Saudi Arabia’s long-awaited drive to free up more oil revenue by shifting to solar power generation is expected to pick up speed this quarter, according to local developers eyeing contracts.

“I’m fully expecting within the first quarter 500 megawatts to come out in tenders and then it’ll ramp up,” said Paddy Padmanathan, the chief executive officer of Acwa Power International in Riyadh. “That will be a game changer for the region.”

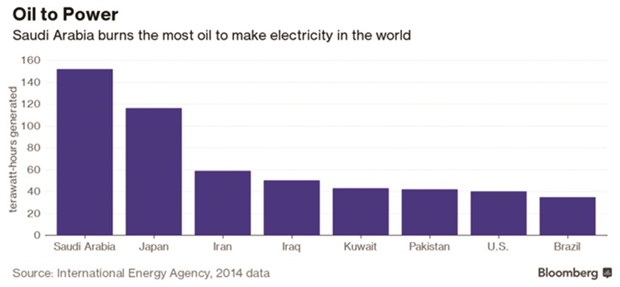

The world’s biggest crude exporter also burns more oil than any other country to generate electricity. According to the most recent International Energy Agency figures, the kingdom consumes at least 900,000 bpd at peak periods of the year to keep the lights on - an amount worth over $16bn annually based on current oil spot prices. Integrating more solar power onto the Saudi grid could free up more crude for export.

Saudi Arabia plans to add another 700 megawatts from wind and solar power generation in 2018 according to people familiar with the plan, who said the kingdom forecasts another 8.8 gigawatts of renewable energy added to the grid between 2019 and 2023.

“We expect Saudi Arabia will be the largest market in the region in the medium to long-term,” said Sami Khoreibi, the founder and chief executive officer of Enviromena Power Systems, a solar developer based in Abu Dhabi. “You take a look at the opportunity cost of using crude oil for electricity production and you have a very high operating expense, and the power demand growth in Saudi Arabia is one of the largest in the region.”

Saudi Arabia’s on-again, off-again pursuit of solar energy has already shown signs of picking in the last six months as the kingdom struggled to patch budget holes and map future economic diversification.

Acwa Power and Fotowatio Renewables Ventures BV were both shortlisted for a 100-megawatt solar tender offered during the second half of 2016. The two 50-megawatt projects will be located in Al-Jouf and Rafha in northern part of the peninsula, according to the state utility. “It is starting,” said Rafael Benjumea, CEO of Fotowatio, which is owned by Abdul Latif Jameel in Jeddah and won a bid in May to help build an 800-megawatt solar plant in Dubai.

“Of course it has taken very long but there’s a clear move to change their renewable energy mix,” he said. “There’s a lot of potential in the Saudi market.”

Saudi Arabia is seeking a financial adviser to help attract investors to three renewable power projects, which would be owned and operated by the private sector and could cost as much as $1.5bn to build, according to people familiar with the plans.

Renewables were highlighted in the nation’s diversification plan, known as Vision 2030, which aims to wean its economy off fossil fuels. Generating more solar and wind power could also ease long-standing concerns over the Kingdom’s rising domestic oil consumption.

A 2011 report by London-based researchers at Chatham House, “Burning Oil to Keep Cool,” said that Saudi Arabia was burning so much oil domestically that it could become a net energy importer by 2038 if it didn’t change its habits. Little has changed in the past five years, according to Glada Lahn, who co-authored the report.

“The original constraint was the fear of domestic demand threatening to outrun capacity in the electricity sector particularly,” Lahn said in a telephone interview. “The fact that the oil price was high during that time really made it acute.”

Lower oil prices squeezed Saudi Arabia and “put pressure on the government to diversify, she said.” The country has seen “an increase in liquid fuel use.”

Lahn, who continues researching the intersection of resources and the environment at Chatham House, expects energy demand to continue to rise at a pace of about 4% to 5% per year through to 2030. The highest demand peaks for electricity are in the middle of the day to run air conditioners, which correspond perfectly to solar energy, she said.

The kingdom originally set a target in 2010 to install 41 gigawatts of clean power by 2040, the equivalent of about 30 nuclear reactors. That initiative was forecast to cost more than $100bn and produce a third of the nation’s electricity from solar. New plans were announced in April, changing the programme to 9.5 gigawatts by 2030. The intention is still to meet the original target, according to Acwa’s Padmanathan.

“Ambitions have not been scaled down,” he said. “They will get to even more than that by 2040. We’re going to do 9.5 gigawatts by 2023, minimum. They haven’t said we’ll do this and stop.”

.