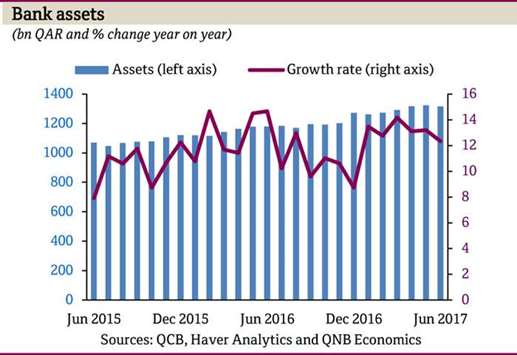

Qatar’s bank assets grew 11.6% year-on-year (y-o-y) in June to QR1.32tn, compared to a growth of 12.3% in May, QNB has said and noted that domestic assets grew 12.4% year-on-year in June from 11% in the previous month.

Foreign assets grew 11% year-on-year in June, from 15.4% in May, QNB Economics said in its latest ‘Qatar Monthly Monitor’.

Deposits at Qatar’s banks grew by 12.7% year-on-year in June compared to 11.7% in May. The share of non-resident deposits to total deposits fell marginally to 22.1% from 24.2% the previous month.

Non-resident deposits slowed to 26.6% year-on-year from 31.6% growth the previous month. Private sector deposits slowed to 2.4% year-on-year compared to 8.9% in June, while public sector deposits growth accelerated to 21.4% compared to 2.2% in June.

The QNB report showed that loan growth stood at 12% year-on-year in June, up from 9.8% in May.

Loans to the public sector (around 40% of total domestic credit) grew 19.6% year-on-year versus 16.3% growth in the previous month.

Private sector loans grew by 7.6% year-on-year while foreign credit grew by 11.1%.

Qatar’s broad money supply (M2), QNB said grew by 7.8% in June compared to 4.7% in May, mainly due to a “sharp growth” in foreign currency deposits, the QNB report shows.

Foreign currency deposits have increased by 16.8% in June from 3.3% in May, the report shows.

Overnight interbank rates rose to 1.77% in June from 1.29% in May; the 3-month interbank rate fell to 2.1% from 2.25%, while the 1-year interbank rate stayed flat at 2.5%, QNB says.

The Qatar Central Bank (QCB) raised its deposit rate by 25 basis points (0.25%) to 1.5% after the US Fed hiked rates in March, but kept the lending and repo rates unchanged, it says.

Qatar’s fiscal deficit narrowed in the first quarter (Q1) to 5.1% of GDP from17.9% in Q4, 2016. Revenue rose by 31% year on year in Q1, helped by higher oil prices, while expenditure rose by 15.8% year on year.

The 2017 budget announced by the government projects a reduction in the fiscal deficit to QR28.4bn in 2017 from a deficit of QR46.5bn in 2016.

The country’s exports grew 5.4% year-on-year to $5.1bn, helped by the recovery in oil and gas prices, while imports fell 40% year-on -year in June.

South Korea was the largest export market, with a share of 19.3% of total exports, followed by Japan and India; the US and China were the top countries of origin for imports.

Qatar’s international reserves dropped to $24.8bn in June from $35.2bn in May.

“We expect months of import cover to average 5.7 months for the year, which is above the IMF recommended minimum of three months for a fixed-exchange rate regime,” QNB says.

Qatar oil production slowed down to 594,000 barrels per day (bpd) in May from 619,000bpd in April.

Average Brent crude oil prices rose by 9.9%, month-on-month in July, reaching $52.7/b due to falling US crude stockpiles. “We forecast Brent crude prices to average $55/b in 2017,” QNB says.

According to QNB, Qatar’s real estate price index picked up slightly during Q2, but the index still fell by 5.5% year-on-year in June from a decline of 9.6% in March.

The real estate price index reflects the prices of land, residential and commercial transactions.

.