Revenue from value-added tax (VAT) at a rate of 5% could help Qatar generate additional revenue of about 1.5 percentage points of non-hydrocarbon GDP a year, an IMF estimate has shown.

In its ‘Qatar Country Report’ released yesterday, the International Monetary Fund said the GCC agreement on the introduction of VAT in 2018 was a “welcome” development.

“Qatar has started to take actions to ensure its smooth and timely implementation. These include establishing a separate and independent tax authority, and recruiting experts to help with the design and implementation of the VAT,” the IMF noted.

According to the IMF, the Qatari authorities also plan to implement excises on tobacco and sugary drinks, starting in 2017 in line with a GCC-wide agreement. This measure is estimated to yield about 0.2% of non-hydrocarbon GDP in revenue.

On the expenditure side, controlling public service benefits and spending on goods and services, while preserving key public investment projects, would contribute to reducing total public spending by 13 percentage points of non-hydrocarbon GDP by 2021, with some impact on growth, the report said.

“Some of these proposed measures have already been incorporated in the 2017 budget, including on-going rationalisation of current expenditure,” the IMF said.

The report suggested that additional revenue measures should be explored to support fiscal consolidation and mobilise resources to support the second national development strategy.

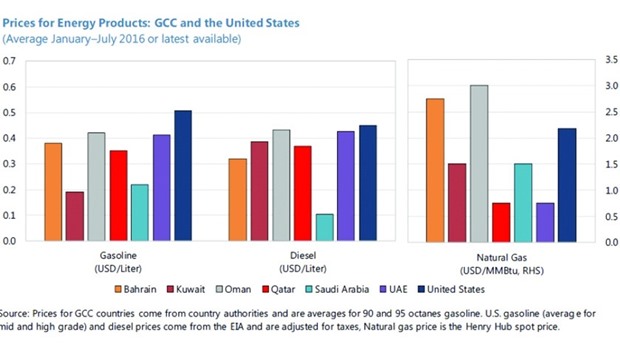

The fund’s economists indicated that there was “room for increasing and broadening” the base of existing taxes, especially the corporate income tax. There is also room for further increases in domestic fuel prices, as Qatar’s fuel and gas prices remain low compared to international prices (and to some GCC peers).

According to IMF estimates, if domestic fuel prices were to be set at the level in the UAE (which has the highest average prices among the Gulf Cooperation Council countries) or the US, additional fiscal revenue could range from 0.4% to 1.1% of non-hydrocarbon GDP.

“For excises on tobacco and sugary drinks to be implemented in 2017, it is important that excise bases are carefully designed and that high rates do not encourage undesirable substitution across similar products,” the IMF said.

The IMF welcomed the ongoing budget reforms and emphasised the importance of rooting fiscal efforts in a medium-term fiscal framework. The authorities agreed, highlighting the progress being made in strengthening the medium-term budget framework, including the establishment of a Macro-Fiscal Unit within the Ministry of Finance and initiatives to ensure that budget execution is in line with the budget.

Capital expenditures and related operational spending are being reviewed and medium-term envelopes have been established.

The public investment management unit of the ministry of finance is making good progress, with emphasis on improving the efficiency of public investment, the report said.

A new tender law and public finance law were recently approved.

Building on these reforms, the IMF recommended that “further efforts to enhance the monitoring of public expenditures, through the institutional frameworks noted above, would help improve efficiency and management of investment spending.

“Further improvement in the transparency of fiscal accounts, including financial transactions of the government, would facilitate a more robust assessment of Qatar’s fiscal position.”