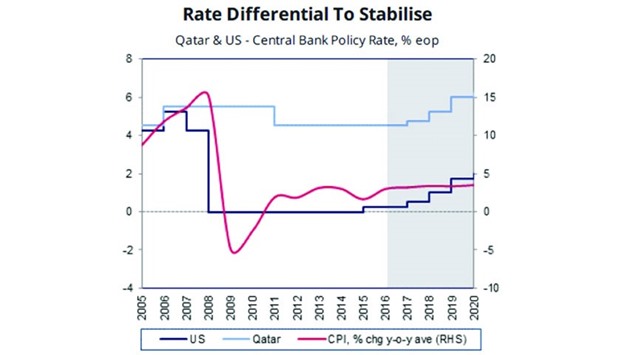

The QCB is likely to follow the Fed in its gradual tightening cycle, hiking interest rates by 25 basis points (bps), or 0.25%, in 2017, BMI Research said.

The expected increase, BMI said, will bring the policy rate to 4.75% in Qatar by the end of 2017. “As we forecast Qatari economic growth to pick up in 2017, with business confidence benefiting from the recovery in oil prices, the economy will be able to withstand a small rate hike over the course of the year.

In parallel, the rate hike will be able to moderate the modest uptick in inflationary pressures over the next 12 months. The Fitch Group company said the QCB will follow the Fed as Qatar's central bank seeks to limit pressure on the riyal's peg to the dollar.

The macroeconomic outlook will improve with the oil price recovery in 2017, resulting in the liquidity squeeze easing, so the small hike carries only limited risks for the economy, it said.

“We do not believe that the QCB will delay its hiking cycle as it did in December 2015, when it did not follow the US Federal Reserve's decision to raise interest rates by 25 bps. Despite foreign reserves having fallen by 15.9% in 2015, Qatar still boasts gargantuan financial buffers, with the import cover ratio estimated at 13.3 months in 2016,” BMI said.

As such, BMI analysts believe that Qatar would be able to defend the riyal's peg to the US dollar should the interest differential go down. Nonetheless, with the worst now past for the Qatari economy, they believe that the ongoing liquidity squeeze, highlighted by the rise in the three-month Qatar interbank rate and contraction in M2 money supply, will ease over the coming months. Therefore, according to BMI, the private sector and households will be able to weather a modest rate hike.

The protracted period of low interest rates does not carry substantial risks for inflation. In the first 10 months of 2016, inflation averaged 2.8% y-o-y, which compares with 1.7% throughout 2015. The uptick in inflation was mostly due to subsidy cuts by the government, BMI said.

Price pressures were primarily driven by the housing and utilities component of the CPI basket, which rose by 4.8% y-o-y over January-September following water and electricity subsidy cuts in September 2015. Pressure on the transport component has also intensified following Qatar's move to market-based pricing for petrol and diesel in May 2016. While the year-on-year effects of subsidy reductions will fade over the coming months, as BMI does not expect more cuts to be introduced, rising commodity prices in 2017 will continue to drive cost-push inflation.

With fuel rates now linked to movements on the global markets, the rise in oil prices in 2017 – BMI’s Oil & Gas team forecasts Brent prices to average $55a barrel next year, up from $45.5 in 2016 – will put upward pressure on the transport component of the CPI basket.

The QCB may follow the Fed in its gradual tightening cycle, hiking interest rates by 25 basis points in 2017, BMI Research has said

Qatar may see an increase in interest rates next year, as the Qatar Central Bank (QCB) is expected to follow the US Federal Reserve in its “gradual tightening cycle” over the coming months, a new report has shown.