The demand for building materials in Qatar’s construction sector will continue to accelerate in the run up to the FIFA 2022 World Cup on the back of robust growth and a strong project pipeline, a new report has shown.

“The government policy will serve to help mitigate bottlenecks with regard to matching growing demand with an adequate supply of building materials,” BMI Research has said in a report.

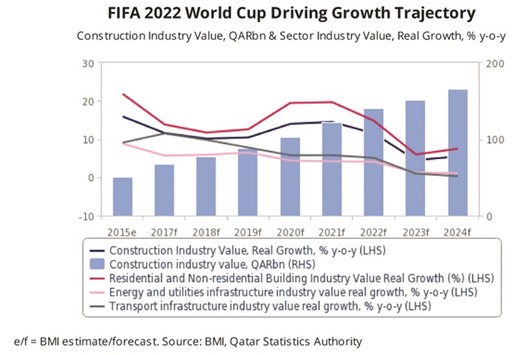

Growing amounts of aggregate building materials will be required to “fuel rapid expansion” in Qatar’s construction sector, which, with the upcoming FIFA 2022 World Cup, is expected to drive annualised average real growth of 12%.

“We expect that prudent government policy under the auspices of state-owned Qatar Primary Materials Company (QPMC) will help to facilitate building material supplies to the private sector, allowing the government to successfully implement its ambitious infrastructure build out,” BMI said.

According to the Fitch Group company, Qatar’s investment programme will spur well-diversified growth spanning the country’s infrastructure spectrum, with transport and commercial construction projects in particular set to be major beneficiaries. The country’s construction boom will in turn buoy demand for primary construction materials.

As a point of reference, Qatar’s public works authority Ashghal estimates that projects in the pipeline will require a cumulative total of 495mn tonnes of limestone and 126mn tonnes of gabbro out to 2022.

The demand for primary materials like cement, bitumen, aggregated and washed sand has likewise “expanded markedly” over the last few years in Qatar, a trend BMI expects to intensify further in the coming years.

Qatar is already one of the highest per capita consumers of building materials and BMI forecasts that Qatar’s cement consumption will grow by 4% on an annualised basis out to 2022.

Accordingly, companies like state-owned Qatar National Cement Company (QNCC), which controls 70% of the Qatari cement market, are planning on ramping up capacity to meet growing demand for materials. QNCC will raise production from 4.4mn tonnes to 5.63mn tonnes per year, the report said.

In particular, BMI highlights growing Qatar’s non-residential and non-residential building space — where it forecasts annualised average growth of 15% out to 20 22 — as a prime driver of cement demand.

In contrast, slowing growth in the road sector after 2017 is likely to decrease the demand for materials like bitumen.

BMI expects that various government initiatives currently in place will forestall any major shocks to Qatar’s construction supply chain in the coming years, helping temper materials inflation amid rapidly intensifying cost pressures.

“Given the hard deadline of the FIFA 2022 World Cup, delays to major projects stemming from the unavailability of building materials will prove untenable, making the smooth functioning of Qatar’s construction market a top government priority,” BMI said.

.