn, Bait Al-Mashura said in its report.

Issued Islamic sukuks decreased by 48%, as Islamic banks stopped issuing sukuks during 2022, the report said.

Qatar Central Bank issued sukuks amounting to QR5.4bn during the year, down 29% on 2021.

Bait Al-Mashura vice-chairman Prof. Dr. Khalid bin Ibrahim al-Sulaiti asserted that Islamic Finance endeavour to establish a “fair financial system” that promotes moral values and strives for the economic well-being of the individual and society on the basis of transparent, well-governed foundations.

Transparency and clarity are fundamental pillars for stakeholders in legitimate financial transactions. Hence, the role of reports that support such a purpose and illustrate the weaknesses and strengths in the industry, development, and innovation areas.

“We, at Bait Al-Mashura, are keen to strengthen such rules, which are considered a basic starting point for researchers, interested parties, and even institutions, through our series of reports, research, and studies that discuss the Islamic finance sector in Qatar, and give a clear picture of its reality and a forward-looking vision for its future,” al-Sulaiti noted.

He stated that Qatari economy outperformed projections in 2022, expanding at a rate of 4.8%. Qatar’s Planning and Statistics Authority (PSA) estimates that the country's GDP at constant prices (2018) reached QR690.1bn, up from QR658.3bn in 2021.

At current prices, the GDP rose to QR863.8bn, up 32% on 2021. The projected GDP growth rate for fiscal 2023 is anticipated to surpass 3%.

“The financial and insurance activities sector made a significant contribution to the GDP, accounting for 8.1% of the total. This amounted to QR70.4bn at current prices, representing a growth rate of 11.9% compared to the previous year’s QR62.9bn,” Bait Al-Mashura noted.

Bait Al-Mashura vice-chairman Prof. Dr. Khalid bin Ibrahim al-Sulaiti