Excess deposits by Qatar’s banks at the Qatar Central Bank increased to $2.6bn in September from $1.9bn in August, Samba Financial Group has said, suggesting the local lenders have “more spare cash on hand” now.

But, Samba in its latest economic monitor said the liquidity situation in Qatar’s banking sector appears “highly nuanced”. On the one hand, the elevated loan to deposit ratio (116.9 in September) and the upward trajectory of interbank rates (three month deposit rates are at 1.7% up from 1.2% in January), pointing to a tightening.

Conversely, excess deposits by local banks at the central bank suggest they have “more spare cash on hand” now.

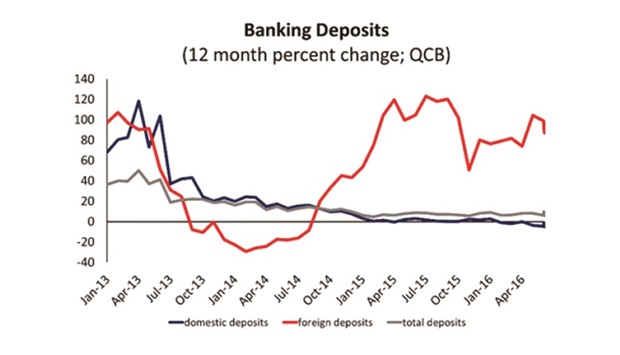

The year-on-year credit growth (12%) continued to outstrip deposit growth (6.7%) in September. The public sector is driving the double-digit credit growth with a 19.2% expansion in September.

Real estate continues to be the largest private-sector recipient of credit growth, expanding at 10%, while lending to contractors has stagnated. Overall deposit growth ticked up in September to 6.7% from 5.8% in August. Domestic deposits continued to fall (5.2%) in September, although non-resident deposits grew by 96.5%, keeping total deposit growth positive.

Public sector deposits, which account for 26.5% of the total continue to fall, down 17.4% over the 12 months from September.

Domestic bond and sukuk issuances, which started again in August, and amounted to $3.4bn over the past three months alone, have further drained liquidity, Samba said.

Back in May, interbank rates fell sharply as it was reported that the authorities injected some of the capital raised in international markets into the banking system. The authorities seem to have the resources at their disposal to do so again if necessary. Moody’s stated in their semi-annual review earlier this month that “event risks stemming from the banking system, government, or external liquidity are limited.”

According to Samba, the contraction in the hydrocarbon segment “continues to stifle” Qatar’s growth with the Q2, 2016 growth coming in at 2%, a slight increase on the first quarter, but still below Samba’s 2.5% forecast for the year.

There was a “healthy” expansion of the nonhydrocarbon sector (5.5%) which was dragged down by another contraction in hydrocarbon output (1.2 %).

The main contributors to growth were, like last year, construction (15.7%) and financial services (8.8%), whilst manufacturing reversed its “positive” contribution from last year and “declined” by 4.4%.

“Still, given the fiscal consolidation taking place in the country, the economy appears to be performing well. We now expect growth of around 2.5% for 2016 and 3.1% for 2017 as a reduced but still robust level of project spending is supported by a small contribution from the hydrocarbon sector towards the end of this year as the Barzan Gas Project is commissioned,” Samba said.

QATAR